Locked Out

The Cost of Speculation in Federal Oil and Gas Leases

Download Report

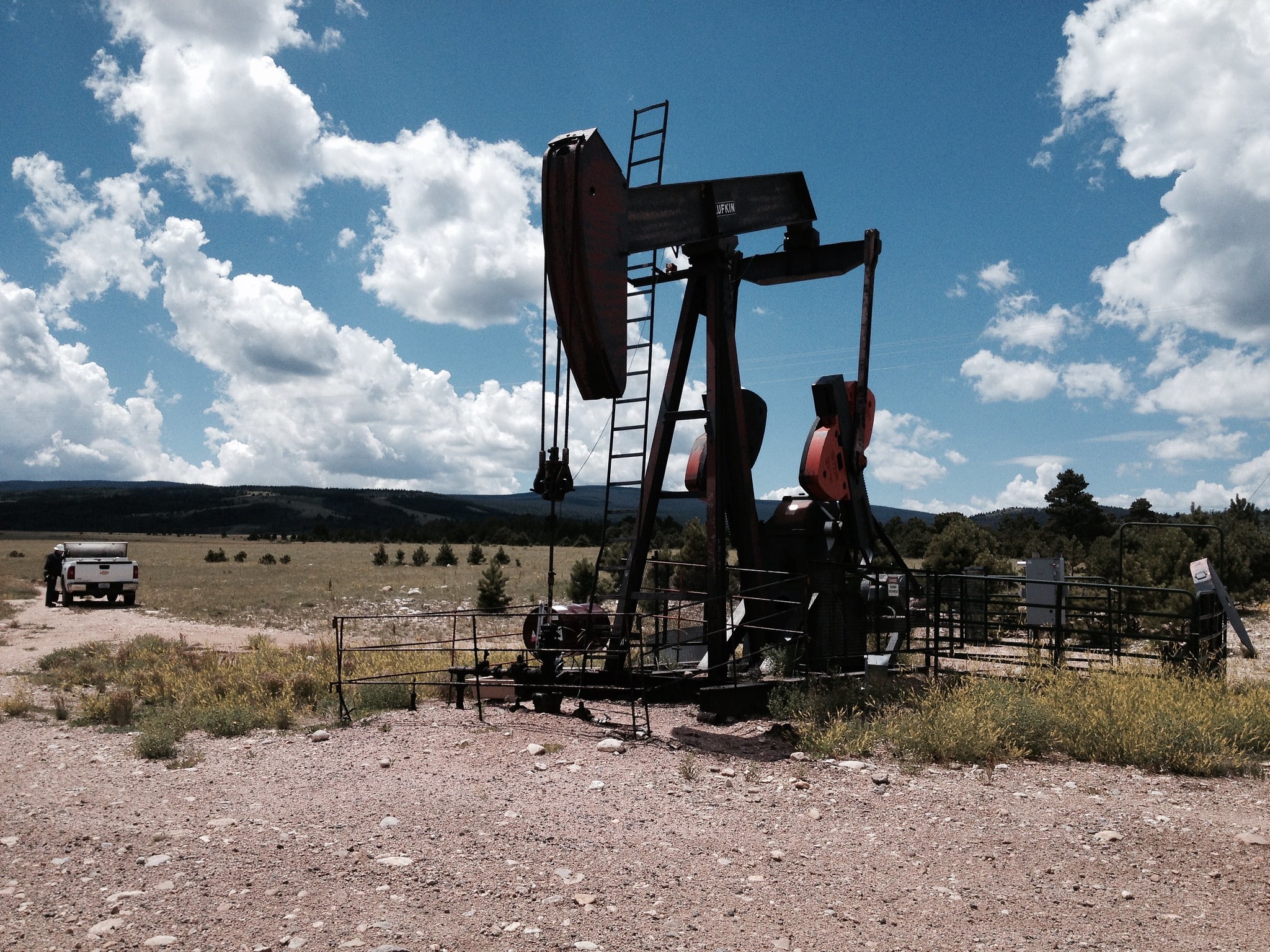

The Bureau of Land Management (BLM) within the Department of the Interior (DOI) manages more than 750 million acres of mineral estate in the U.S.

It administers oil and gas leases on federal lands, charges royalties and rent for them, sets minimum bonus bids, and establishes bonding requirements for site remediation. These lease terms and requirements are structured to promote oil and gas production.

But, because they have not been revised in decades and it is extremely inexpensive to lease federal lands, there is little to discourage companies from holding federal leases without developing oil and gas resources on them.

