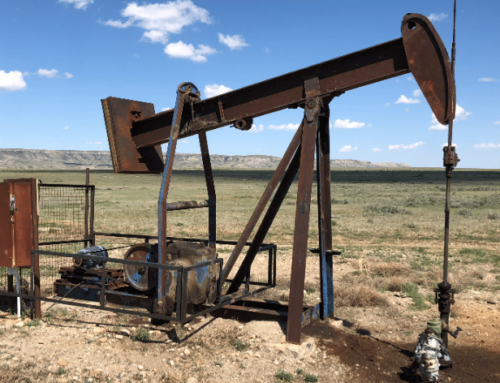

The House Appropriations Subcommittee on Interior, Environment, and related Agencies held a hearing today to discuss the FY2014 Presidential Budget Request for the Bureau of Land Management (BLM). Within the Department of the Interior, BLM manages more than 245 million acres of surface and approximately 700 million acres of sub-surface minerals. The single witness was Principal Deputy Director Neil Kornze. While egregious taxpayer giveaways like the 1872 Mining Law and oversight and management of oil and gas development were mentioned during opening statements the discussion focused on two other areas vulnerable for taxpayer abuse: fees for grazing and renewable energy development on public lands.

During the hearing, Chairman Simpson (R-ID) questioned the President’s proposed fee increase for grazing on public lands. The BLM manages approximately 160 million acres of public grazing lands and the FY2014 budget proposes a $1 increase to the current fee of $1.35 per Animal Unit Month (AUM) assessed from grazing private livestock on public lands. Chairman Simpson asked how the funds collected from the fee would be used. Kornze informed the committee that the $1 per AUM increase would be used to bolster administrative efforts to reduce the backlog of approximately 5,000 grazing permits and for cost-recovery efforts within the program.

Ranking Member Moran (D-VA) asked Kornze if he could discuss the difference in fee rates between grazing on private lands and public lands. Kornze stated that the rates vary substantially. The $1.35 per AUM federal fee is generally much lower than what is assessed by state and private landowners which follow market value more closely. On average, Kornze stated, state fees range from $4-$7 per AUM with private landowners tending to charge evener higher. In response, Moran said “it would appear that there is some subsidy going to those [ranchers] that [graze on] federally owned lands.”

The fair market value of renewable energy development on public lands was the second focus on the subcommittee hearing. BLM Acting Director Kornze noted that 41 renewable energy projects have been permitted and constructed on public land in recent years. Chairman Simpson and Representative Pingree (D-ME) questioned Kornze on the difference in cost between developing renewable projects on public versus private lands. Kornze did not produce an answer during the hearing but assured the subcommittee that fair market value was being met.

Taxpayers for Common Sense has highlighted grazing giveaways for many years and most recently in our Green Scissors 2012 report. Reforming grazing fees to reflect fair market value could create more than $320 million in revenue over the next ten years. TCS also highlighted in our 2010 report “Fair Market Value: For Wind and Solar Development on Public Land” how BLM’s current system has failed to ensure taxpayers receive fair market value when compared to other energy development programs such as oil and gas, coal, hydropower, and geothermal.

With nearly $17 trillion in debt and $1 trillion deficits, the topics discussed in today’s hearing are a step in the right direction but further action must be taken. Ensuring fair market value for federal taxpayers for publically owned resources is essential in these tight budget times. The current fees and systems for grazing, renewable energy development, hardrock mining, and fossil fuel development on public lands fall dramatically short and practices at the BLM must be reformed.

Get Social