Taxpayers for Common Sense staff will be combing through the President's budget over the next several hours and days, explaining what the numbers mean and their impact on taxpayers. We'll also post budget documents here as they become available so WATCH THIS SPACE for live updates.

Links to our Live Stream Analysis:

2:20pm

Hardrock Royalty Replay

Similarly to previous budget requests, this year’s budget calls for a minimum five percent royalty for hardrock mining and a new Abandoned Mine Land (AML) fee. The hardrock royalty proposal is estimated to generate $80 million over ten years, and the AML fee on hardrock production is estimated to generate $1.8 billion through 2025.

Under the General Mining Law of 1872, the hardrock mining industry is able to extract valuable taxpayer-owned hardrock minerals such as gold and silver from public lands for free. Making matters worse, companies often abandon their mining sites once they are no longer profitable—forcing taxpayers to pay for reclamation costs.

Legislation proposing a royalty rate for the hardrock mining industry has been introduced in previous Congresses. Many of these proposals have included a significantly higher royalty rate than the five percent rate included in the President’s budget request. A 12 percent royalty, as has been proposed in various bills, would be in line with other onshore extractive industries (i.e. coal, oil, and gas) and represent a fair return to federal taxpayers.

February 5, 2015

3:30pm

Loan Guarantees for the Taking

The President’s budget request includes no new loan guarantee authority for the Title 17 Loan Guarantee Program (LGP), most well-known for its award and subsequent default to the failed solar company, Solyndra. But Department of Energy (DOE) emphasized that they plan to use the $24 billion already available. Of the existing loan guarantee authority, $8 billion is slated for fossil energy, $4 billion for renewable energy and efficiency, and $12 billion for nuclear energy. DOE is currently reviewing applicants for the fossil energy portion of the program and is in the midst of a new nuclear energy solicitation for applicants that includes an expanded portfolio of small modular reactors and upgrades at existing facilities.

No new funding does not mean taxpayers should rest easy. Last year DOE LGP finalized a $6 billion loan guarantee to Georgia Power for a pair of nuclear reactors at Plant Vogtle in Georgia. In a shocking move, DOE assessed the subsidy cost to taxpayers at $0–effectively saying the loan guarantee has no risk for taxpayers. But since the award the project has only encountered additional cost increases and schedule delays raising the issue of whether or not the project will reach completion. Further, one project partner, MEAG, has yet to receive their portion of the project loan guarantee, raising more questions about Vogtle’s financial footing. TCS has documented the red flags with the Vogtle project since it first applied to the program in 2008. With another $12 billion waiting in the wings for nuclear energy, taxpayers stand to lose significantly more than we did on Solyndra.

