Josh Sewell joins Steve Ellis to pull back the curtain on how Taxpayers for Common Sense advises foreign governments on the importance of transparency in the stewardship of public resources. Plus, everything you need to look for when President Biden’s Fiscal 2024 Budget Request is released.

Episode 41: Transcript

Announcer:

Welcome to Budget Watchdog All Federal, the podcast dedicated to making sense of the budget, spending and tax issues facing the nation. Cut through the partisan rhetoric and talking points for the facts about what’s being talked about, bandied about, and pushed to Washington, brought to you by taxpayers for common sense. And now a host of Budget. Watchdog AF, TCS President Steve Ellis.

Steve Ellis:

Welcome to all American taxpayers seeking common sense. You’ve made it to the right place. For over 25 years, TCS, that’s Taxpayers for Common Sense, has served as an independent nonpartisan budget watchdog group based in Washington, DC. We believe in fiscal policy for America that is based on facts. We believe in transparency and accountability because no matter where you are on the political spectrum, no one wants to see their tax dollars wasted, and when I say “no one,” I’m not just talking about all of us here in the good old US of A. Citizens in every country have a vested interest in how their tax euros, dinars, pesos, shekels, and rupees are spent.

That, my dear podcast listeners, is something that we take very seriously here at Taxpayers for Common Sense. You see, while Uncle Sam’s system isn’t perfect, I think we all know that, it is one of the best, and when it comes to helping our friends around the world to get it right on budget oversight and transparency, well, TCS is always willing to share the love. Today, TCS senior policy analyst, Josh Sewell, is here to pull back the curtain on how we advise foreign governments on the importance of transparency in the stewardship of public resources, plus, give us a preview of what to look for when President Biden’s fiscal year 2024 budget request is actually released.

Josh Sewell:

Hey, happy to be here.

Steve Ellis:

Lots to cover today, gang. Josh, while Americans get their first look at the Biden Administration’s budget priorities for 2024 this week, TCS will be meeting with members of the Algerian Government’s Supreme Audit Institution to discuss the role of a budget watchdog and taxpayer advocacy and budget accountability and oversight. Besides recommending this podcast to everyone in Algeria, what’s top of mind for that session?

Josh Sewell:

Well, first, what a fun place to work. I hadn’t really thought my work at TCS would involve foreign governments. Sometimes because of the nature of our work, it seems like we’re removed from parts of our own country, including state and local governments. But this isn’t the first delegation from a foreign country we’ve worked with.

Steve Ellis:

Yes. I mean, we’ve hosted delegations from Tunisia, Japan and South Korea, and I even went to Angola in 2016 and Moldova in 2018 as part of the financial services volunteer court to meet with civil service organizations there. The truth is, despite significant differences between the US and those countries, there are some commonalities, right?

Josh Sewell:

Yeah, and one of the big ones is budgets are really important, not just because taxpayers in any country have a right to know how their dollars are being managed, but because budgets are about more than dollars. They’re about priorities.

Steve Ellis:

They’re about more than dollars because they’re about euros or pesos or shekels. What the government spends their money on is just as important as how it spends that money. In other words, budgets are about values, not just value.

Josh Sewell:

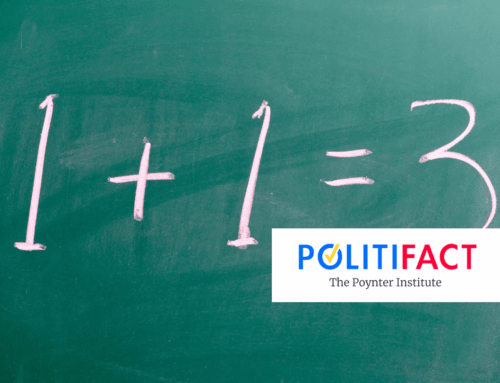

Absolutely. Communicating the value of how a government is spending tax dollars or euros or shekels or whatever is, in fact, critical. That’s the point we emphasized with these folks. Also, that it’s really important that communication around the budget and spending issues has to be honest. By that, I don’t mean just that the math adds up.