Taxpayers for Common Sense’s latest report – Locked Out: The Cost of Speculation in Federal Oil and Gas Leases – underlines the extent to which the federal oil and gas leasing system, which is managed by the Bureau of Land Management (BLM) of the Department of Interior, undervalues public land by allowing private interests to hold it cheaply without producing oil and gas, preventing other uses of the land. In president Ryan Alexander’s words, “As the owners of federal lands and resources, US taxpayers have the right to fair market compensation for all public natural resources, as would any private landowner. Accordingly, taxpayers should be appropriately compensated when the land we all own is leased to private businesses.” But the current leasing system causes taxpayers to lose out when federal land is leased to speculators who don’t produce oil and gas. These speculative leases also prevent the land from being used by others. The report found that more than a quarter of all non-producing leases issued in the last decade in six western states had one or more characteristics of “unreasonable speculation.” In total, more than 3,000 leases covering more than 3.1 million acres of federal land were found to be unreasonably speculative. “Some speculative investment in oil and gas leasing is customary. But, our report contends that if lots of parcels are being leased with speculative characteristics, then the system is too permissive of speculative behavior and taxpayers are not being fairly compensated for the land and resources they own,” said Alexander. “In the face of a $19 trillion national debt, we hope Secretary Zinke institutes much needed reforms to the oil and gas leasing program to ensure taxpayers get a fair return on the resources we all own.”

At the end of fiscal year 2016, more than half of all federal acreage set aside for oil and gas leasing was tied up in non-producing leases, locking out other potential uses. A significant portion of these leases have characteristics that suggest they represent unreasonable speculative activity. The BLM leasing rules need to better reflect the value of holding federal land and minimize how much is idly held, especially with speculative intent.

Allowing millions of acres of federal lands to be locked up in leases with minimal chance of producing oil or gas contradicts the multiple-use principle that guides the BLM’s management of federal lands under federal law.

If priced appropriately, issuing a lease to a private entity that has the intention and realistic expectation of producing oil and gas in the future allows for reasonable market speculation consistent with the BLM’s mandate.

However, the leasing of land by a private entity that does not mean to produce oil or gas, and either wants to hold the land for other reasons or seeks to profit by selling its leasing rights to a production company, represents unreasonable speculation. Permitting land to be locked up by such practice is inconsistent with the BLM’s mandate.

Current unreasonable speculation in oil and gas leasing on federal land is enabled by the leasing process and terms used by the BLM. Through extensive use of the noncompetitive process, acceptance of low minimum bids and rental rates, and other practices, the BLM is not encouraging diligent development on federal lands.

As a result, tens of millions of acres that are currently under lease remain idle, and will probably never be developed. These policies also limit the return the agency receives from industry for the right to hold federal land and develop public oil and gas resources.

While reports from numerous federal agencies have touched on speculation in oil and gas leasing,[1] none has defined what represents unreasonable speculation or examined the extent of this activity. This is a necessary step for the BLM to take as part of a much-needed update to its resource management program.

Taxpayers for Common Sense (TCS) has identified four characteristics of federal oil and gas leases that indicate they might be unreasonably speculative, given the likelihood these leases will be terminated without ever reaching production.

Active oil and gas leases on federal lands in six states were then screened for the four characteristics, using BLM data, to determine the extent of unreasonable speculation. The four factors are:

- Parcels leased for less than $10/acre.

Rationale: According to the CBO, industry developed only 8 percent of parcels that were leased for $10/acre or less in one eight-year period, compared to 25 percent of parcels that were leased for $10/acre or more.[2]

- Parcels leased by companies that are not exploration and production companies.

Rationale: Many of these leaseholders have never filed a production report or drilled a well and are not recognized as “active” operators by state oil and gas agencies. Their ownership of a lease can only be regarded as speculative, and unlikely to lead to production by the leaseholder.

- Parcels leased non-competitively.

Rationale: Before a parcel can be leased non-competitively, it must be made available in a competitive auction and receive no bid. A parcel’s failure to attract bidding is an indication of its low potential for production. Only 3 percent of non-competitive leases issued in the years 1996-2003 were ever developed.[3]

- Leases isolated from producing leases or infrastructure.

