On March 5th, the Bureau of Land Management (BLM), under the Department of the Interior (DOI), held an auction for oil and gas leases on federal land in Wyoming. The sale in Wyoming offered 28 parcels, totaling 12,975 acres, of which 11,738 acres received a bid and were sold. This was the first lease sale held by BLM in 2024.

| State | Acres Offered | Acres Sold | % Acres Sold | Total Bid Revenue | Avg. Bid Per Acre | Avg. Bid Per Acre 2016-2020 | Total Revenue |

| WY | 12,975 | 11,738 | 90.5% | $8,963,166 | $763.61 | $170 | $9,003,285 |

Tuesday’s sale received competitive bids on a higher percentage of offered acres and a higher average bid per acre than in 2023, the first year of sales held under new leasing policies implemented in the Inflation Reduction Act (IRA). BLM leased more than 90% of the acres offered at an average bid of $763/acre. Only one parcel, containing 716 acres, sold at the minimum bid of $10/acre.

In our recent report, Waste in Wyoming II, TCS found that between Fiscal Year (FY) 2013 and FY2022, taxpayers lost $3.8 billion in potential revenue from oil and gas production on federal lands in Wyoming due to below-market royalty rates and fees. Inadequate bonding policies also leave taxpayers at risk of shouldering up to $88 million in reclamation costs from currently producing oil and gas wells on federal land in the state.

Taxpayers in this most recent sale and last year’s sales benefited from the critical leasing reforms implemented in the Inflation Reduction Act (IRA), including:

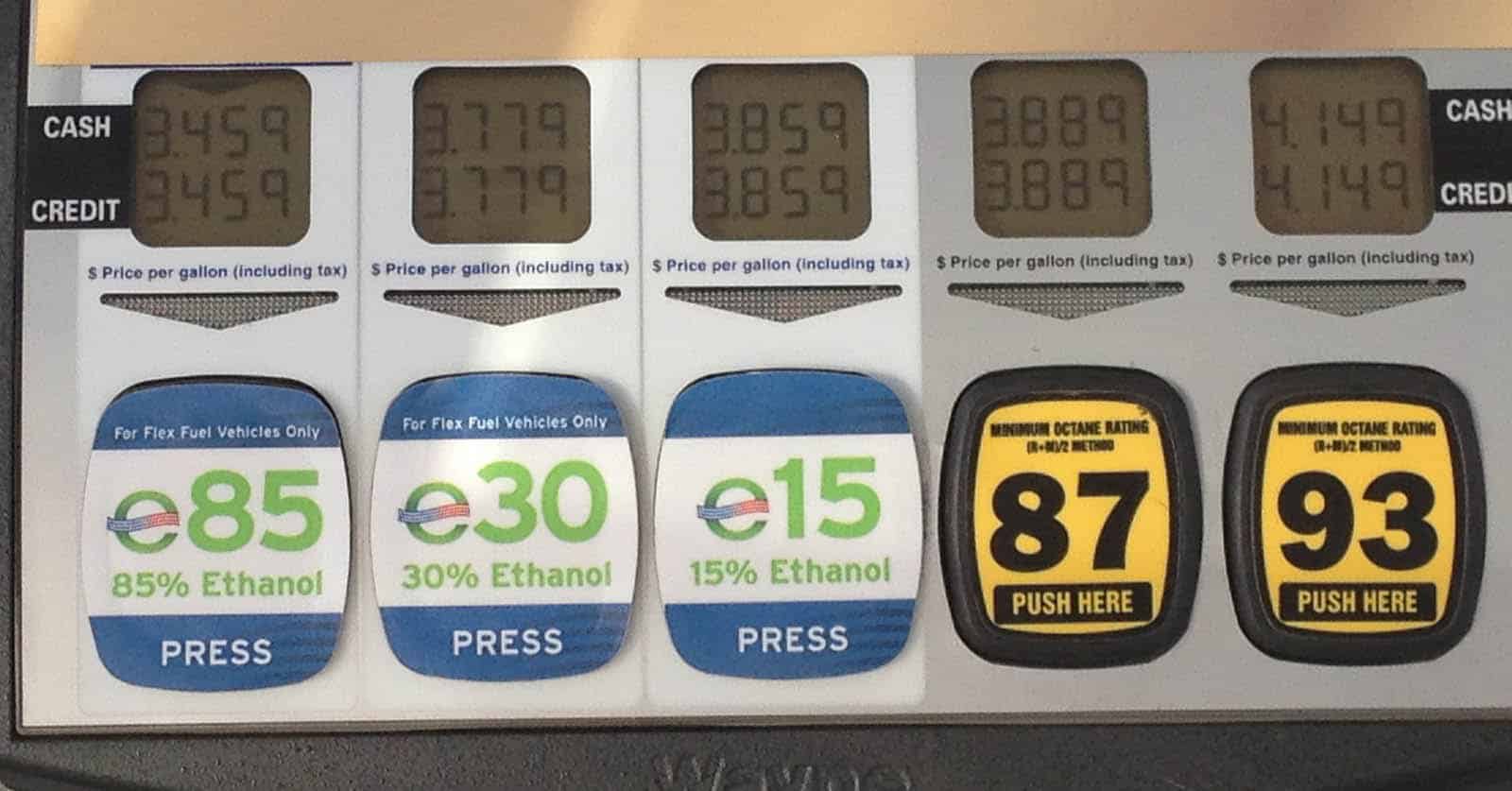

- A federal onshore royalty rate of 16.67% (raised from 12.5%)

- Rental rates of $3/acre for the first 2 years, $5/acre for years 3-8, and no less than $15/acre for years 9-10 (raised from $1.50/acre for years 1-5 and $2/acre for years 5-9)

- Minimum bid of $10/acre (raised from $2/acre)

However more needs to be done to protect taxpayers. Last year, BLM leased more than 161,000 acres of federal land of which 126,345 acres were in Wyoming. Wyoming had the most land leased for oil and gas development in 2023, but the sales raised little revenue due to low bids. BLM also received bids on just 55% of the acres offered at auction in Wyoming in 2023, costing taxpayers in administrative expenses.

The BLM recently proposed a new leasing rule that would codify the fiscal reforms made in the IRA and implement other needed changes, such as improving oil and gas bonding requirements. Additionally, the rule would help direct leasing to appropriate locations and increase processing fees, allowing the BLM to cover the cost of administering the federal oil and gas program.

The proposed rule would increase returns to taxpayers, disincentivize speculative leasing, and hold the oil and gas industry more accountable.