With $1.6 trillion in discretionary budget authority … the Rube Goldbergian Biden fiscal year (FY ) 2023 federal budget is decidedly not deficit reduction. Hit play if you need a contextualized, nuanced, and laser-sharp read on the numbers and what they really mean. Host Steve Ellis is joined by TCS Senior Policy Analysts Josh Sewell and Wendy Jordan.

Read all our analysis of the FY2023 budget here.

Listen here or on Apple Podcasts

Episode 19 – Transcript

Steve Ellis:

Welcome to all American taxpayers seeking common sense. You’ve made it to the right place. For over 25 years TCS, that’s Taxpayers for Common Sense, has served as an independent, nonpartisan budget watchdog group based in Washington DC. We believe in fiscal policy for America that is based on facts. We believe in transparency and accountability, because no matter where you are on the political spectrum, no one wants to see their tax dollars wasted.

Steve Ellis:

We come on the air today as the smell of fresh federal ink still hangs in the air on Capitol Hill as the president’s fiscal year 2023 budget request is hot off the presses. With $1.6 trillion in discretionary budget authority, you might think that there’s something in here for everyone. I mean, I can’t lie, there are a number of items in here that are TCS approved. But that my fiscally minded friends does not an endorsement make. If you want, or even more importantly need a contextualized, nuanced, and laser-sharp read on the numbers and what they really mean, you’ve come to the right place. And I’ve take the liberty of assembling the right people to get the job done with style. Joining me to explain and interpret this Rube Goldberg-ian Biden budget are TCS senior policy analysts Wendy Jordan and Josh Sewell.

Wendy Jordan:

Play ball.

Josh Sewell:

Put me in coach, I’m ready to play.

Steve Ellis:

Batter up. Josh, the listeners of this podcast already know that a presidential budget request is really just an aspirational document, signaling principles and directions, and that congress still needs to draft, debate, and enact annual spending or appropriations bills to allow the rubber to meet the road. But seriously, the president’s budget is going to reduce deficits by a trillion dollars, so what’s going on here Josh?

Josh Sewell:

Sure, if every single thing that the president requests in this budget comes to fruition, then you would see a trillion dollars in less spending, while at the same time, having one trillion plus annual deficits every year. Overall debt would actually increase to a record 106% of annual GDP. There’s a lot of assumptions in this thing, and it’s not really deficit reduction. We’re still looking at it. It’s one thing to have economic assumptions. This budget was built in the fall of last year, so they probably underestimate the durability of the inflation we’re seeing, which is somewhat understandable. But I saw, and this is pretty nuanced but it’s important, in table S7 there’s a footnote that says CBO, Congressional Budget Office, numbers are used for the emergency appropriations in the bills that have been passed already. Now, since they just passed the budget two weeks? Was it a week before the budget request came out for this current fiscal year? They don’t have the most recent numbers.

Josh Sewell:

So it says we used CBO numbers for all this stuff, but we’re going to use office of management and budget numbers for the Infrastructure and Investment Job Act’s assumptions. So we’re not going to look to CBO, we’re going to use our own internal numbers in projecting forward the outlays and the impacts of the president’s signature initiative, his infrastructure bill.

Steve Ellis:

There’s a couple of things there to unpack for our podcast listeners, Josh. I mean, one thing is, is that you mentioned the Infrastructure, Investment, and Jobs Act, that’s the bipartisan infrastructure framework, that massive trillion dollar infrastructure package passed last year. But then also you mentioned table S7, and for podcast listeners, those are the summary tables that are in the back of the main budget document that are actually very helpful and useful for figuring out scoring. It’s one of my favorite parts of the budget, to be honest, those summary tables. I print them out every year, have them on a bulletin board by myself there, by my desk. So that’s something else that, for the wonks that are listening to Budget Watchdog AF, well those can be some interesting reading.

Steve Ellis:

Also Josh, you mentioned something, I want to bring you in on this Wendy. We just passed this omnibus just a few weeks ago, and so wasn’t the administration really hamstrung, and budget watchers hamstrung, in really figuring out where the spending is going, where does it relate to the previous fiscal year in trajectory?