Rationale: If leases are “isolated” – not reasonably close to producing leases or the corresponding infrastructure (e.g., roads, pipelines) and known reserves – then it is more likely they are speculative.[4]

Speculative Leasing by the Numbers

Taxpayers for Common Sense analyzed BLM data for all onshore oil and gas leases authorized in six western states between July 2007 and July 2017. The subset of leases on which production has not yet been recorded were screened to identify how many had one or more of the above characteristics of unreasonable speculation.

Acreage of Leases with Speculative Characteristics by State

| Colorado | Montana | New Mexico | Nevada | Utah | Wyoming | Total | |

|---|---|---|---|---|---|---|---|

| Bid of $10 or Less per Acre | 200,945 | 95,799 | 39,602 | 267,917 | 164,169 | 777,553 | 1,545,986 |

| Speculative Company | 119,046 | 44,319 | 31,281 | N/A | 150,512 | 585,352 | 930,508 |

| Non-Competitive | 61,060 | 38,515 | 1,760 | 501,242 | 55,575 | 124,759 | 782,912 |

| Isolated | 112,510 | 96,279 | 75,476 | 659,833 | 42,768 | 330,001 | 1,316,868 |

| Total with One Characteristic or More | 361,515 | 186,292 | 109,564 | 831,333 | 284,880 | 1344,621 | 3,118,205 |

Number of Leases with Speculative Characteristics by State

| Colorado | Montana | New Mexico | Nevada | Utah | Wyoming | Totals | |

|---|---|---|---|---|---|---|---|

| Bid of $10 or Less per Acre | 237 | 152 | 61 | 166 | 153 | 785 | 1,554 |

| Speculative Company | 209 | 95 | 70 | 0 | 135 | 595 | 1,104 |

| Non-Competitive | 90 | 44 | 1 | 211 | 35 | 113 | 494 |

| Isolated | 192 | 199 | 153 | 308 | 44 | 316 | 1,212 |

| Total with One Characteristic or More | 470 | 342 | 220 | 414 | 262 | 1,357 | 3,065 |

The totals above were generated by analyzing data on federal leases downloaded from the BLM’s Land & Mineral Legacy Rehost 2000 System, or “LR2000.” From the pool of all oil and gas leases in each of the six states, leases that were executed in the last 10 years and had not entered production were screened for the defined factors of unreasonable speculation.

In total, 3,065 leases were found to have one or more of the speculative characteristics outlined above. These speculative leases comprise more than 3.1 million acres of federal land that is closed to other uses. By acreage, these leases represented roughly 28 percent of all nonproducing acreage on BLM oil and gas leases in the selected states, as reported in the BLM’s Oil and Gas Statistics. The large number of nonproducing leases that did not meet one of the characteristics suggests there may be additional variables that could be used to identify leases that are unreasonably speculative.

Nevada was found to have the highest percentage of nonproducing leases with at least one of the set speculative characteristics – 70 percent. Wyoming, however, had the most total leases with one of the factors – 1,357 leases that spanned more than 1.3 million acres.

Having received a bonus bid of less than $10/acre was the most common speculative characteristic found among the sample of leases. Noncompetitive leases, however, were the most likely to have one of the other speculative characteristics.

Land under lease in the six western states for which data was analyzed represented 82 percent of the total acreage of federal oil and gas leases in effect at the end of FY 2016. Production in these states constituted 75 percent of all oil and 95 percent of all gas produced on federal lands from 2006 to 2015. It is safe to conclude, therefore, that the leases in these states are representative of all oil and gas leases issued by the BLM.

Policy Discussion

The BLM’s multiple-use mission, set forth in the Federal Land Policy and Management Act of 1976, mandates that it manage public lands and their various resource values so that they are utilized in the combination that will best meet the present and future needs of the American people, with “consideration being given to the relative values of the resources and not necessarily to the combination of uses that will give the greatest economic return or the greatest unit output.”[5]

The preponderance of speculative leases that will likely never produce royalties for taxpayers cannot represent the best use of these lands. Instead, issuance and maintenance of such leases prevents the best use of these lands. Government oversight reports have raised serious concerns about whether oil and gas development on federal lands provides a fair return for taxpayers.[6] These reports and others find that updating lease terms and regulations would incentivize diligent development and increase federal revenues while reducing speculation and the opportunity costs associated with idle, non-producing leases on federal lands. According to the Congressional Budget Office (CBO), only 10 percent of federal oil and gas leases issued competitively and 3 percent issued non-competitively are ever developed.[7]

Prior reports provide helpful guideposts for developing a definition of speculation. The Government Accountability Office (GAO) has referred to speculation as companies “having no experience in the oil and gas industry for the purpose of selling [oil and gas resources] at a profit,”[8] that are “waiting for an oil company to buy them out at a profit.”[9] The Office of Technology Assessment (OTA) equated speculation with development potential and “the [lack of] distinction between known and unknown mineral areas. . . .”[10] CBO echoed this characterization, describing speculative leases as “those for which the availability of oil and gas is particularly uncertain. . . .”[11] CBO also compiled data on development rates for competitive and non-competitive leases that are useful in constructing a definition for speculation.

