In the summer, Americans enjoy our federal lands more than any other time of year. Here in Washington, we’re jealous. Instead of enjoying the mountain passes and river valleys, we are knee-deep in the policies that oversee the development of the natural resources that come from our lands and waters, making sure taxpayers are getting a fair return for the resources we all own. The unfortunate reality – under current policies, whether it’s oil, gas, gold, or gilsonite, taxpayers are losing valuable revenue.

This week we turned our attention to livestock grazing on public lands. On Thursday, the House Natural Resources Committee held a hearing on the topic. The hearing adequately addressed the importance of federal land access for ranchers for cattle grazing, etc. But it spent too little time focused on the landowners (aka federal taxpayers) stake in the issue. Unfortunately, current policies virtually give away access to valuable grazing grounds for pennies on the dollar.

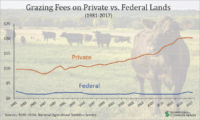

According to the USDA’s statistics office, in 2017, ranchers paid private landholders $20.20 per Animal Unit Month (AUM) on average across 17 states. (An AUM represents the amount of forage [e.g. grass] a cow and her calf, or equivalent livestock, eat in a month.) In comparison, the Bureau of Land Management (BLM) and the U.S. Forest Service (USFS), which manage almost all grazing on federal lands, set the fee for the 2017 grazing year at just $1.87/AUM, or less than one tenth of the market rate for private lands.

Despite the already-flagrant under charging, BLM and the Forest Service reduced the rate by a quarter, down to $1.41/AUM, this year. Unfortunately for taxpayers, the disparity between the grazing rate for private lands and the federal grazing fee is nothing new. Historically, grazing rates have been set at the lowest level allowed by regulation 18 of the last 38 years. They hit a record high in 1981, at $2.31/AUM (and that is not adjusted for inflation), under President Reagan. As the gap between market rates and the federal rate has gotten worse over time, taxpayers have been losing out on increasingly more revenue.

Tracking the exact numbers on how much the BLM and the USFS collect from grazing on public lands is more difficult than it should be, but available data indicate that together they brought in an average of $25 million per year over the last three years. If BLM had simply kept its 1981 fee on pace with inflation, the 2016 rate would’ve been $6.20, and BLM and the Forest Service would’ve gotten 3-4X more, or $95 million at current grazing levels.

When looking at revenue generators, this is low-hanging fruit, which is why the Government Accountability Office (GAO) has repeatedly included revenue collection from grazing on its list of “Major Management Challenges” for the Department of the Interior. The Congressional Budget Office (CBO) also estimated that if BLM merely followed what states charge for grazing on state lands, federal taxpayers could net $100 million more over 10 years, after taking out states’ share. So the question is, at a time of record deficits, why is BLM not seizing the initiative to earn more from federal lands? Or, why isn’t Congress making them?

Which brings us back to the hearing this week. The issue of under-charging and under-collecting for grazing on public lands was only raised in passing. It was referenced obliquely by those claiming lower rates were justified because of the poor condition of public rangeland for ranchers’ use, and those claiming the low rate wasn’t sufficient to improve the rangeland’s ecological condition. Both lines of argument implicitly acknowledge a crucial point – it actually costs money for BLM and the Forest Service to administer the public lands for grazing purposes. It’s not just what’s coming in, but what’s going out.

BLM spent $90 million per year on ‘Rangeland Management’ and ‘Range Improvement’ over the last three years. The Forest Service spent $57 million per year on grazing management over the same period. Which means that instead of generating revenue, grazing on public lands is actually costing taxpayers money – roughly $125 million per year

There is no good time to give away taxpayer-owned assets for bargain basement prices. But in these budget times, the case for increasing our grazing fees could not be clearer. We hope this week’s hearing is just the beginning of an important discussion that truly tackles our egregious grazing policies. At the end of the day, the use of federal lands by any interest—rancher, miner, driller, should not come at the expense of federal taxpayers. No one wins when we give away the store.