Certain big tax breaks for fossil fuel companies with foreign income are no longer on the chopping block in the President’s fiscal year (FY) 2023 budget request. As oil and gas commodity prices soar and the industry is raking in profits, now is not the time to go soft on ending their subsidies that cost taxpayers billions of dollars every year.

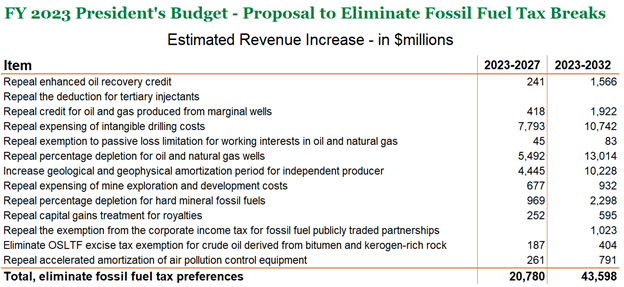

For fossil fuel companies’ domestic income, the FY23 budget calls for cutting the same 13 tax breaks as last year. If Congress were to follow through, taxpayers would save $43 billion over the next decade, which is up $8.3 billion from estimated savings in last year’s budget. The difference likely stems from the increased income oil and gas companies are currently making.

However, last year, the budget proposed saving an additional $86.2 billion over 10 years by modifying rules for dual capacity taxpayers and other accounting rules. Those cuts are missing in this year’s budget. Given how costly the tax breaks are to taxpayers and the industries’ current profitability, the omission is particularly glaring.

When President Biden entered office in 2021, he signed Executive Order 14008 that included a section promising to “eliminate fossil fuel subsidies from the budget request for Fiscal Year 2022 and thereafter.” TCS applauded the intention but found a lack of details in the FY 2022 budget request. At the least, though, the FY22 budget called for thoroughly eliminating fossil fuel subsidies in the tax code. This year’s budget continues to leave us questioning the Administration’s plans to end fossil fuel tax preferences.

Padding oil and gas companies profits so they can funnel billions more to their investors needs to end.