2:25pm

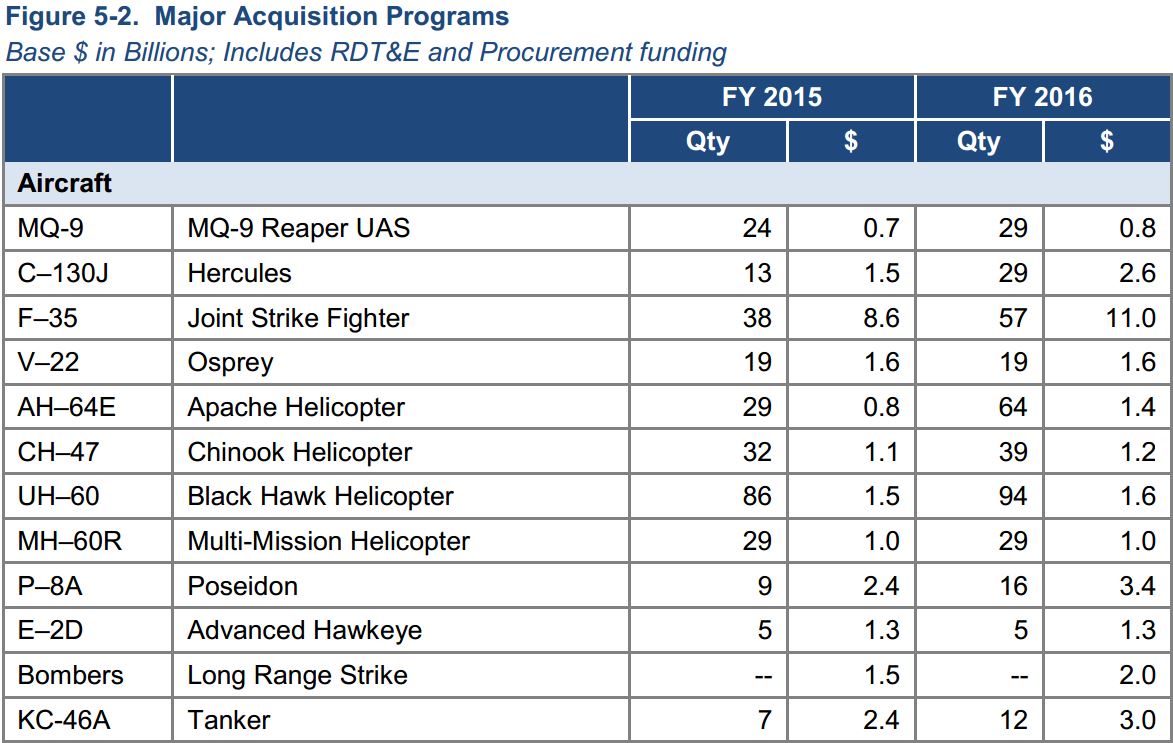

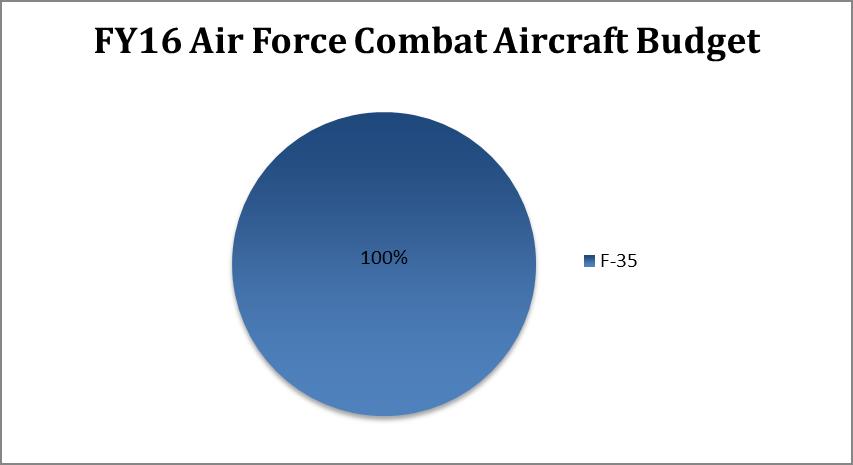

F-35 = 36% of our Aviation Future?

Deep in the Pentagon’s FY16 budget submission, in a chapter entitled “Pursue Investments in Military Capabilities” is a table of “Major Acquisition Programs.” This table gives the dollar amount being spent, in both procurement and research & development, on the Pentagon’s major programs. The aircraft section lists twelve different aircraft programs where, presumably, the Pentagon is pursuing investments in future capabilities.

In a black and white table, filled with numbers, it isn’t very eye-catching or memorable. So we put the Pentagon’s own data into a pie chart and added some color:

Fully 36% of all “investments in future capabilities” in aircraft programs is being sunk into the F-35 program.

Further evidence the Pentagon is putting all its future aviation eggs into one, unaffordable, basket.

2:00pm

Budget Admits Taxpayers not Reaping Promised Farm Bill Savings

The President’s budget throws cold water on the already dubious notion that taxpayers will reap savings from adopting the 2014 farm bill. During the farm bill debate Agriculture Committee members repeatedly pushed the notion that adopting the $956 billion farm bill would reduce the deficit by replacing certain agriculture entitlement programs with “cheaper” new ones.

Updated estimates of just a handful of farm bill programs show significant erosion of the $16.6 billion in “savings” lawmakers projected in the 10-year period 2014-2023. Note that the President’s budget only provides actual amounts spent in fiscal year 2014 and cost estimates for fiscal years 2015 and 2016.

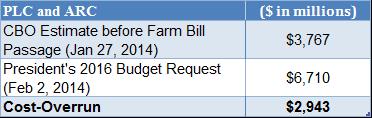

The President’s budget projects the Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC) programs, which don’t start running until the 2016 budget years, will cost nearly $3 billion more in FY16 than originally anticipated. PLC sends checks to farmers if crop prices fall below a price goal set by Washington while ARC sends checks if a farmer’s yearly revenue falls short of a government-guaranteed level determined through a complicated equation.

The other significant cost overrun is in the Supplemental Disaster Programs. These four programs provide funds for producers of livestock, honey-bees, farmed-fish, and owners of orchards or plant nurseries when they lose livestock, grazing sources, or trees due to natural disasters. The budget estimates these four disaster programs will cost $3 billion more in FY14-16 than CBO estimated would be spent over the entire 10 year period 2014-2023.

Secretary Vilsack even admitted the PLC/ARC programs are costing more than anticipated, though he continues to hold out hope that lower crop prices will lead to lower costs in the federally subsidized crop insurance program. But in light of the administration’s updated cost estimates and the budget busting track record of the last two farm bills (over budget by $400 billion) it’s becoming clear the 2014 farm bill fleeced taxpayers.

12:40pm

The Plane That's Eating the Pentagon Budget

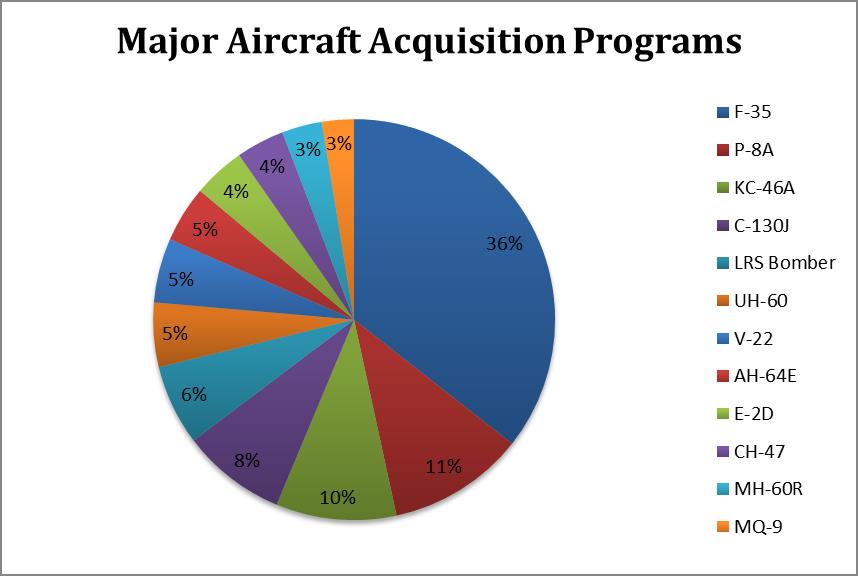

The Air Force, the Navy and the Marines all fly combat aircraft in service of the nation.