Steve Ellis:

Well, wait, Josh. If it’s not math and it’s not value, then what’s left in the budget?

Josh Sewell:

Reality. I mean, budgets have to be real. This is something we talk about all the time and this is something that we’re going to be digging into when the budget drops Thursday of this week. Are the economic assumptions realistic? Projected revenues based on tax increases we all know have a 0% chance of being enacted this year under this Congress. Does the budget overpromise on new programs and underdeliver on a realistic way to pay for them? Again, reality.

Steve Ellis:

Yeah, there’s a lot of times I think that when we see this, that the budgets, they just roll out the same line like it’s a new thing, and they expect that it’s going to change. I mean, these budgets are aspirational documents. They’re not reality in that respect. They’re not actually going to become law. Every president’s budget is dead on arrival when it comes to Congress, and so it is trying to figure out, what are they really going to fight for? What are they going to work for? That’s a lot about the overarching issues of wide budgets matter. What are some specific examples of our success here in the US that are most applicable to building systems in another country?

Josh Sewell:

One of the things we discussed with the Algerian Ministry of Finance was usaspending.gov. This is a website that anyone can go to where you can get some information on where your actual tax dollars are going. TCS was an integral part of getting usaspending.gov created and then improved on over the years. In fact, one of the few decorations we have in our office is actually the signature page of the law enacting usaspending.gov. This is one of the things that we talked to, again, these folks who came in to talk to us this week because it’s really vitally important that information on your budget comes not just in the budget request, but following through on where that money is going. It has to be easy. It can’t be something where we have to dig through dozens and dozens of pages, dozens and dozens of websites to try to find it, if it’s online at all.

Steve Ellis:

I actually was at that bill signing ceremony back in, I think it was 2007. Actually, that legislation was co-sponsored by then-freshman Senator Tom Coburn, very conservative senator from Oklahoma, and then-freshman Senator Barack Obama, who I guess doesn’t need much more introduction than that. Then also, podcast listeners, you may have heard Josh mention that there was the Ministry of Finance, and that’s because last week we met with the Ministry of Finance. This week, we’re meeting with members of the Supreme Audit Institution.

I also think it’s important, too, there was another victory that we got there, Josh, which is where we got the budget justification sheets, those underlying documents that explain what is in the budget, why it’s in the budget. From each agency, what is some of the information behind each of those line items, and those were scattered across government at all the different agencies. Just this last congress, we got the Budget Justification Sheet Transparency Act enacted, and now, all of those from all the agencies are at usaspending.gov. We’ve talked about the Supreme audit coming this week and the Ministry of Finance last week from Algeria and clearly they know how to track funds. We always get something out of these discussions. What is something that they do that we’re not doing?

Josh Sewell:

One of the most important things that came out of this meeting for me was that producing what’s called a “citizens’ budget.” I think the Algerians, I don’t know if they have an official citizen budget that meets all of the criteria that some people would want from this, but they actually in some ways do a better job of presenting their budget in a simpler, easier to understand way for, let’s be honest, normal people, not people like us whose job it is to sift through these.

As a reminder, our budget request is thousands and thousands of pages long, and when you look at all those budget justifications, it’s tens of thousands when you put it together. One thing that we’ve long advocated for and is advocated for by a lot of other groups is to create a citizens’ budget. There are countries that do this. It’s basically what it sounds like. It’s a budget that citizens can understand. You don’t have to be a tax expert, you don’t have to be a budget expert to be able to understand this.

Steve Ellis:

From what I recall in our conversation, they’re working on doing one, which is more than the US is doing. They’re not actually even… It doesn’t come up. I mean, our profit’s whistling in the wind. But this is something that every citizen, you could just have a better sense of, where are the revenues coming from? Where’s the spending going? What are the shortfalls? How much interest are we paying? All in a non-politicized central document.