In the past, similarly speculative leases for coal mining resulted in a significant response from DOI. Outcry over speculation of public coal lands in 1906 led President Theodore Roosevelt to withdraw more than sixty-four million acres from eligibility. And again in 1970, an internal BLM study found that less than 10 percent of federal land being leased for coal production was actually producing coal, leading Secretary of the Interior Rogers Morton to impose a moratorium on all new coal leasing “in order to allow the preparation of a program for the more orderly development of coal resources upon the public lands of the United States…”[12]

Over the last 30 years, production of oil or gas has been reported on only one-quarter of all acreage on federal lands leased for oil and gas drilling.[13] It is time for the BLM to reevaluate its oil and gas leasing program in order to maximize the proportion of leased acreage that is actually generating revenue.

Oil and Gas Lease Speculation Policy Options

- Increase Oil and Gas Lease Annual Rental Payments

The BLM has not increased the rental rates since they were initially set in 1987, even though the MLA only sets a floor for the rates that must be charged by the BLM. Under the MLA (as amended in 1987) lessees are required to pay annual rent of “not less than $1.50 per acre per year for the first through fifth years of the lease and not less than $2 per acre per year for each year thereafter.”[14] These payment requirements should at the least be raised to follow inflation, and adjusted annually by regulation. According to inflation measurements by the Bureau of Labor Statistics, $1.50 in 1987 is equivalent to $3.17 in 2016 dollars, and $2.00 is now $4.23.[15] An immediate increase in rental rates to these levels would not only increase income to ensure fair return to taxpayers, but would also create incentive for timely development rather than speculation on federal leases.

The BLM should consider adjusting the rental fees upward in areas where leases are more valuable, as in the offshore oil and gas program, or on leases that fail to begin production, as several western states have done to encourage exploration and development. New Mexico doubles the rental fee for the second 5 years of leases issued under 10-year primary terms if the leases have not begun producing, and Texas increases the rental rate from $5 per acre per year to $25 per acre per year if the lease is not developed by the end of the third year. In recent sales, the Bureau of Ocean Energy Management (BOEM), the BLM’s sister agency, has imposed rentals that escalate over time to encourage faster exploration and development of offshore leases. The BLM should increase annual rental payments to also provide a greater incentive for lessees to develop leases promptly or relinquish them so that they may be re-leased to other parties, as appropriate.

- Increase Minimum Acceptable Bid

The MLA sets the minimum bid at $2 per acre for a period of two years from December 22, 1987. Under the MLA the Secretary may, at the conclusion of the two-year period, “establish by regulation a higher national minimum acceptable bid for all leases based upon a finding that such action is necessary: (i) To enhance financial returns to the United States; and (ii) to promote more efficient management of oil and gas resources on Federal lands.”[16] The Secretary (through the BLM) has not exercised this authority. The BLM’s experience indicates that most parcels sell for well in excess of the current minimum acceptable bid, which indicates the current minimum acceptable bid should be higher. The agency should increase the minimum bid to at least equal inflation since the $2.00 bid was adopted. In addition, the BLM should study what level of minimum bid will lead to decreased bidding, and adopt a minimum bid that ensures a minimal increase in non-competitive leasing but also ensures the recovery of full value for taxpayers.

According to the CBO, increasing the minimum bid to $10 per acre for competitive and noncompetitive leases would boost net federal and state income by an estimated $50 million over 10 years.[17] This accounts for decreases in rental and royalty income for parcels that attract no bids, which would be minimal because such parcels have historically generated relatively little production and royalty income. The CBO also found that parcels that go unleased as a result of the higher minimum bid would have had relatively little exploration and would have a negligible effect on realization of new information about the locations of oil and gas resources.

