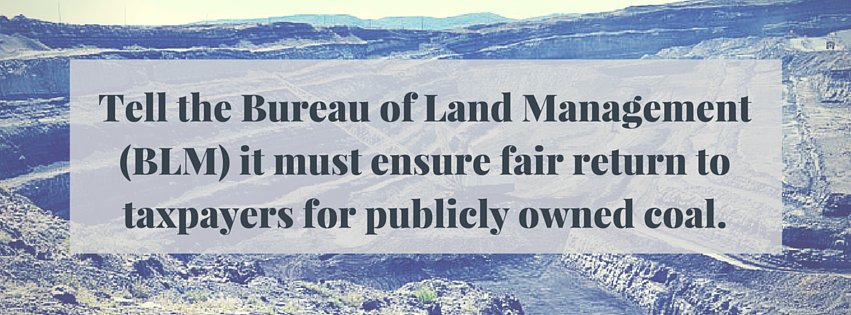

Make your voice heard on federal coal reform!

Coal mined on federal land belongs to all U.S. taxpayers and getting a fair return for its development should be a central focus at the Department of the Interior (DOI), the federal agency charged with managing the nation’s federal lands and waters.

Unfortunately, the federal coal program, administered by the DOI’s Bureau of Land Management (BLM), has failed taxpayers for decades and lost billions of dollars in revenue from federal coal production.

After announcing they would undertake a comprehensive review of the coal program in January, the DOI and the BLM are seeking public comment on the program’s review. To make sure that the taxpayer interest is protected, the BLM needs to hear from you:

You can send your message to the BLM at the address below before July 28, 2016. More instructions on how to comment can be found here.

BLM_WO_Coal_Program_PEIS_Comments@blm.gov

More information on BLM's federal coal review and how to comment can be found here.

Here are some suggestions on what to include in your comments:

- The current coal program is in need of significant reform because undervalued federal coal is responsible for billions in lost taxpayer revenue.

- The current leasing system, known as Lease by Application, has failed taxpayers for more than four decades. The system, largely secretive, improperly distorts the valuation of lease tracts, and generates significantly reduced bids.

- Undervalued lease numbers are often used as comparables for new tracts– locking in a rolling system of taxpayer losses.

- There is little, if any, competition under the leasing program. The Government Accountability Office found that 90 percent of coal lease sales from 1990 through 2012 had only one bidder.

- Without competition, the BLM must accurately calculate the Fair Market Value of federal coal to protect taxpayers—something its closed-door process has repeatedly failed to do.

- The BLM has failed to consider changes in the marketplace when valuing coal. Exports to foreign markets have more than doubled in the last ten years dramatically impacting coal’s overall value. The final sale price of coal may be much higher than values assigned at the time coal is mined, and the BLM must consider this to get full value for the taxpayer.

- BLM has a responsibility to taxpayers to ensure they are fully compensated for the sale of public resources. With an ever-rising $19 trillion federal debt, this revenue is more important than ever.

For more information on the federal coal program and the BLM’s review, visit the TCS resources below:

- TCS Federal Coal Program Resource Page

- TCS Statement: Review of Federal Coal Program Is Welcome News

- BLM Begins Review of Federal Coal Leasing Program

- TCS Event Discusses Fair Return on Nation’s Coal

TCS Testimony on the BLM Review:

- TCS President Ryan Alexander testifies on federal coal review

- TCS President Ryan Alexander Testifies in Salt Lake City on Federal Coal Review

- TCS Calls for Federal Coal Reform at BLM Hearing in Colorado

- TCS at Pittsburgh Public Hearing: Time to Fix Federal Coal, Get Fair Return