Josh Sewell:

Yeah, and it’s interesting, We talked about the value of budgets. We talked about budgets being aspirational. But what happens if institutions’ promises don’t come to fruition? That’s what these folks in Ministry of Finance asked us is, “What enforcement mechanisms do you have? Your GAO when they produce a report, does anything happen with it?”

It was a little sobering, to be honest, because they were like, “Not always. Oftentimes no.” Because in the end, what it comes down to is that it doesn’t really matter how many reports you have or how many guideposts you have, it’s up to Congress and the president to actually take this information and do something with it. We rely on Congress to make decisions and we rely on the president to enforce those decisions and to carry them out in good faith. Then we all, when we get reports from the GAO or other folks, “Something’s not working, we need to adjust.” I think that was what was the most sobering part of this conversation with folks from a country that’s not been a democracy nearly as long as ours and is coming to look to us for some assistance is like we actually got a lot of stuff we need to work on ourself.

Steve Ellis:

That’s absolutely right. I mean, they had just been to the GAO before they came to see us, and so they didn’t want to throw cold water on the GAO, but it is one of these things where there’s a lot of reports, but not always action on what they recommend. They kind of laughed at this, too, but the standard joke about the GAO reports is that progress made, challenges remain about various programs.

You’re listening to Budget Watchdog All Federal, the podcast dedicated to making sense of the budget, spending, and tax issues facing the nation. I’m your host, TCS President Steve Ellis, and we continue now with Mr. Agriculture, Josh Sewell. I want to build on what we were just talking about, Josh. Budget comes out and we do our analysis. We were talking to them about what do we actually do to push this out? What do we actually do with all the information that we compile?

Josh Sewell:

Sure. Well, for us, it’s pretty well-defined. We give it to our listeners and policymakers. We’re going to dig through everything we can grab a hold of. We’re going to write about it, we’re going to work with journalists to get it published. We’ll get on TV if we can. We’re going to be tweeting away. We’re going to basically talk to anyone and everyone we possibly can about the details that we either find in this or that we can unpack because we’ve been doing this budget analysis for a long time.

In the end, we’re going to build on this and we will meet with policymakers. We’re going to be up on the Hill. We already have been this year now that the House and the Senate are much more open than they have been in the past. When we can, we’ll testify before Congress. We’re going to basically do everything we possibly can to fight for taxpayers. That’s just how we do it. I think it’s important that that’s what we have to do. All of that helps our country have a better government with better outcomes for taxpayers. That’s the whole point of why we’re here and that’s what we told the Algerian government officials is the role of a budget watchdog. The president’s budget release, it’s the perfect time to be reminded of and reinvigorated in this important role that we and our supporters play in keeping our government working for us.

Steve Ellis:

That was one of the important things there and we’ll see you again when we meet with the members of the Supreme Audit Institution is that basically they’re the OMB, the GAO of their government, and so nobody really likes somebody looking over their shoulder telling them, “Hey, you’re not doing this right,” or whatever, and that’s kind of what we do. But we were trying to show them and I think they got that we were trying to be a constructive part of our democracy of our republic, and actually try to have better outcomes, as you said, for taxpayers. Pivoting, we’ve got the president’s budget release such as it is, and I’d like you to talk a little bit more about that. What’s in store this week?

Josh Sewell:

This week, the president is releasing his budget request for fiscal year 2024, but it’s not going to be the entirety. This is something that we saw once with this administration where on Thursday, March 9th, got to remember what month it is, they all run together, on March 9th, the administration is releasing their overall budget requests, so we’ll get some top-line numbers and a lot of glossy, nice press release like materials on a few of the agencies. But we’re not going to get every single detailed table. We don’t expect to have the analytical tables, which is where you really get the detailed assumptions, the detailed analysis that you can get about economic assumptions and revenue and specific categories and all these things that you really drill down to understand how they built this budget.