This chart represents the Department of the Navy (DoN) “combat aircraft” account for FY16. (Note that the DoN buys planes for both the Navy and Marine Corps.) The P-8 is the largest piece of the pie, with the F-35 coming in second. Overall, the chart shows some balance and a sense of the need for trade-offs to purchase all the airframes necessary for the future of Naval Aviation.

And this chart shows the Department of the Air Force “combat aircraft” account for FY16.

In the most stark terms, the Air Force is mortgaging its future on the F-35.

12:05pm

Project Funding the Goldilocks Way

In last year’s budget, the Department of Energy (DOE) requested that the Mixed Oxide (MOX) Fuel Fabrication Facility project (see below) be put into “cold standby” while they considered alternatives to the burgeoning boondoggle.

This year, DOE has taken a similar approach to research on domestic uranium enrichment technologies, requesting $100 million to keep the project in “warm standby.” Meanwhile, they plan to conduct a “technology options study, and a cost analysis for build out of the existing centrifuge technology” as Congress stipulated in the FY’15 CROmnibus.

The project originally started as the “American Centrifuge Project” (ACP), a research, development, and demonstration (RD&D) endeavor conducted by the United States Enrichment Corporation (USEC). To make it quick: USEC received $280 million from DOE from June, 2012 to April, 2014 for the ACP; went bankrupt in March, 2014; emerged as Centrus Energy; and was retained as a subcontractor maintaining the enrichment technology, which had been transferred to Oak Ridge National Laboratory.

Keeping the project in “warm standby” means taxpayers will be forced to keep the centrifuges running at remarkable cost, possibly only to have the whole effort scrapped in the near future. While DOE determines which project is too hot, and which is too cold, their efforts give off the impression that they’re lost in the woods. Instead of pausing huge projects to study whether they’re necessary, or if an alternative exists that would be “just right,” maybe DOE should be asking the tough questions up front. Taxpayer money would stand a lot better chance of remaining uneaten.

February 4, 2015

3:35pm

Clean Coal Funding Continues

The budget requests $560 million for the Fossil Energy Research and Development program, $84 million more than last year’s $476 million request. The program is primarily dedicated to carbon capture and storage (CCS) – the process of separating carbon dioxide (CO2) from fossil fuels then pumping it deep inside the earth – and advanced power systems. Despite years of investments, CCS technology is decades away from being commercially viable and taxpayers should not pour any more subsidies into this costly pursuit. Some specifics of the CCS request within the Fossil Energy Research and Development budget:

- $369.4 million for CCS and Power Systems program

- $116.6 million for carbon capture R&D

- $108.8 million for carbon storage R&D

- $39.4 million for advanced energy systems R&D

The “Clean Coal Technology Program” has been cut in this year’s budget, with a request of $1 million for close-out activities, down from last year’s $8 million request for the program.

3:07pm

Still Smiling on SMRs

In its FY2016 Nuclear Energy budget, the Department of Energy (DOE) is requesting $62.5 million for its Small Modular Reactor (SMR) Licensing Technical Support program. That’s down from DOE’s previous two requests, but shocking nonetheless given the program’s track record. SMRs, in theory, are mass-producible reactors that generate less than 300 MWe. By comparison, traditional reactors produce around 1,000 MWe. The mini-nukes are also, by comparison, significantly more costly per MWe than traditional reactors. The difference would supposedly be eliminated through economies of scale – using multiple SMRs in conjunction – but no one’s been able to make the math work. The technology’s outright implausibility is what prompted us to award DOE’s program the Golden Fleece Award in 2013.

3:00pm

In Other News: Newly Slimmed-Down OCO Is Still 5th Largest Agency

We’ll be the first to say that it’s a good thing the Overseas Contingency Operations (OCO) account received a $13 billion reduction from last year’s request.

But, same as we first reported last year, if OCO was its own federal agency, it would still be the 5th largest in the discretionary budget. Yep. The Pentagon “base” budget is still the largest at $534.3 billion. The next three are Health and Human Services ($79.9 billion), Education ($70.7 billion) and Veterans Affairs ($70.2.) But still firmly in 5th place is OCO at $50.9 billion.

Sorry State Department and Other International Programs – at $46.3 billion in the FY16 request, you’re still in 6th place. Better luck next year.

2:43pm

What Counts as a “Cut” for the Army Corps of Engineers

The President’s budget proposes just over $4.7 billion in funding for the Army Corps of Engineers Civil Works projects. This represents an increase of nearly 4.5% over the President’s 2015 request, but a reduction of 13% from the $5.45 billion that was appropriated in the CROmnibus. Much of the difference comes from the President’s proposal to “cut” (that is, request less than what Congress appropriated last year) $493 million worth of funds for low priority studies or construction projects and $199 million from the Operations & Maintenance budget.

These low priority projects, which typically have a potential return on investment too low to pass muster with the President’s Office of Management and Budget, are none-the-less high priority for Members of Congress who want to bring federal funds to their constituents. When it comes time to write the budget bills you can bet Congress will once again appropriate much more than the President requested while eliminating amounts for specific projects, trimming funds for all projects, or adding funds to others. They’ll also likely continue their practice of providing hundreds of millions in slush-y funds ““for work that either was not included in the administration's request or was inadequately budgeted.”

The 2015 CROmnibus provided more than $1 billion for these 26 different slush-y funds. In addition to the 2016 budget request, the Corps has released its work plan stating exactly how it spent these funds.

