The Government Accountability Office (GAO) has released its annual report to Congress titled “The Nation’s Fiscal Health: Road Map Needed to Address Projected Unsustainable Debt Levels,” which serves as a stark warning about our fiscal future. The report analyzes the current state and future projections of the federal debt, primary deficits, and interest spending, highlighting the implications of existing fiscal policies. With the public debt reaching alarming levels and projected to grow at an unsustainable pace, the GAO underscores the urgent need for a strategic plan to mitigate the trajectory of the nation’s debt.

As of September 30, 2023, the public debt stood at $26.2 trillion, approximately 97% of the Gross Domestic Product (GDP). This level of debt, which has grown in tandem with the GDP, reflects the government’s borrowing from external sources, including the private sector and foreign governments. Public debt does not include intra-government borrowing such as borrowing trust fund surpluses. The fiscal year 2023 ended with a $1.7 trillion deficit, marking the fourth consecutive year of deficits surpassing $1 trillion.

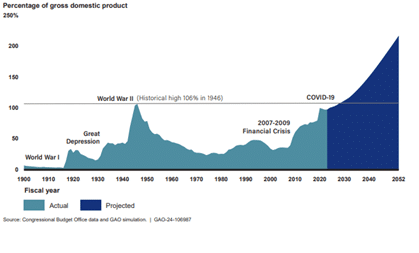

Historically, debt relative to GDP increased during wars and recessions but decreased in peacetime and economic expansions. However, this pattern has shifted, with debt growing even during periods of economic growth. Projections indicate that, under current policies, public debt will reach a historical high of 106% of GDP by 2028 and could exceed 200% of GDP by 2050. This growth is attributed to borrowing to finance annual budget deficits, which are expected to widen due to the gap between program spending and revenue.

The report highlights that primary deficits will expand primarily due to projected increases in Medicare, Medicaid, the Children’s Health Insurance Program, and Social Security spending, outpacing relatively lower projected increases in revenue. Revenue is projected to average 17.1% of GDP annually between 2023 and 2052, slightly below the 50-year historical average of 17.4%. The aging population and rising healthcare costs are significant factors driving these trends.

outpacing relatively lower projected increases in revenue. Revenue is projected to average 17.1% of GDP annually between 2023 and 2052, slightly below the 50-year historical average of 17.4%. The aging population and rising healthcare costs are significant factors driving these trends.

The study outlines several implications of the growing debt, including potential policy constraints, risks to economic growth, the nation’s credit, and the possibility of a fiscal crisis. Rising debt limits policymakers’ flexibility to respond to economic downturns and unexpected events, as interest costs consume a larger share of federal spending. The report warns that perpetually rising debt could slow economic growth, erode confidence in the U.S.’s fiscal management, and ultimately lead to a fiscal crisis if not addressed.

The GAO recommends that Congress develop a plan to address the long-term fiscal path, emphasizing that sustainable fiscal policy would involve aligning spending and revenue policies to reduce persistent deficits and the nation’s borrowing needs. The report calls for difficult budgetary and policy decisions to address the key drivers of debt and alter the government’s fiscal trajectory.

GAO’s report to Congress paints a concerning picture of the United States’ fiscal health, with unsustainable debt levels projected to pose significant economic, security, and social challenges. It underscores the need for action to develop a comprehensive plan to address these issues and ensure a sustainable fiscal future.

Taxpayers for Common Sense is supporting legislative efforts to create a bipartisan, bicameral fiscal commission that can tackle these difficult issues and make bold proposals that lawmakers would have to vote on. As currently proposed, the commission would consist of 16 members, appointed by congressional leadership, with equal representation from both parties. The commission would be required to identify policies to achieve a sustainable long-term debt-to-GDP ratio as well as to improve the solvency of federal trust funds such as Social Security and Medicare. The commission would then report its findings to Congress and Congress would be required to consider them under expedited procedures. This process would follow similar commissions, such as the Greenspan commission, which extended Social Security’s solvency by 30 years.

TCS is supportive of this commission for several reasons. By creating an independent and bipartisan environment to identify problems and solutions, the fiscal commission could be devoid of political pressures, allowing it to focus on achieving the stated goals. Further, the goals set out for the commission are clear: make our country’s fiscal future sustainable. While there is no guarantee that a fiscal commission will be successful, considering that lawmakers have not adopted substantive budgetary reforms while the fiscal crisis deepens, a fiscal commission is worth considering as a potential solution to address the nation’s fiscal challenges.