On Thursday, the Bureau of Land Management (BLM), an agency within the Department of the Interior, held a live auction for oil and gas leases on federal lands in three western states. The results of the sale lagged expectations, attracting bids well below historical averages. Lower revenue for taxpayers from the sale is compounded by lower royalties on future production of up to $240 million because of the BLM’s outdated 12.5 percent royalty rate on federal lands.

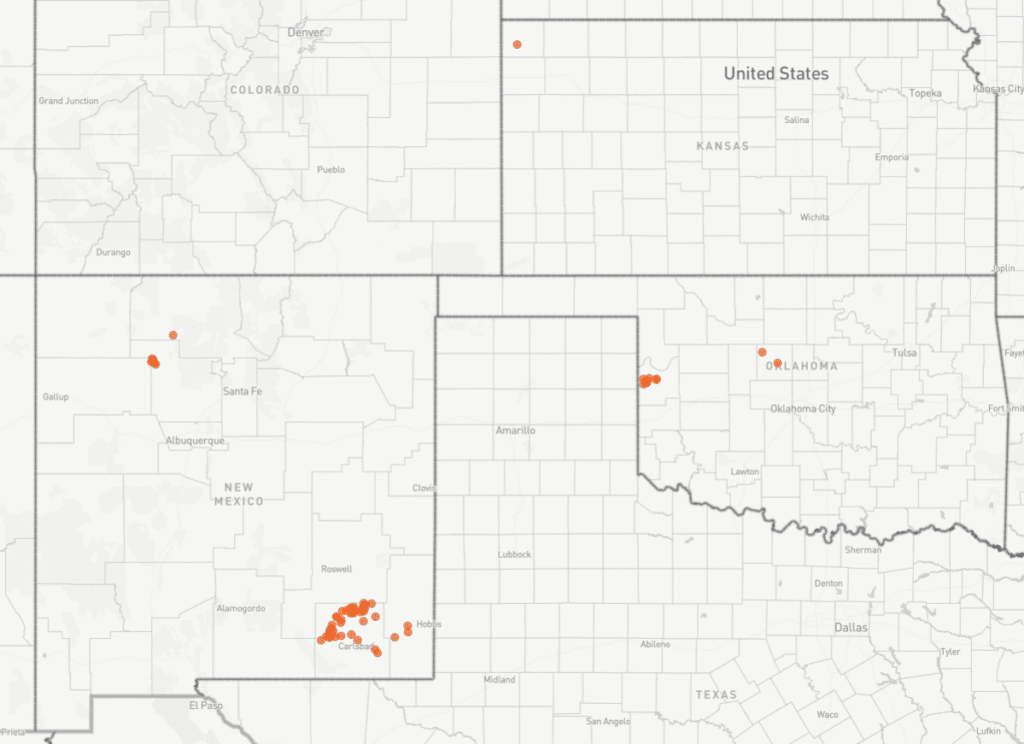

The BLM administers the federal oil and gas program, holding quarterly oil and lease sale in states throughout the west. These competitive auctions make federal lands available to private bidders for oil and gas exploration and development in exchange for the “bonus bid” that wins at auction, rental fees, and a royalty on production. This week’s lease sale was held by the BLM’s New Mexico office and included plots of land, known as parcels, in New Mexico, Kansas and Oklahoma. Of the lands on offer, New Mexico held the vast majority with 56 parcels made up of over 14,500 acres, followed by 11 parcels in Oklahoma totaling 2,300 acres and just one parcel with 160 acres in Kansas. Altogether, the sale offered 68 parcels covering over 17,000 acres of federal land.

Parcels of federal land available for lease in Thursday’s sale.

Auction Results

Of the available parcels, oil and gas companies submitted bids for all but two. One was a 160-acre plot located in Oklahoma, the other, the sole 160-acre parcel in Kansas. Of the leases that received bids, 15 parcels comprising roughly 3,500 acres – 21 percent – sold for $10 or less. Parcels in Oklahoma in particular seemed to be in low demand – 89 percent of acres leased there sold for $6 or less. Altogether, seven parcels made up of just over 1,000 acres sold for just $2 per acre, the minimum amount the BLM can accept.

Per acre bids for parcels in New Mexico were especially low compared with previous years. Over the last five years, parcels in New Mexico have received bids at auction averaging over $5,800/acre, the highest in the nation. In Thursday’s sale, the bidding averaged $1,400 per acre, a whopping 76 percent below the 5-year average.

Locking in Lost Revenue

In addition to lower revenue from the lease sale up front, taxpayers will get shorted millions more because of BLM’s antiquated policies. The royalty rate imposed on federal onshore oil and gas production significantly lags the market rate. The BLM charges 12.5 percent, compared to the 18.75 percent imposed on offshore federal production, and rates as high as 20 and 25 percent on state and private lands. This means taxpayers will lose again when oil and gas is eventually extracted and sold from the lands leased on Thursday.

In its public lease sale documents, the BLM estimated potential oil and gas production for most parcels offered in the lease sale. Assuming the anticipated production occurs over 20 years, taxpayers could lose out on as much as $240 million in royalty revenue compared to potential gains under a 20 percent royalty (see table below).

Potential Royalty Revenue from Parcels in Thursday’s Sale – 3 Scenarios

| Royalty Rate | 12.50% | 18.75% | 20% |

| Total royalty revenue | 402,844,298 | 604,266,447 | 644,550,877 |

| Potential loss | 201,422,149 | 241,706,579 |

Unfortunately for federal taxpayers, low revenues and disappointing results are regular occurrences in BLM oil and gas lease sales. Wholesale federal leasing and lack of industry interest has meant poor results in lease sales. The federal oil and gas leasing program is in dramatic need of reform after decades of neglect. Taxpayers deserve a fair return from the use of federal land and the development of valuable oil and gas natural resources.