2:30pm

Instant Relief for the Shipbuilding Account: Cancel the Littoral Combat Ship

The Navy has spent a lot of time and spilled a lot of ink saying it can’t find room in its budget for all the shipbuilding requirements of the next decade. Things are so dire, Navy leadership says, that they need to take the extraordinary step of moving the cost of the replacement for the Ohio class submarine out of their budget into a new pot of imaginary money.

We have a great way to relieve that stress on the shipbuilding budget. Cancel the Littoral Combat Ship (LCS.) We’ve written about this poorly conceived, poorly executed program in the past. Secretary Hagel, in ordering a review of the program, stated it was designed to perform its missions in a “relatively permissive environment.” And this seems a little odd to us since operating in the “littorals” means being close to shore – not the most “permissive” of environments.

The Navy has already devoted more than $10 billion to the program through FY15. The FY16 request is for $1.8 billion for another three ships. Cancel LCS now and save at least $8 billion through FY19.

The Administration has requested $345 million for the Mixed Oxide Fuel Fabrication Facility (MFFF), up more than 50% from last year’s request but the same amount Congress gave the project last year. The MFFF is supposed to remove impurities from plutonium feedstock obtained from nuclear weapon pits, form the plutonium into mixed oxide (MOX) fuel pellets, and fabricate the pellets for use in a commercial reactor. But since its inception, the program’s costs have skyrocketed.

Last year, the FY15 budget sought to place the MFFF into “cold-standby.” According to the FY16 DOE Budget Request:

“The FY 2015 National Defense Authorization Act and the FY 2015 Consolidated and Further Continuing Appropriations Act, 2015, each directed the Department to conduct additional analyses of the MFFF construction project, including independent cost and schedule estimates as well as an analysis of alternative approaches for disposition of the 34 metric tons of weapons grade plutonium and their relationship to the Plutonium Management Disposition Agreement (PMDA). The Department has requested Aerospace Corporation, a federally funded research and development center, to perform these analyses.”

The MOX program has been a problem for a while, and it’s pretty clear what those analyses should say: shift MOX from cold standby to cold bye-bye. Congress needs to pull the plug.

11:08am

Nonproliferation Gets a Little Respect in DOE Budget Request, Meanwhile Naval Reactors Keep Steaming Full Speed Ahead

In last year’s analysis of the FY15 budget request, we noted the dichotomy of calling terrorists acquiring nuclear weapons one of the “gravest threats” the U.S. faces, and then cutting the budget of the Defense Nuclear Nonproliferation Program Office by 20 percent.

This year’s budget request of $1.9 billion includes an increase of more than 18 percent to the nonproliferation office – bringing it back to within a million dollars of its funding in FY14. And while we don’t usually support major increases to federal programs from one year to the next, we do believe the mission of the office, “to detect, secure, and dispose of dangerous nuclear and radiological material” is important. It deserves steady, predictable funding. Wild fluctuations in the amount of money in this account will only complicate the ability of the office to meet its mission.

On the other side of the National Nuclear Security Administration (NNSA) ledger, we have Naval Reactors. This is the portion of the NNSA budget that supports nuclear propulsion of U.S. Navy vessels. And it’s clear the Administration considers this a growth industry. After a whopping 26 percent increase in FY15, the FY16 budget request for Naval Reactors is almost $1.4 billion. That represents another 11 percent increase to the program. And the long term funding for Naval Reactors is shown to climb to almost $1.8 billion in FY19. This represents almost 30 percent further growth to the reactors account by FY19.

This shows the stark difficulties of budgeting for non-Pentagon priorities – even in the Department of Energy budget.

February 3, 2015

The Incredible Shrinking Cut List

One of the perennial items in the budget is the Cuts, Consolidations, and Savings list. Over the years, though, it's gone through some changes. It used to be called the Terminations, Reductions, and Savings list, until the FY13 budget, and it seems to be continually getting smaller – at least since FY14. Of course number of pages isn’t a very good metric, it’s about the dollars and we’ll get into that. But considering we read it every year, the list's shrinkage is stark.

The first Obama budget Terminations list weighed in at 131 pages, down from a hefty 194 pages in the last Bush budget, but still respectable. It stayed that way until FY12 when it expanded to 215 pages. You might recall that this was the first budget after the 2010 “tea party” election and the Administration was eager to offer up more cuts. In fact it went from $10.3 billion in savings in FY11 to $24.8 billion in FY12. Other than the name change, it stayed the same (with some different programs considered) in FY13. But then the list changed dramatically. For many years, the list included a description of each program being offered up for a “cut” or “consolidation” or “saving.” That disappeared in FY14 and the list plummeted to 10 pages, and went from being a separate document to being tucked into the back of the main budget. As we wrote at the time:

“What is missing is the detailed explanation for why or how these changes will be made. We’re happy to again see the President listing where cuts can be made, but think he needs to give the American public more details. For example, what steps will be taken to shave $11.8 billion from crop insurance? What’s meant by multi-agency food aid reform? And even before you detail how you're consolidating it, what is the Department of Energy’s W 78/88 Life Extension Program?”

Indeed.

But the shrinkage continued: to 7 pages in FY15. And now 4 pages in FY16. You could argue that they are a victim of their own success, that items are being cut. And that some of the Administration proposals are detailed elsewhere. But that doesn’t completely explain it. Actually a table of a bunch of programs and year-to-year funding reductions doesn’t even begin to explain it. So we'll be digging into this more as we read through the list, which shouldn't take us long.

