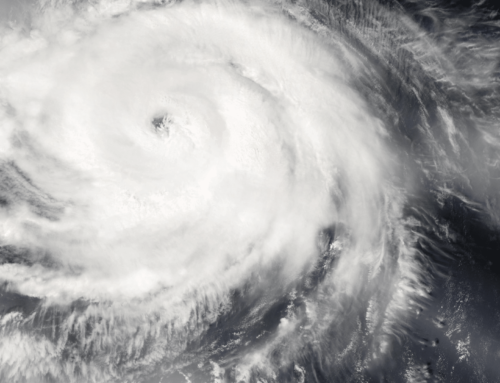

Recent wildfires in Canada, sending smoke into the Midwest, and extensive recent flooding and severe storms in the southern U.S. are stark reminders of the increasing volatility and destructive potential of climate-driven natural disasters. Last week, the National Oceanic and Atmospheric Administration (NOAA) predicted a more active Atlantic hurricane season this year, in part due to warmer-than-average ocean temperatures. The simple fact is that more disasters mean more loss of property and life and economic disruption. Amidst this backdrop of escalating climate-related disasters, the Federal Reserve Bank just released its findings from its pilot Climate Scenario Analysis (CSA) exercise, shedding light on the financial sector’s preparedness for climate-related risks.

The Federal Reserve conducted the CSA in 2023 to assess how well large banks manage and estimate the financial impacts of climate change, focusing on both physical and transition risks. The exercise involved six of the nation’s largest banks—Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, and Wells Fargo.

These banks were provided with climate scenario narratives, which they used to analyze the potential impacts on specific portfolios and business strategies. They used their existing credit risk models, adjusting inputs to better capture climate-related risks. They also responded to qualitative questions about their governance, risk management practices, and the challenges they faced.

For example, financial institutions may face escalated credit risks as sectors like agriculture, insurance, and real estate struggle with the impacts of climate change, potentially leading to increased default rates and significant losses. Market instability could arise from sudden revaluations of assets not accounted for climate risks. Physical climate events such as hurricanes and wildfires may damage critical infrastructure and disrupt business operations, increasing operational costs across affected supply chains. Additionally, the growing frequency and severity of climate-related events are straining insurance markets and federal assistance programs, necessitating legislative and regulatory adjustments to address these emerging challenges.

A significant aspect of the exercise was identifying data gaps and modeling challenges. Participants noted difficulties such as the lack of comprehensive data on building characteristics, insurance coverage, and counterparties’ climate risk management plans. These challenges highlight the complexities of assessing climate-related financial risks and underscore the need for improved data collection and modeling techniques.

And while the CSA was exploratory and did not have consequences for bank capital or supervisory implications, this initiative is part of a broader movement among financial regulators to integrate climate risk into financial stability monitoring and to develop more robust risk management frameworks in the face of climate change.

For instance, this aligns with the Security and Exchange’s (SEC) proposed rules requiring companies to disclose their greenhouse gas emissions . These disclosures are intended to provide investors with better information on the financial impacts of climate change on companies, which is like the data gaps identified in the Federal Reserve’s report.

It also aligns with the Federal Acquisition Regulation (FAR) Council’s proposed rule on climate-related financial risk, which would require major contractors to disclose Scope 1, 2, and 3 emissions, to set emissions reduction targets, and to report on climate-related financial risks such as disaster-driven risks to supply chains.

The Federal Reserve report also discusses the critical role of insurance in mitigating climate risks for consumers, businesses, and banks. This is relevant to broader regulatory trends where understanding and managing climate-related risks, including insurance dynamics, are becoming crucial for financial stability and operational resilience. The federal National Flood Insurance Program has undergone significant changes to better reflect the risks and impacts of climate change, as it aims to incorporate future catastrophic modeling from climate change, including sea level rise, drought, and wildfires, into its insurance pricing.

For us, the implications of this study are profound. Enhanced climate risk management by major financial institutions could potentially reduce the need for taxpayer-funded bailouts or interventions in the future. As these practices become standardized, they can lead to a more resilient financial system that safeguards public resources against climate-related financial crises.

Get Social