Wendy Jordan:

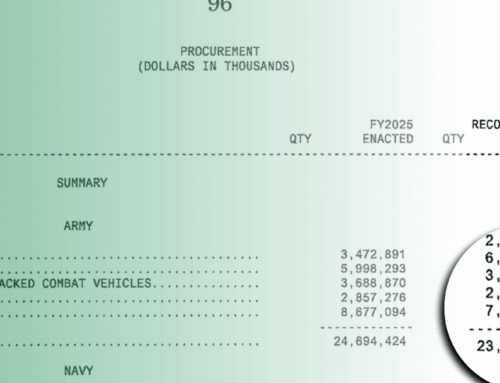

Right. 38 years I’ve been looking at budgets. I always, one of the first things I do is look at budget increase, budget decrease compared to the previous fiscal year, which would be FY22 in this case. And guess what? In all of the Pentagon budget documents, there is no column for FY22. There’s the FY21 column, and there’s the FY23 column, and there’s nothing in between. So I can’t do my usual increase/decrease. So I went and looked at… I have a favorite table, it’s a 25-1, because I’m that kind of budget nerd. And the 25-1 is an OMB table. So I went and looked at that table, and they do have an FY22 column for all of the major sub-accounts at the Pentagon, like ONM personnel. But having run the numbers from that table, I am guessing that the 25-1 has an error in it. So I’m not going to rely on that until I see the FY22 column in some future Pentagon, hopefully before the FY24 budget drops, some future Pentagon document.

Steve Ellis:

Got it, got it. One thing Josh, we were talking about gamesmanship with the numbers. If you look at this budget right, it basically says the pandemic’s over, right? They didn’t request any funding in the budget for COVID or pandemic related spending right?

Josh Sewell:

Now there is money, especially in health and human services, as well State Department USAID, for pandemic preparedness, and for some vaccines and therapeutics for building up the capacity to respond to disease outbreaks. But most of that is forward thinking, so it’s for the next pandemic or the next variant, some of it. But there’s not a line item request for money we need today. Now to be fair, today we are in fiscal year 2022, and this is the 2023 budget request. But this is again another example of how the president’s budget request isn’t the end all, be all of spending. Because at the exact same time this request came out, the administration was continuing to discuss, and… I was going to say demand. That’s too strong a word. To put emphasis on needing $28 billion in emergency spending to get us through May or June for some of the immediate COVID response.

Josh Sewell:

And actually going into recording today, it looks like the Senate is probably agreeing to do $10 billion, so we’re going to have somewhere between 10, 15, $20 billion coming out that’s not even a part of this budget, and that’s not going to be the end of the 2022 COVID-19 spending. And again, this has happened every year for the last four years. When hurricanes hit, when wildfires go, we’re going to see another supplementary spending request for natural disasters. So I mean, you’re talking… I don’t think any of us anticipate having a COVID-19 experience like we did in 2020 or 2021, where all of a sudden you have trillions of dollars you weren’t anticipating spending that were not a part of the president’s budget request, but we’re going to see tens of billions, and at least tens of billions of dollars that are not anywhere in this budget.

Steve Ellis:

Yeah, I mean last I saw that it sounded like a bipartisan group of senators settled on $10 billion to be spent right now, or appropriated right now on dealing with this. And we’re clearly not out of the woods by any stretch of the imagination. So, and I don’t know we will be even by September 30th, or at least not completely out of the woods. So digging into, and I’m just going to go ahead and throw it in there because I know you’d bring it up anyway Josh, but surely there’s some savings to these farm subsidy programs that you’ve often come on the podcast and talked about.

Josh Sewell:

Curiously, there is not. So I’ve been looking at budgets for a while. Not as long as Wendy. The curious thing about this administration is that they find absolutely nothing wrong with farm subsidies. And I say it’s curious, because I’ve been working on the farm bill and ag subsidies for over 10 years, and every single year until this administration the president has requested substantial changes in farm policy. And even going before those 10 years, I mean both Bushes, President Clinton, they all found something that they wanted to change, and it was usually billions of dollars worth of savings in the farm programs. Well, this administration completely abandoned any reforms in the farm safety net, starting in its budget last year, but then on continuing this year.