It’s more than just a campaign document, but to be honest, it’s kind of like what you would get if you took a citizens’ budget and you took away every single detail and just had the first page. That’s what we’re going to get on Thursday and whatever other tables we can find, or some agencies, if they do produce some materials, we’ll go through that. But this is sort of a slow rollout this year where we anticipate, our understanding, is that next week, Monday and Tuesday, you’ll start to see the historical tables and then the analytical tables that I mentioned and the other actual details on the building blocks of the budget.

Steve Ellis:

Which I have to say is kind of ridiculous that they’re doing it this way, in my opinion. I mean, the fact is that it’s supposed to have come out the very first week in February, so they’re already late. They said, “Okay, we’ll do it March 9th,” which is also kind of odd doing it on a Thursday instead of a Monday or a Tuesday. Then they’re still just going to do this small document, and then just a few days later, I mean, what a difference a few days makes. You can produce an appendix, you can produce historical tables, you can produce the analytical perspectives. You can actually put something behind your numbers in just a few days. Why not just wait until Tuesday? Anyway, it’s something where they get their moment to put out their message to talk about what they want to and then it takes time to actually dig through and find out what they didn’t want you to notice.

Josh Sewell:

Yeah, and it is ridiculous because they’ve been working on this document for a year, more than a year in some respects, in many respects, when an agency is already building their fiscal year 2025 budget. I mean, that’s literally how long it takes. The finalized document comes out in October, November. They have a pass back with OMB. This is not like they just are crunching the numbers to the last minute. This is about controlling the narrative and winning that election cycle. It is about that. But it’s a winning that media cycle for more than just one day. That’s one of our criticisms on this is like, it’s done, just give it to us because I think there’s going to be a lot of big questions. This budget request, we anticipate, will tackle some big issues.

It’s supposed to be, like past budgets, it’s going to be a marker for the president to compare himself to Congress, especially Republicans in Congress. But honestly, even his own party, secondments in his own party. This is a way for him to lay out and say, “This is what I want.” We anticipate he’s going to be running for reelection. That’s also why they’re doing it on a Thursday in Pennsylvania where he’s originally from and a swing state. These are all indications that this is one of the first steps in his announcing his reelection. They’re always political, but it’s annoyingly more political than us budget nerds would like this year.

Steve Ellis:

Let’s talk about some of the things that have already, he said that are going to be in this budget proposal. One of the things is he’s talking about cutting the deficit by $2 trillion. How does that fit into the overall context?

Josh Sewell:

If you remember just a couple of weeks ago, the Congressional Budget Office produced its annual or semi-annual report about the economic realities in this country and the budget in economic realities and they’re projecting $22 trillion in total deficits over the next 10 years, so trimming $2 trillion, I wouldn’t ignore that, but that would still leave $20 trillion in deficits, presumably over the next 10 years, which will all be added onto our national debt. Two trillion’s a big number. I’m not going to pretend it’s not. But it’s a lot smaller than 22 trillion.

Again, that deficit reduction assumption is going to be based on a lot of assumptions about economic progress, economic growth, also about revenue and spending, and so the president’s going to propose, I imagine, a number of new programs to change spending in certain ways. The other reporting is that this budget’s going to include a number of tax increases, mostly on the wealthy, that the president has proposed in his last two budgets, which should indicate they’re probably not going to go anywhere since they were proposed in the last two budgets.

Steve Ellis:

Right, and that those two budgets were reviewed by a Democratic Congress that isn’t in place right now. One thing, earlier this week I talked to a group of journalists, a group of National Press Foundation fellows and underscored the trillion and what a trillion is and that we are likely never to see a trillion of anything in our lifetime and that a trillion is a million millions. It’s a thousand billions. Josh has heard me say this before, but if I gave you a dollar every second over the course of a year, you would have $31.5 million, roughly. It would take you 31,000 years to get to a trillion dollars, just to put that all into his perspective. Okay, so then, you talked about some tax increases and some of those are going to be in Medicare, so what are they talking about doing to shore up Medicare?