Biofuels Boosters

The President’s FY16 budget includes yet another boost for biofuels. It proposes more support for biofuels infrastructure projects, namely ethanol blender pumps.

The corn ethanol industry has already received more than 30 years of taxpayer subsidies, including a nearly identical federal tax credit entitled the “Alternative Fuel Vehicle Refueling Property Credit” for E85 (85 percent ethanol) blender pumps, which expired at the end of 2014 but will likely rear its head when the “tax extenders” package is considered.

Congress did not intend Rural Energy for America Program (REAP) funding to be spent on ethanol blender pumps, but USDA listened to the siren song of lobbyists and started funding them in 2011. While the majority of REAP funding goes to energy projects, $3.3 million went to install blender pumps (not an energy project) at gas stations and other facilities to dispense higher blends of ethanol. Congress put the kibosh on that policy in the 2014 Farm bill.

Or so we thought.

The President and USDA didn’t take the hint. The FY15 budget request contained $200 million worth of new tax credits for the “construction of infrastructure that contributes to networks of refueling stations that serve alternative fuels,” aka blender pumps. No dice. Now, the FY16 budget contains $50 million in loan guarantees to support “the retail sales of biofuels” through the USDA Business and Industry Loan Guarantee Program. Similar to REAP, they are hijacking a chunk of program intended for something else (in this case to support rural small businesses and local and regional food systems) to subsidize biofuels infrastructure projects, aka ethanol blender pumps. If at first you don’t succeed…

Someone needs to tell the President he’s not running in the Iowa Caucuses next year and to stop the subsidies for this mature industry. That someone is Congress.

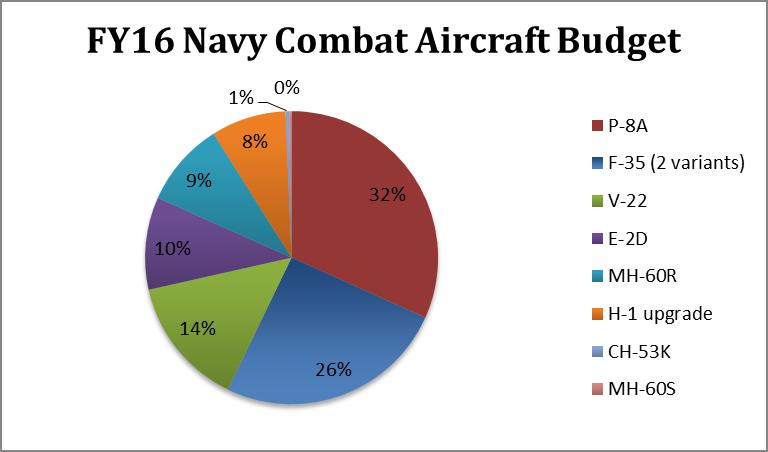

Mortgaging Pentagon Procurement for the F-35

We think and write a lot about the F-35 Joint Strike Fighter. We leave it to others to talk about the technical capabilities of the plane. We focus on its affordability. And we think it’s hard for anyone to argue, with a straight face, that the Pentagon can afford to spend $1.5 trillion over the life of a single aircraft program.

But it’s hard for most of us to even conceptualize what $1.5 trillion really means. So let’s put just this year’s procurement request for the F-35, across all three services, into perspective.

The Pentagon is asking to purchase 57 F-35s in FY16 – that’s 19 more than the 38 they received in the final FY15 bill. The overall cost of those 57 airframes is slightly more than $11 billion (that’s both procurement and research and development.) But let’s look just at procurement of airframes and spare parts – that comes in at $9.2 billion. The overall Pentagon request for procurement – in the base budget – is $107.7 billion. So that means fully 8.5 percent of all Pentagon procurement in this budget request is devoted to a single aircraft program. That’s all procurement – from staples to ships. If you just look at overall aircraft procurement and R&D costs, 35 percent – more than a third – is going to just the F-35.

We don’t know how else to say this – the Pentagon is mortgaging the future of not just other aircraft programs, but all Pentagon procurement to purchase one, unaffordable aircraft.

Only $16 Billion in Proposed Agriculture Budget Savings

While we’re pleased the Administration agrees the bloated federal crop insurance program should be cut (although its proposals could certainly go further), it failed to propose any savings from similar farm subsidy programs that are ripe for reform. While the President supported the elimination of outdated and wasteful direct payments prior to passage of the 2014 farm bill, he has failed to put forth a proposal to rein in similarly-wasteful shallow loss entitlements that benefit the same “big five” crops – corn, soybeans, wheat, rice, and cotton. His budget also fails to rein in farm subsidies to millionaires, city-dwellers, and non-farmers, something he supported prior to being sworn into office.

The President’s FY16 budget request expects to save $16 billion over ten years, primarily by cutting the highly subsidized federal crop insurance program. Past budgets, in FY13 and FY14 for instance, suggested $32 billion and $38 billion in savings, double and more than double the savings proposed this year. In his FY15 budget, the President assumed that he could forgo new reforms since $16.6 billion in savings was found in the 2014 farm bill. The savings, however, are based on budget gimmicks and are unlikely to ever be realized. The CBO’s most recent cost estimate shows just two of the new agricultural income entitlement programs are expected to cost $9.5 billion more than originally estimated.

If the following outdated and inefficient programs were eliminated or reformed, taxpayers would save over $90 billion over the next decade:

- Eliminate cotton “transition” payments, direct payments by another name, which were provided for two additional years to only the cotton industry.