Josh Sewell:

And I think it just, we’ll call it curious. Frankly I was not all that surprised last year when the administration comes in again at a time when they ran on saying we need to spend more money to respond to COVID, we need to spend a ton of money in an infrastructure bill. So the fact that they couldn’t find some savings at a time when they didn’t find savings anywhere, not a huge surprise. Now that you’ve had a year and inflation is really affecting a lot of folks and the deficits are back, again, we still have trillion dollar annual deficits, it’s time to start thinking about where can we trim the fat, where can we make decisions where, get rid of the nice to haves and keep only the things we must have. And I think farm subsidies is a pretty clear area where, not only us, but even the farmers we’ve talked to say there are some things we really don’t need to do anymore. At the very least, can we cut some things and spend on something else?

Steve Ellis:

Right, right. Because I mean, certainly it’s clear that these are not perfect program, and it’s not just… you mentioned farmers and obviously us, but there’s also independent analysts that don’t have an ax to grind but know a lot about it like the Government Accountability Office that have called for some of these changes and reforms and added some of these programs that are high risk. And Josh, just by way of informing our listeners, what percentage of farm income last year roughly was from the federal government?

Josh Sewell:

Between 40 and 50% came from the federal government, and that’s across the board. Now obviously there are some farmers who don’t get a lot of money from the government, depending on what you’re growing, but there are others who get a significant portion of their income from farm subsidies. And again, that’s the highest level it’s been since I’ve been working on this, and it’s the highest level it’s been since I’ve been working on this, and it’s the highest level… one of the highest levels since we’ve had this kind of farm programs, post-depression.

Steve Ellis:

You’re listening to Budget Watchdog AF, a podcast for those concerned about the fiscal state of the country and how we’re spending our tax dollars. I’d like to turn back to you, Wendy. There were a couple curious things that we saw in the defense part or the Pentagon part of the budget that either were intentionally positive trends, although we don’t know exactly what congress will do about it. So I was wondering if you could get into a little bit about some of the defense spending items that you found.

Wendy Jordan:

First of all, I will point out that national security top line, which is beyond the Pentagon, includes other things that are not directly in the DOD appropriations bill, 813 billion. Add another 13 and a half billion in mandatory spending, and you’re at a little over $827 billion for national security spending. So there’s a lot of room in that top line you would think. I cannot give you a direct, as we discussed earlier, can’t give you a direct increase/decrease, although it’s obviously an increase number, because we don’t have the official FY22 national security number that I can directly compare it to, but we will someday.

Wendy Jordan:

So within that, there are two budget lines that we look at year after year after year, and see that it’s usually quite a robust request first of all. And then it is always… well, at least in the 38 years I’ve been doing this, there are increases in those budget lines that are done by the congress as the bills go through the appropriations process. So shipbuilding is one of those programs. The shipbuilding programs this year asked for only… only, put that in air quotes, nine new hulls spread across destroyers, submarines, oilers, all kinds of different types of ships, nine hulls. Last year the request was for eight new hulls. So eight to nine, it’s an increase but it’s not a crazy increase right? So not bad. Seems that they’re being fiscally responsible over there at the Department of the Navy.

Wendy Jordan:

Well, the untold truth or the often untold truth is that in fact, the congress added five hulls last year. So it was a request for eight, but they ended up with 13. So 13 new hulls for the Navy in the FY22 budget. So if you’re a shipbuilder or a shipbuilder booster, what are you going to say? The Biden administration has cut the number of shifts from 13 to nine in this request. I’m sure we will hear that frequently during congressional hearings when the Navy is up testifying about the budget request, and I am equally sure that we will see a significant boost in the number of hulls that are actually appropriated for by the end of the process when President Biden signs the FY23 bill into law many months from now.

Wendy Jordan:

I’m going to bet right now that it’s going to be an almost 50% increase. I’m going to bet, and we will come back to this in a year, that they will add four hulls this time. So I’m going to bet we’re going to end up with 13 hulls again this year. And we’ll see if I’m right.

Steve Ellis:

Okay, so we’ve seen this sort of two step goes on. The president requests a certain number and then they go beyond that. What about on the F35, and then Josh, can you talk about the other agencies are places where we see this similar sort of gamesmanship go on?

