June 28, 2016

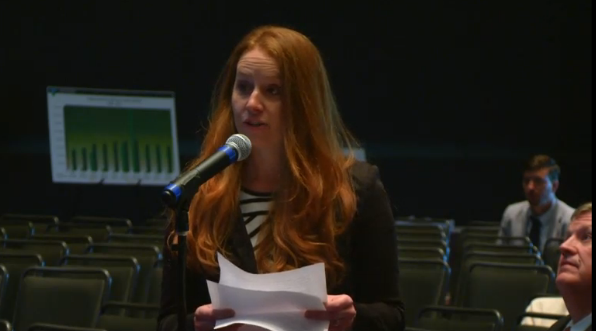

Prepared remarks of Taxpayers for Common Sense Senior Program Director Autumn Hanna before the Department of the Interior in Pittsburgh, PA on ways it can ensure fair return for federal taxpayers:

Good afternoon. My name is Autumn Hanna and I am a Senior Program Director at Taxpayers for Common Sense, a national, non-partisan budget watchdog organization that for the last two decades has worked to achieve sound fiscal policy across the federal government.

I am especially pleased to provide comments to the Bureau of Land Management on the federal coal program here in my hometown. The BLM leases coal owned by all federal taxpayers and the management of the federal coal program is an important issue here in Pittsburgh and across the country.

For the last fifteen years, I have worked at Taxpayers for Common Sense to actively ensure that taxpayers receive a fair return on ALL resources developed on federal lands and waters, from hard rock minerals, oil, gas, and coal to wind and solar.

Coal is a central part of our nation’s energy mix and over the last decade, the BLM managed leases that produced approximately 4.3 billion tons of coal, resulting in $9.5 billion in revenue collections by the United States.

These funds are an important source of revenue for the country. And while the Department of Interior is legally required to provide a fair return to taxpayers for the development of the coal we all own, the leasing program has been plagued with problems. Further, it fails to meet the goals set forth during the last review under the Reagan Administration.

In 2013 my organization released a study on Fair Market Value of federal coal. We found that the current coal program was in need of significant reform and responsible for billions in taxpayer losses.

For example, by supplanting the competitive system envisioned by Congress more than 40 years ago, the current Lease by Application system has failed taxpayers. The system improperly distorts the valuation of lease tracts, brings in significantly reduced bids, and shrouds crucial information in secrecy.

There’s little, if any, competition under the leasing program. Incredibly, the Government Accountability Office found that 90 percent of lease sales in the Powder River Basin from 1990-2013 had only one bidder. The game is essentially rigged: Under the current system, individual companies often draw the tracts for leasing themselves.

In the absence of competition, the BLM must accurately calculate the Fair Market Value of federal coal. Here, too, the BLM has failed.

Before determining the Fair Market Value, the Secretary of Interior must provide an opportunity for public comments. But it is impossible to provide feedback when the BLM refuses to share its valuation data or methodology. Final lease sale numbers are often undervalued and can be used as comparables for new tracts– locking in a rolling system of undervalued leases and taxpayer losses.

Finally, changes in the marketplace must be considered when calculating fair market value since coal exports to foreign markets have more than doubled in the last ten years. As we detailed in our comments to DOI last year, coal valuation at the initial point of sale may not truly capture the value of the taxpayers’ resource.

The BLM has a responsibility to taxpayers to ensure they are fully compensated for the sale of public resources. In the face of an ever-rising $19 trillion federal debt, taxpayers can afford nothing less.

Thank you to the BLM for the opportunity to present comments here today.

Get Social