- Reform Non-Competitive Leasing

If the BLM does not receive bids that are equal to or greater than the minimum bid for a parcel, then it does not lease the parcel at the competitive sale. Parcels that are not leased competitively are available, per the MLA, for lease non-competitively for a period of two years following the auction. Roughly 40 percent of existing leases were issued non-competitively.[18] Entities leasing such parcels non-competitively are required to pay an administrative fee and the first year’s rent, but a minimum acceptable bid or other bonus bid is not required. The BLM should establish a different annual rental rate for non-competitively leased parcels in tandem with increased minimum bids to encourage due diligence. Unfortunately, the BLM cannot ensure that full market value is received on onshore oil and gas leases so long as the non-competitive leasing alternative remains in the Mineral Leasing Act. Therefore, the agency should also seek a legislative change to eliminate this requirement, which offers potential lessees an incentive to game the system and attempt to obtain a lease with no bonus payment.

- Independently Value Resources

The offshore oil and gas leasing system requires that the minimum bid be sufficient to cover the value of resources, which is a better system than onshore leasing under the MLA, where the $2.00 minimum is not based on value. The BOEM does an individual analysis of the likely value of hydrocarbons within any tract that receives one or two bids, and rejects the bids if they seem too low for the value. Like the BOEM, the BLM is charged with receiving a fair return to the public for leased oil and gas resources. Yet current law denies the BLM the ability to take the value of land being leased into account when evaluating bids. The BLM should seek a legislative amendment allowing the agency to independently assess the value of minerals in individual lease sales and establish a lease-specific minimum acceptable bid.

- Expand Qualification Requirements for Bidders and Lease Tracts

The MLA authorizes the Secretary to establish standards “. . . as may be necessary to ensure that an adequate bond, surety, or other financial arrangement will be established prior to the commencement of surface-disturbing activities on any lease, to ensure the complete and timely reclamation of the lease tract, and the restoration of any lands or surface waters adversely affected by lease operations after the abandonment or cessation of oil and gas operations on the lease.”[19]

In addition to financial assurances for reclamation, the BLM should require qualified bidders to meet other qualification criteria, including: a qualified bidder must already be active in federal or state leases and have successfully demonstrated due diligence, or a qualified bidder must demonstrate sufficient exploration or extraction experience or expertise to operate a well profitably.

Similarly to the BOEM, the BLM should determine if a tract does not to have the potential capability of being explored, developed and produced profitably. This should include an analysis of whether oil and gas resources beneath proposed tracts can be recovered in marketable quantities, given such factors as market conditions and drilling, production and transportation costs. Lease sales on tracts that are too far from infrastructure should require a commitment to construct the necessary infrastructure, whether by the lessee or a third party. The BLM should develop a plan for the timing of leases, including proximity to gathering infrastructure that maximizes both taxpayer return and effective development. By identifying and offering lands based on the likelihood of development – as suggested by a tract’s proximity to existing infrastructure, competitiveness of bidding process, etc. – the BLM will limit the number of leases and acreage locked up in lease that will never realistically produce any oil or gas.

- Impose a Fee on Nonproducing Parcels

The CBO has found that establishing a separate new fee of $6 per acre on nonproducing leases would increase net federal income by $200 million over 10 years.[20] It would also have the added benefit of giving firms a financial incentive to be more selective in acquiring parcels and to explore and develop those parcels more quickly. CBO found such a fee would have a negligible effect on production. Such a fee could be incorporated into the rental rate structure under the BLM’s authority to set rental rates.

- Increase Onshore Royalty Rates

While it is a necessary first step, reform of the BLM’s oil and gas leasing program to ensure a fair return to federal taxpayers will require more than just eliminating speculation. In addition to the measures described above, the BLM cannot serve as a responsible steward of federal lands unless it also exercises its authority to increase royalty rates.

The BLM’s current regulations for royalty rates collected from onshore oil and gas leases set a flat rate of 12.5 percent for competitive leases and non-competitive leases. Although the BLM is authorized to specify a higher royalty rate, it has not done so. In November 2016, Interior amended its regulations to, among other things, allow for greater flexibility in setting royalty rates.[21] The BLM’s failure to raise onshore royalty rates, or failure to create an efficient process for rapidly increasing royalty rates in response to rising prices, represents a significant loss to taxpayers for resources developed on federal lands. This failure also contradicts the agency’s stated goal to “design an oil and gas fiscal system that both ensures that the United States’ oil and gas resources are developed and managed in an environmentally-responsible way that meets our energy needs, while also ensuring that the American people receive a fair return on those resources.”[22] Fair return to taxpayers is a competitive rate of return – a royalty rate that is consistent with royalty rates charged on state and private lands. State and private lessors charge royalty rates higher than 12.5 percent.[23] The BLM should increase the royalty rate to 18.75 percent for onshore oil and gas production, a rate consistent with federal offshore oil and gas production and the prevailing state and private royalty rates. The CBO estimates increasing royalty rate of 18.75 percent for onshore parcels to match the rate for offshore parcels would generate $400 million in net federal and state income over the next 10 years.