Wendy Jordan:

F35, well obviously when I started doing this the Air Force was not buying F35s. It was buying F16s, and I can remember as a young congressional staffer always being surprised at how the final F16 number was always higher than the request. How did that happen? Well, we can see it again now. The F35 request, now this is the request that was dropped by the president or by the Office of Management and Budget on March 28th, all right? Everybody keep that date in mind, March 28th. And the request was for 28 F35s. I’m just going to give you the Navy Marine Corps request here. The Navy Marine Corps request, they both fly F35s. The Air Force also flies F35s, so they’re not part of this equation today. The request was for 28. March 28th, they requested 28. Easy to remember.

Wendy Jordan:

Then we had these little things called the unfunded priorities lists, which close readers of Taxpayers for Common Sense wastebaskets have heard us talk about or write about before. The unfunded priorities lists are when the congress asks the military service chief, “So what isn’t in the budget that you actually want to have?” These are now required by statute. They used to be just part of a Kabuki theater in the congress years ago. Now they’re required by statute. And so the Navy and the Marine Corps produce their unfunded priorities lists. The Marines’ was dated March 28th, so the day that the budget dropped, the Marines said, “Hey, just kidding. We actually needed more F35s than we asked for.” The Navy’s unfunded priorities list was dated March 24th, and it’s like this bizarre feat of time travel that the Navy, four days before the budget was dropped, was already disagreeing with what the president’s budget request was for in the area of F35s.

Wendy Jordan:

So request again for the Marine Corps and Navy combined was 28 F35s. The combined increase that they’re asking for is an additional 12, so almost 50% more, and that would make it 40 F35s for the Navy and Marine Corps. We don’t yet have the Air Force request for the unfunded priorities list for the F35, so I’m sure if past is prologue they’ll ask for another probably dozen, 10-12 F35s, and congress will be off to the races. They will say, as they lard up the F35 account, this is because the military service chiefs told us they have to have these. And it makes me wonder, why do we go through the budget process? Why do we go through the military services asking for what they ask for from the secretary of defense, the secretary of defense going to the Office of Management and Budget, if we’re going to allow this backdoor unfunded priorities list to completely upend what the president’s budget request says.

Steve Ellis:

Because I think it was actually… I don’t know if it was, well Secretary Gates I know basically, when he was defense secretary got rid of them, and that’s why congress then eventually made them required by law. But it was either him or another secretary of defense that said that it can’t be a priority if it’s not in the $800 billion request, that it’s pretty low level.

Wendy Jordan:

Right, can’t be much of a priority. These lists used to be called unfunded requirements lists, the URLs, and a previous secretary of defense said if it’s unfunded it’s not a requirement, so stop calling them URLs. And then they became unfunded priorities. And just for the record, for our podcast listeners, the Air Force in the budget request asked for 33 F35s, so the entire request for F35s was 61, and now we’ll see what the Air Force has on their unfunded priorities list. And I will certainly write it up and put it on our website when the UPL is made public.

Steve Ellis:

And you can find all of our budget analysis at taxpayer.net, and so it’ll be on a lot more issues than we’re going to cover in this podcast. But then Josh, what are other places where we see this sort of do-si-do, Kabuki theater between what the president requests and what congress ends up delivering.

Josh Sewell:

So there’s another area of the budget that you see some very big differences between what’s requested and what’s actually spent, and that’s in the Army Corps of Engineers Civil Works division. So these are again, these are the folks who are in charge of building flood control projects, some navigation infrastructure on our nation’s waterways, and some ecosystem restoration related to those. Again, this is a bipartisan issue that has tracked through every president I’ve ever worked on, where the president will request some amount of money knowing that congress says, “Okay, thanks,” and then increases that construction and maintenance spending by anywhere from 13 to 60% in the actual appropriations.

Josh Sewell:

So we actually have a chart on our website where you can see it since fiscal year 2014 until the current request, where it’s the president’s request is at this level, and the appropriations just go higher and higher and higher. And interestingly, and again this is why you want to look at the request and the numbers and say, the assumptions are not always true, in that when you look at for between fiscal year 2022 which we’re in now and the presidential budget request, he would actually be requesting a decrease of $170 million. Now, I’ve been in Washington long enough that I usually qualify nearly everything I say, but there’s 0% chance that cut happens. 0% chance, because the congress will not do it. And the president, like the ones before him, knows this.

