In October 2016, Hurricane Matthew brought heavy rainfall and flooding to North Carolina. Like has happened in other parts of country, many of those affected were without flood insurance. North Carolina is leader in floodplain mapping and risk communication, but actual storms and flooding are among the best (albeit late) means of communicating risk. As such, Taxpayers for Common Sense wanted to see the impact of Matthew on the state’s flood insurance take-up rate.

The Federal Emergency Management Agency makes flood insurance policy information by city, town, or county (unincorporated areas) available every few months. This includes number of policies, premium paid, and the amount of coverage. Unfortunately and inexplicably, FEMA replaces the data with each refresh which makes it impossible to identify trends.

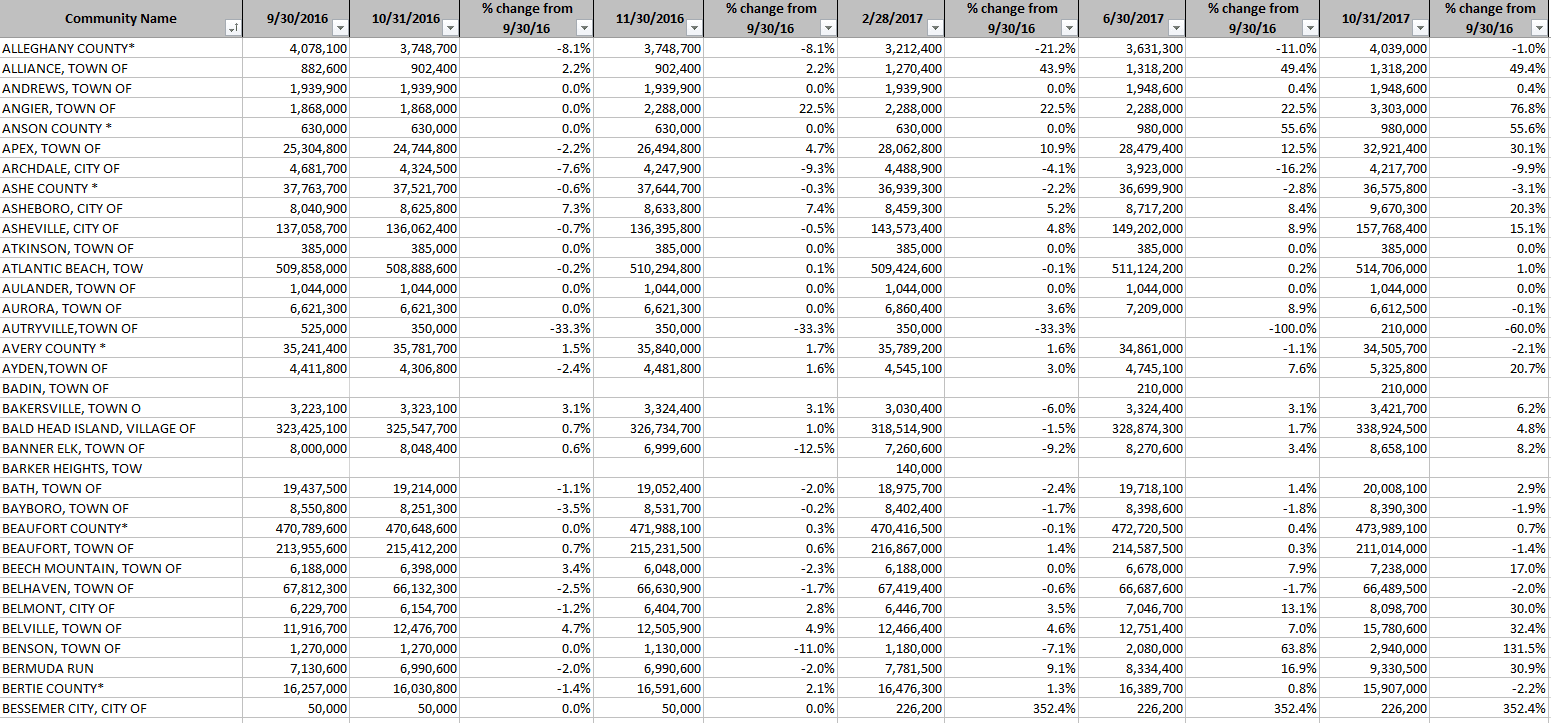

TCS reached out to FEMA and was eventually able to get pre-Matthew data (9/30/2016) to compare with data from a year later (10/31/2017). Using the Internet Archive’s Wayback Machine, TCS was able to obtain additional data points of 10/31/2016, 11/30/2016, 2/28/2017, and 6/30/2017 to compare.

All of the data is available here. Overall, nearly 300 North Carolina towns, cities, and counties increased the number of NFIP policyholders. Seventy remained steady, and 130 saw decreased participation. Not surprisingly, coastal communities are the biggest participants in the NFIP. But notably Fayetteville had a whopping 65 percent increase in the number of policies, albeit to only 1,290 (2010 Census documented 87,000 housing units in the city). Other large cities saw increases including ten more percent increases in Charlotte, Durham, Raleigh, and Greensboro.

The Coastal Resilience Center (U.S. Department of Homeland Security Center of Excellence based in North Carolina) identified six small communities to work with after Matthew based on their flood history: Fair Bluff, Kinston, Lumberton, Princeville, Seven Springs, and Windsor. All but Seven Springs and Windsor saw steadily increased participation. Seven Springs had growth and then fall off. It should be noted that buyouts and families leaving the area after suffering damage can affect these numbers particularly for extremely small towns.