Josh Sewell:

Yeah, this is one of the things that the administration has put out a little early is that there’s a proposal in the assumptions of the president’s budget to extend the solvency of Medicare, at least the hospital part of it, Medicare Part A another 25 years. What they would do is they’re proposing… Again, we don’t have a lot of the details, but they’re saying they’re going to increase the tax on folks who make more than $400,000 a year. That’s going to be the main way to extend this life of the Medicare trust fund, which is supposed to become insolvent, I believe, in 2028.

Steve Ellis:

Right. I think it’s a clear thing on insolvency. I mean, technically, it’s insolvent, and technically, in 10 years, Social Security will be insolvent, but it’s not that they’re not continuing to generate revenue, so Social Security in 10 years time would be paying 75 cents or 75% of the benefits. Not saying that people who were getting their Social Security would actually want their benefits cut by 25%, but certainly on Medicare, it is about trying to do cost containment. I think they also talked about allowing more drugs Medicare can actually negotiate the price over and negotiating over price over drugs sooner after they’re first released, so it’s become a huge thing with the Medicare and the whole State of the Union where they agreed that they weren’t going to cut Medicare. Really, it’s something that has to be addressed. I mean, it clearly is an issue. You can’t just ignore it and hope it goes away because it’s not going to go away and it’s going to have a huge cost.

Any other things that you want to tell our podcast faithful about that you’re looking for in the budget or hoping to see, Josh?

Josh Sewell:

Well, I think mostly we’re going to be going through every detail on this budget, and we’re going to have a rolling analysis on our website, taxpayer.net, that people should follow and watch, and if you follow us on Twitter, we’ll be pushing things out there. But I think we’ve done these budgets, these budget analyses numerous times, and they’re really important, so I think at this point, though, what I would want to see is I want to see the president planting his flag and saying, “This is how I think we can…” What he’s saying with Medicare, whether you like it or not, he’s given an indication of what he wants to do, and there’s also some benefit increases in there, and so you can respond to that as a member of Congress, and as a citizen. I want to see that in other parts of the budget.

It’s not just Medicare that is the only entitlement mandatory spending that is ballooning in cost and is not sustainable. They’re going to have to address Medicaid. There’s some issues there. We’re going to have to address Social Security. It’s not talking about draconian cuts, but these are long-term, and some of them pretty near-term issues. Hey, and guess what? There’s a lot of other parts of the budget, too. Farm spending. Farm bill’s coming up. We got to figure out a way to contain some of the spending to make sure it’s producing the results we want. You go down the line.

Also, on all the discretionary stuff, the stuff that we fight about, debate every single year. What are we going to do in national security? What are you going to do in some of your attempts to reinvigorate the domestic economy? We’re going to be looking at all these details and we’re going to have a lot of well-thought-out analysis, but I think the biggest thing about this is just we need people to look at it as well, engage on it. We can’t produce that citizen’s budget for you. We’re going to try our hardest to do our version of it on the areas that we know about, but I think we just have to… You can’t ignore the budget, but take it with a grain of salt, and then make the parts that you like a reality and work on the parts you don’t like.

Steve Ellis:

Well, there you have it, podcast listeners. Good oversight cuts down on oversights. I hope you come to our website and you check out our work on the budget coming out on Thursday at taxpayer.net. We’ll have a rolling analysis. You’ll be able to see a lot of this information as real-time as we develop it and so I think that you’re going to find a lot of valuable nuggets and information there, podcast faithful.

This is the frequency. Market it on your dial, subscribe and share, and know this, Taxpayers for Common Sense has your back, America. We read the bills, monitor the earmarks, and highlight those wasteful programs that poorly spend our money and shift long-term risk to taxpayers. We’ll be back with a new episode soon. I hope you’ll meet us right here to learn more.