Conclusion

For decades, taxpayers have lost billions of dollars in valuable revenue from federal oil and gas development on federal lands to a broken leasing system that is need of significant reform. Unreasonable speculation occurs on federal land because oil and gas leases are undervalued. Furthermore, thousands of nonproducing leases are locking up millions of acres of federal land, preventing them from being used for other purposes that could provide benefits to federal taxpayers.

The Department of the Interior has the opportunity through its newly formed Royalty Policy Committee and internal agency reviews to institute much-needed reforms to the federal oil and gas leasing program. With a $19 trillion federal debt, it is imperative that the resources our nation owns generate the revenue American taxpayers are rightfully owed.

Intentional Space

[1] See, e.g., Government Accountability Office (GAO). (1976). Role of Federal Coal Resources in Meeting National Energy Goals Needs To Be Determined and the Leasing Process Improved (RED-76-79). Published: April 1, 1976. http://www.gao.gov/products/RED-76-79

GAO. (1979). Onshore Oil and Gas Leasing–Who Wins the Lottery? (EMD-79-41). Published: April 13, 1979. http://www.gao.gov/products/EMD-79-41

GAO. (2008). OIL AND GAS LEASING: Interior Could Do More to Encourage Diligent Development (GAO-09-74). Published: Oct. 3, 2008. http://www.gao.gov/products/GAO-09-74

U.S. Congress – Office of Technology Assessment (OTA). (1979). Management of Fuel and Nonfuel Minerals in Federal Land (NTIS order #PB-295788). April 1979. http://ota.fas.org/reports/7909.pdf

Congressional Budget Office (CBO). (2016). Options for Increasing Federal Income From Crude Oil and Natural Gas on Federal Lands (CBO-51421). Published: April 19, 2016. https://www.cbo.gov/publication/51421

[2] CBO (2016). Screen-friendly version, page 22. Specifically, the CBO looked at parcels leased between 1996 and 2003.

[3] CBO (2016). page 2

[4] Available geographic information system (GIS) data for nonproducing leases were used to identify those that are five or more miles away from a producing lease or unit.

[5] 43 U.S. Code §1702

[6] See: Note 1; GAO (2013). OIL AND GAS RESOURCES: Actions Needed for Interior to Better Ensure a Fair Return (GAO-14-50). Published: Dec. 6, 2013; GAO (2007). OIL AND GAS ROYALTIES: A Comparison of the Share of Revenue Received from Oil and Gas Production by the Federal Government and Other Resource Owners (GAO-07-676R). Published: May 1, 2007.

[7] CBO (2016). Page 2.

[9] GAO (1979)

[10] OTA (1979)

[11] CBO (2016)

[12] U.S. Department of the Interior – Secretarial Order No. 2952, 38 Fed. Reg. 4682 (Feb. 17, 1973). https://cdn.loc.gov/service/ll/fedreg/fr038/fr038033/fr038033.pdf

[13] Calculated from BLM Oil And Gas Statistics – https://www.blm.gov/programs/energy-and-minerals/oil-and-gas/oil-and-gas-statistics

[14] Mineral Leasing Act of 1920 (as amended) §17(d) – 30 U.S.C. 226

[15] Calculated using Bureau of Labor Statistics, Consumer Price Index Detailed Report – Table 24: Historical Consumer Price Index for All Urban Consumers (CPI-U)

[16] Mineral Leasing Act of 1920 (as amended) §17(b)(1)(B) – 30 U.S.C. 226

[17] CBO (2016). Page 22

[18] BLM Public Land Statistics 2016 – 16,341 out of 37,596 total active leases were issued noncompetitively

[19] Mineral Leasing Act of 1920 (as amended) §17(g) – 30 U.S.C. 226

[20] CBO (2016). Page 23

[21] 43 CFR §3103.3–1, published in 81 Fed. Reg. 83007 (November 18, 2016)

[22] 80 F.R. 22150.

[23] 80 F.R. 22152.

Related Posts

Most Read

Recent Content

Our Take

Dec 19, 2025 | 7 min read

Stay up to date on our work.

Sign up for our newsletter.

"*" indicates required fields