- Reform the highly subsidized federal crop insurance program (by enacting proposals such as reforming or repealing subsidies for the most expensive and risky policies or the wealthiest individuals) and eliminate new shallow loss entitlement programs – the Supplemental Coverage Option and Stacked Income Protection Plan – which guarantee revenue for well-off agribusinesses.

- Eliminate the Market Access Program and Foreign Market Development Program, trade promotion programs subsidizing activities that should be managed and funded by private industry instead of taxpayers.

- Eliminate marketing assistance loans and Soviet-on-the-Potomac government-set minimum price supports, called Price Loss Coverage (PLC) subsidies, which prop up prices for certain commodity crops.

- Eliminate a new shallow loss entitlement program created in the 2014 farm bill, Agriculture Risk Coverage (ARC). ARC subsidized dips in agribusiness income of as little as 14 percent from an expected level, a revenue guarantee that no other U.S. industry enjoys.

While the media has recently highlighted several issues that the Administration and Republican-controlled Congress disagree on, farm subsidy reform is one area where they’re on the same page. For instance, former House Budget Committee Chairman Paul Ryan proposed $31 billion in similar agriculture savings in FY14. Enacting bold agriculture reforms, something Democrats, Republicans, and the President at least used to agree upon, would provide a more cost-effective, accountable, and transparent farm safety net that is responsive to taxpayers.

At TCS, we’ve been writing and talking about OCO spending for a long time. And we’ve been making the argument that OCO is a safety valve, a slush fund, protecting the Pentagon from the effects of the Budget Control Act (BCA) that every other federal agency feels in its budget. Our view is that much of the money in the OCO budget is actually for “base budget” functions and should be funded there – where it is subject to BCA caps.

Someone has apparently been listening. We are pleased to note that the FY16 OCO is $50.9 billion – a decrease of $13 billion from last year. And we’ll be combing through the detailed justification tables to see where that money has landed back in the base budget, which was probably increased by that $13 billion, right?

But wait, hold the phone, squelch that enthusiasm for fiscal responsibility. The base Pentagon budget has increased by $37.2 billion in the request and that’s nearly three times the amount that was taken out of the OCO budget. Robbing Peter to pay Paul, anyone?

Once again, the President's budget proposes cutting twelve subsidies in the tax code for the fossil fuel industry. The FY 2016 proposal mirrors budget requests since FY 2011 and includes the elimination of four coal and eight oil and gas tax preferences totaling approximately $49.7 billion in revenue over the next ten years, according to the budget documents.

Here is a brief description of some of the biggest cuts, and why they should be cut:

- Intangible drilling costs (IDC) allows qualified natural resource developers to immediately deduct all of the costs of designing and fabricating drilling platforms and can represent 60 to 80 percent of the costs of drilling a well. The oil industry characterizes the IDC deduction as the equivalent of the “research and experimental” (R&E) cost deduction. In the case of oil and gas wells, the principal uncertainty that exists is only whether oil and gas are present in commercial quantities, not how to construct the oil rig.

- Domestic Manufacturing Tax Deduction for Oil and Natural Gas Companies allows oil and gas companies to deduct 6 percent from qualified income. Like other qualifying activities, the nature of oil and gas production is such that the jobs associated with the production of oil and gas from domestic wells cannot be moved abroad in the way that jobs producing consumer goods might. (Of course we question the entire Section 199 tax manufacturing deduction which goes to roughly one-third of all U.S. corporate activity).

- Special Percentage Depletion Allowance enables producers to claim tax deductions in excess of their investment. While it is nominally designed to allow the oil and gas industry to deduct the cost of purchasing rights to oil and gas resources, the percentage depletion deduction bears no actual relationship to the cost of acquisition. It allows independent producers a flat deduction of a percentage of gross income from each well.

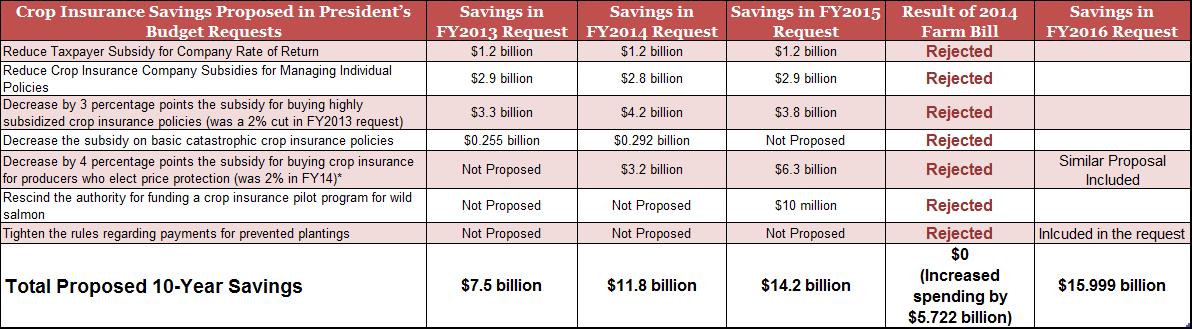

Perennial Crop Insurance Cuts

The President’s FY2016 budget plants the idea of cutting $16 billion from the highly federally subsidized crop insurance program. Trimming crop insurance is a perennial savings that thus far has failed to take root (see the chart below). The outlook on taxpayers actually harvesting these savings is bleak. The $956 billion farm bill, signed into law just under one year ago, actually increased the cost of the $8.5 billion-a-year federally subsidized crop insurance program by nearly 7% by creating multiple new shallow loss income entitlement programs, expanding to additional crops, and increasing subsidies for certain types of policies or farming practices.