Josh Sewell:

So this is a way of reducing your overall spending, sure it’s only by a couple billion dollars in this one area, knowing that congress is going to come out and spend more later. So that’s how you can work these numbers. You’ve got a big budget, you’ve got a lot of places you can make these kind of relatively minor changes, knowing someone else is going to bail you out in the actual spending later, and so it makes your budget request get into what you want it to look like, which in this case is a more fiscally responsible than we’ve seen in recent years.

Steve Ellis:

And as you point out, these are not the only places where we see this sort of gamesmanship, and we certainly see it on a bigger scale even on the revenue side of the ledger in talking about taxes. And so you have proposals that are made that, leaving even aside their merits, and that maybe the Biden administration really, really does believe that there should be this sort of wealth tax for instance on billionaires, on unrealized income, that it’s just not going to happen. And yet you get to count that revenue in your budget because you’re proposing it, when in reality that may never come to pass. Or even other things that we’ve pushed very hard for, oil and gas, reforms on taxes for the oil and gas companies, or repealing some of those breaks. And so you see some of that gamesmanship in this area as well, Josh.

Josh Sewell:

Yeah, absolutely. And again, most of the increases in revenue that the president’s budget request is projecting come from this imposition of new taxes, or increases in taxes like that 2% increase in the highest marginal rate for the highest income earners. And again, it’s valuable to have these in a budget request because it shows what the president is claiming he wants, it’s showing what he values, what he believes we should move towards in revenue and in spending and in taxation. But to then use that as the basis to pat yourself on the back for deficit reduction, you’ve got to take that with some large grains of salt. Because again, it’s not going to happen.

Josh Sewell:

Some of these things, now some of these things should happen. We would support some of these changes. But as far as the billionaires tax and some of these individual, the specific line items that are in there, they’ve already been rejected by this congress. There’s at least two senators who said we’re not going to do this, two democratic senators. Which means, and the republicans are all saying we’re not going to do it, that means it’s dead in the water. So again, there’s some value, but not as much value as some people want to put into it. Certainly not for this particular budget. Now, for debates around what comes down the pike down the road for elections ahead, that’s where budgets are really, sometimes some of their biggest value may be in identifying differences between parties and potential platforms in the future.

Steve Ellis:

Yeah, and it’s really, is the administration going to fight for these proposals and these budgets, and recognizing that it’s an election year, and that’s always a difficult time. And are these really going to come to fruition? I mean, certainly the administration put its marker down on infrastructure, and worked hard to get a package through. Maybe not as big as they wanted. They haven’t been able to deliver on their Build Back Better initiative, although that’ll remain to be seen, and isn’t really even mentioned in this budget is it Josh?

Josh Sewell:

Yeah, not a whole lot. Not nearly as much as you’d think that it would be, again, since there is a real push to get some version of that Build Back Better package into law. And actually when you look at last year’s, the way they even structured the budget last year was all about making the Build Back Better initiative in each subcategory, and they had some details of how they would build back better in this area of the budget, and they would build back better in the infrastructure. And so it’s interesting that they have made a pivot away from that in even structuring their budget. Almost completely turned the page on infrastructure investment and on COVID-19, but in reality we haven’t.

Steve Ellis:

Right. I think to some extent, it’s also giving themselves some flexibility and some wiggle room that they want to have these negotiations go forward, and putting them in their budget would put it in black and white what they wanted, instead of figuring it out, hammering it out with most notably Senator Manchin, but also Senator Sinema, the two democratic senators you were mentioning. So there you have it, the presidential serve is in, and now the big green ball is in congress’s court. Stay tuned over the coming months as we dig in and see if taxpayer dollars are being spent wisely or not. This is the frequency, mark it on your dial, subscribe and share, and know this: Taxpayers for Common Sense has your back, America. We read the bills, monitor the earmarks, and highlight those wasteful programs that poorly spend our money and shift long-term risk to taxpayers. We’ll be back with a new episode, and I hope you’ll meet us right here.