As addressed in the State of the Union, the President’s fiscal year (FY) 2025 budget includes proposals to eliminate tax breaks for fossil fuel companies, some of which have been embedded into the tax code for over a century. The Biden administration has called for axing these tax breaks every year during his term and this year is no exception. The same tax subsidies for both fossil fuel companies’ domestic and foreign income that were on the cut list in the President’s FY2024 budget request remain in the President’s FY 2025 budget request.

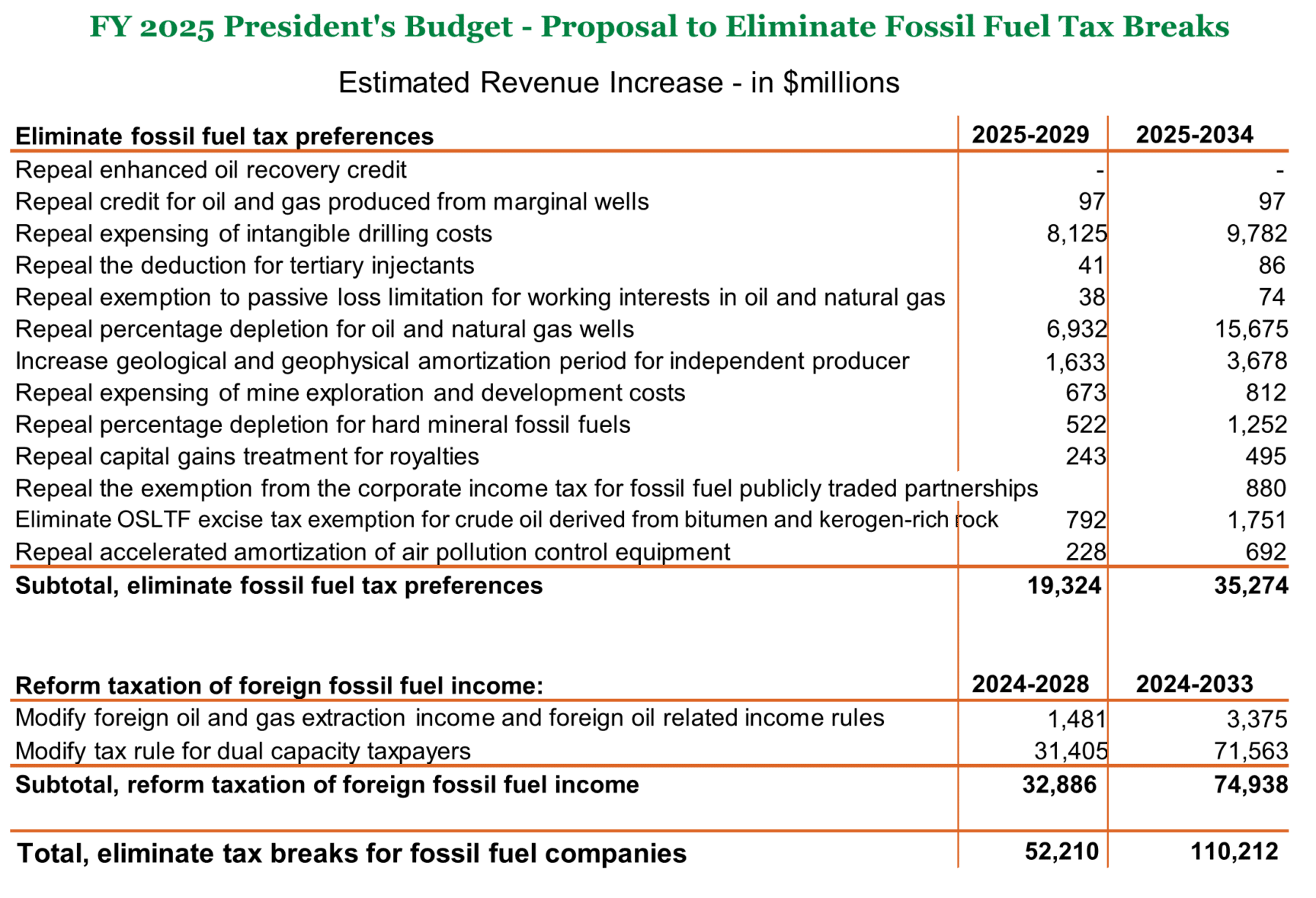

Eliminating the tax subsidies would increase revenue for taxpayers by almost $110 billion over 10 years. The biggest savings come from the proposed modification of tax rules for dual capacity taxpayers, which will bring in $71 billion over 10 years. Eliminating percentage depletion and expensing of intangible drilling costs will save taxpayers $15.7 billion and $9.8 billion, respectively. See all proposed cuts in the table below:

Other proposals in the President’s budget that could affect fossil fuel companies include raising the corporate income tax and increasing the excise tax rate on stock buybacks. However, the Last-In First-Out (LIFO) inventory accounting rule is absent from the proposed fossil fuel tax break cuts. Oil and gas companies use LIFO to increase their book costs and thus reduce the total amount of income that they owe from taxes. The last time LIFO cut was proposed was during the Obama administration. The Treasury Department estimated it would recoup $81 billion in revenue over 10 years, though at that time the corporate tax rate was capped at the higher rate of 35%, making the break more valuable.

The oil and gas industry has been posting record profits since recovering from the pandemic, meanwhile distributing hundreds of billions of dollars’ worth of stock buyback to their investors. Despite being a long established, mature, and profitable industry, oil and gas companies have been receiving subsidies through preferential tax treatment, as well as sweetheart leasing terms like below market rate royalty and loopholes like noncompetitive leasing, for decades. While we were glad to see that the Inflation Reduction Act (P.L. 117-169) included some much-needed federal oil and gas leasing reforms, a stronger commitment to end broader fossil fuel subsidies is long overdue. It is also worth noting that although the table above provides a list of fossil fuel tax breaks that have been written into the tax code for decades, there are other tax breaks for fossil fuel companies, like the 45Q tax credit for carbon capture and sequestration, which essentially pays oil, gas, coal and ethanol companies for capturing their own carbon emissions on a per ton basis.