Taxpayers could save billions by reforming federal farm policy to create a more cost-effective, transparent, and accountable safety net that is responsive to current needs. But planting ideas for reform then leaving them to whither and choke in a thicket of special interest carveouts won’t cut it.

(Click on the chart below for an updated version with added details)

Were We (TCS) Right?

Check out how our projections matched up to reality. Here’s what we wrote Friday in our Weekly Wastebasket. While you’re at it, keep up with all the budget wonkery by subscribing. It’s free (for reals).

For EAS – $277 Million Too Much

Begun in 1978 when U.S. airlines were deregulated, the Essential Air Service (EAS) program provides subsidies to air carriers to maintain scheduled flights between rural communities and regional hub airports. EAS-subsidized air service typically includes two or three round trips per day, using small regional aircraft, typically with 19 or fewer seats. The budget proposal includes net budget authority for EAS and the rural airport improvement fund of $102 million in 2016 (p. 921), compared to $98 million in 2015, and $119 million in 2014. In addition to this mandatory funding, which comes from overflight fees, the proposal also requests $175 million from the “Airport and Airway Trust Fund for Payments to Air Carriers” for the essential air service program (p. 924), up from $155 million in 2015 and $149 in 2014. This brings the total budget authority for EAS in 2016 to $277 million. TCS has been calling for the elimination of EAS for all states except Alaska for many years, and there is no time like the present to get rid of the wasteful and unnecessary program.

That Cap’s Too Small for You – Get a Bigger One!

Under the Budget Control Act (BCA), much maligned but still the law of the land, the cap on overall National Defense spending in Fiscal Year 2016 was set at $523 billion. But the folks at the Pentagon are looking for a new cap – evidently a much fancier one, too. The President’s Budget Request (PBR) for this year would throw that cap away and increase Pentagon “base” spending to $534.3 billion. (We’ll talk about Overseas Contingency Operations or “OCO” funding in a later blog post.)

But, as those late night commercials like to say, “That’s not all!” If you add in the portion of the Department of Energy budget that is devoted to DoD programs, $12.6 billion this year, you get $546.9 billion, AT LEAST, for spending on “National Defense.” And if you compare that to the BCA cap of $523 billion for “National Defense” you see the cap is busted by AT LEAST $23.9 billion. And today’s pre-rollout press is reporting that overall Defense spending will bust that cap by $34 billion. We’ll figure out the details of that as more agency budget documents become available.

The Pentagon seems confident the Congress will buy them a new cap – a much bigger one.

Pentagon Topline Increase of more than $25 Billion

The Pentagon portion of the President’s Budget Request for FY16 is $585.2 billion. This topline number is broken down into a “base” budget request of $534.3 billion and an OCO request of $50.9 billion.

And even though the OCO request is declining – more on that in a subsequent blog entry – the overall Pentagon budget would be increased by $25.2 billion if Congress agrees to this budget request.

For perspective, that $25.2 billion increase is more than the Administration is requesting for the Department of Commerce ($9.8 billion), the Environmental Protection Agency ($8.6 billion), the Corps of Engineers ($4.7 billion), and the General Services Administration ($800 million) combined. That adds up to $23.9 billion for four entire federal agencies that would easily fit within the $25.2 billion increase to Pentagon spending.

