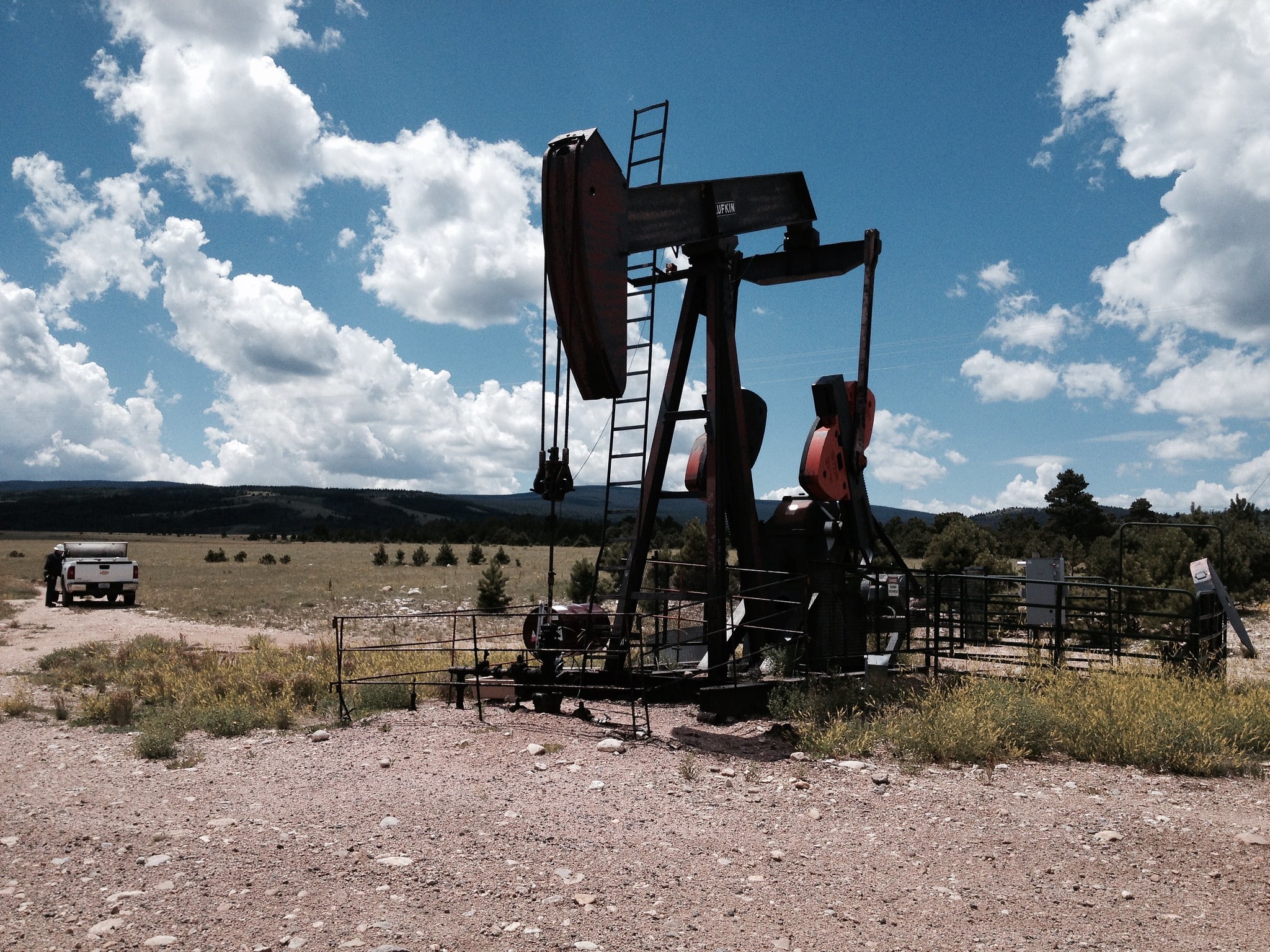

Oil and Gas companies have skirted millions of dollars in payments owed to the federal government for the extraction of natural gas from federal lands, a report released Monday concluded. The Government Accountability Office (GAO) said in a new analysis that the Minerals Management Service (MMS), the agency charged with collecting royalties, cannot provide “reasonable assurances” that the federal government is receiving adequate payment through its in kind program for natural gas extracted from federal lands and waters. The royalty-in-kind program allows oil and gas companies to forgo cash payments for royalties and instead pay in kind using oil and gas as payment. This system adds a layer of complexity to royalty collection, as it requires the federal government to resell on the open market the acquired oil and gas.

Although the RIK program has been a source of criticism for years, it wasn’t until recently, that the RIK program hit its boiling point. In 2008, an internal government investigation revealed that RIK employees had become intimately involved with oil and gas executives. This new analysis demonstrates further staffing, management and data collection problems associated with the program—all jeopardizing significant taxpayer revenues.

In 2008, the Minerals Management Service collected $2.4 billion in royalty-in-kind gas but the GAO’s review found that taxpayers were likely owed tens of millions more. According to GAO, these underpayments are largely attributable to the poor identification and collection of “gas imbalances” or the difference between the amount of gas the MMS should receive as payment and the actual amount of gas collected. Because MMS does not audit oil and gas companies’ production data, it is impossible to accurately determine what percentage of natural gas taxpayers are rightfully owed.

Additionally, companies that make in kind payments can game the system to their advantage. When the MMS receives in kind payments they must resell the oil and gas on the open market. But by making payments when the value of gas is low and holding onto it when it is high, oil and gas companies work the system to make significant profits for themselves and cause the federal government to lose out on valuable revenue.

The inherent conflicts in the program coupled with the rampant management and data collection problems clearly demonstrate it is time the RIK program end.