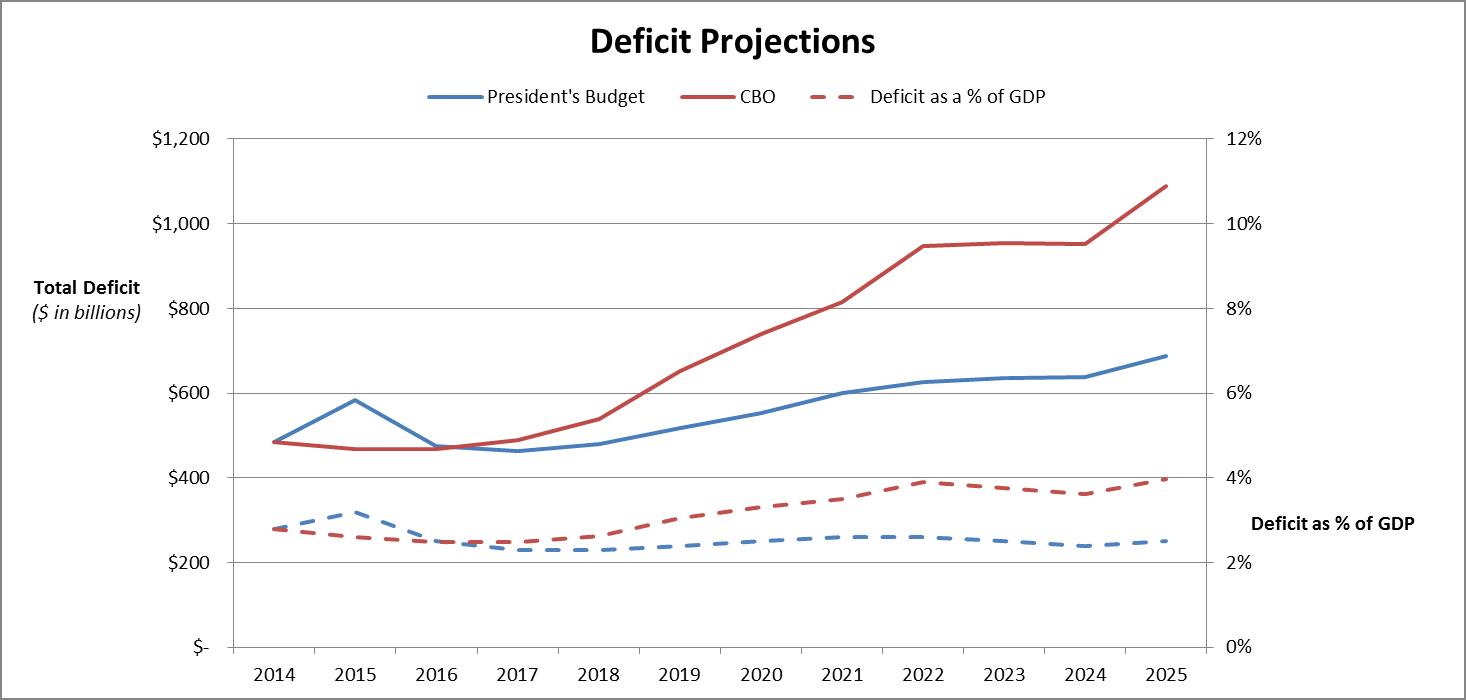

Fun with Numbers

The FY16 budget request anticipates $3.525 trillion in revenue offsetting $3.999 trillion in spending (outlays) resulting in a $474 billion budget deficit. As a percentage of GDP the deficit would be roughly 2.5 percent while the publically held debt would increase to 75% of Gross Domestic Product.

The budget also looks back at previous fiscal years and estimates that the budget deficit in FY15 would be $583 billion. That’s convenient – and wrong. Back in August, the Congressional Budget Office predicted the rebounding economy would result in a deficit less than half a trillion dollars. And just last month they projected an FY15 deficit of $468 billion (and a FY16 deficit of $467 – assuming President and the Congress didn’t monkey with the budget caps). Of course, updating old assumptions would mean an possible year-to-year increase in the deficit, and that wouldn’t go over too well.

Comparison of President's Budget and CBO projections:

12:00pm

Tax Gimmick to Bailout Highway Trust Fund

As expected, the proposal includes a $478 billion, six-year surface transportation reauthorization (p. 56). It would raise roughly $238 billion from a one-time tax of 14 percent on foreign profits of multinational companies. Current tax law allows companies to defer taxes on foreign income until it is repatriated to the U.S.

The idea of tapping foreign profits to shore up the chronically underfunded Highway Trust Fund (HTF) is not new. Sens. Barbara Boxer (D-CA) and Rand Paul (R-KY) recently announced a bill that would allow companies to voluntarily repatriate foreign earnings at a tax rate of 6.5 percent. And Rep. John K. Delaney (D-MD) introduced a proposal in the House, which like the President’s would deem foreign earnings automatically repatriated but taxes them at 8.75 percent and puts $120 billon into the HTF. The problem with all of these approaches is that they will not only encourage parking more income overseas in the future but also avoid the underlying problem of the HTF – that it runs a yearly deficit because gas taxes don’t cover transportation spending. The HTF is expected to run out of funds again in May. Grabbing revenue from a one-time international tax reform without balancing this basic equation is just kicking the can down the road.

11:35am

Statement by TCS President Ryan Alexander

The fiscal year (FY)2016 budget request is the opening gambit of the budget game. This is a political document, one that sets forth the President’s vision for what should happen, not what he thinks will happen. Like most Presidential budgets, this one includes some proposals designed to appease his supporters, some designed to provoke his opponents, and some which may just become law. This is ante for the annual budget poker game.

The headline for the FY16 budget request is that the President has declared that the Budget Control Act (BCA) of 2011, which he signed, is no longer necessary. The budget exceeds the BCA-agreed upon spending caps by $74 billion. There are revenue raising proposals to offset the costs, but we have plenty of indicators that most of those revenue raisers will be rejected out of hand by Congress. In fact, one of the proposals still in the budget – changing tax rules on 529 education savings plans – has already been abandoned by the Administration. There is even a proposal to allow corporations to repatriate profits they have parked overseas at a lower rate. This revenue would be used to fund infrastructure investments. While the nation needs to invest wisely in infrastructure, this is a colossally bad idea that would leave in place an antiquated tax code and encourage companies to park more profits overseas in the future. We also expect that many of the new spending provisions will be rejected by Congress. We hope, rather than expect, that Congress will not accept more spending without offsets, even if those offsets are different than those proposed by the President.

Roughly half of the $74 billion of the President’s proposed new spending will go to defense spending and the other half to non-defense discretionary spending. Before we consider the wisdom of any of these proposals, let’s revisit history: the President and Congress agreed to come up with $1.2 trillion in deficit reduction over ten years through spending cuts and/or revenue increases. If they failed, they detailed spending caps that they all agreed to for the next decade, including FY16. In fact, FY16 funding levels would be an increase of $2.1 billion over FY15 levels. Since the BCA was put in place both parties have said it should be scrapped, but neither side has been willing to come up with a plan that is acceptable to the other. Instead of blasting the caps as “mindless” as one Administration official told the Washington Post, the President and Congress need to come together with a thoughtful package that keeps the deficit reduction promise they made to taxpayers in 2011. To be clear, the nation would still have a nearly half trillion dollar budget deficit under this budget and the debt is already in excess of $18 trillion.

In the coming days, we will pick through the proposals and I’m sure we’ll find some that Taxpayers for Common Sense supports, some we can live with, and some that we find irresponsible. Congress needs to take a clear headed look and come up with their answer, too. We’ll be watching.

11:30am

President's FY2016 Budget

Below are the documents that comprise the President's Fiscal Year (FY) 2016 Budget. Supplemental materials and other information are located on the White House's Office of Management and Budget website.

Historical Tables (Zip file download)

.jpg)

.jpg)

Get Social