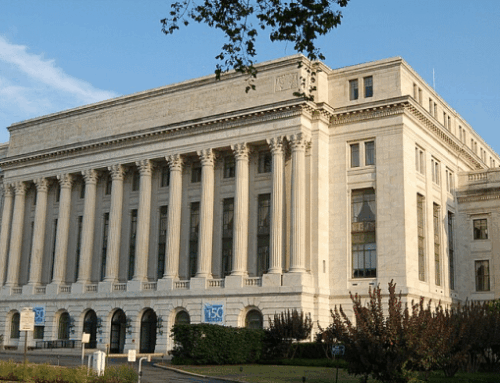

Congressional and presidential candidates are on the campaign trail spinning spooky stories about their opponents while promising treats to supporters. But the real Halloween trick is being planned in the halls of the U.S. Department of Agriculture (USDA).

November 1st brings no respite from Halloween fright, because that’s when USDA releases final crop prices used to calculate federal crop insurance payouts. Under this program, taxpayers subsidize production of more than 120 different crops covering 282 million acres. Most of its cost is tied up in policies that don’t insure against a loss of crops, but actually guarantee high levels of income through “revenue protection” policies.

The price tag will be scary big. Harvest prices have been hovering around $7.50 per bushel for corn and $15.50 for soybeans, the most highly subsidized crops. That's double the price from just four years ago, and for corn, $2 more than what was even expected at planting.

Record crop prices mean the crop insurance program will have a record high cost for taxpayers. When Congress passed the 2008 farm bill, crop insurance was projected to cost $6.8 billion this year. The price tag now will easily be $15 billion, though it could rise depending on market conditions.

Federal crop insurance masquerades as a free market program—private crop insurance companies sell and administer policies purchased by farmers and ranchers—but closer inspection reveals a government program. The government approves both the companies that sell crop insurance and the policies that they can sell (which don’t differ between companies). Taxpayers paid $1.4 billion last year to 15 private companies to administer the program. We also cover the majority of losses—last year, insurance companies made $1.7 billion in underwriting gains while taxpayers lost $500 million. Oh, and taxpayers also subsidize crop insurance premiums, contributing an average of 62 cents for every 38 cents an individual producer pays, to the tune of $7 billion this year.

Yet much of this is unnecessary. For all the drought scares, the agriculture sector is expected to enjoy a record $122 billion in profits this year. And plenty of subsidized crops, from pistachios to peanuts to pumpkins are having banner years.

But for farm state lawmakers and agriculture special interests, it’s not enough. Like zombies after brains, they have an insatiable appetite for taxpayer dollars.

Much like sixth-graders on a sugar high, many lawmakers want to use the post-election lame duck session to ram through a trillion dollar farm bill. This bloated bill has morphed into a witch’s brew of special interest giveaways. But instead of wool of bat and eye of newt, the cauldron’s filled with marketing loans for wool from goats and margin insurance for producers of catfish. Rather than restrain, it actually expands crop insurance including special carve-outs for popcorn, peanut, and poultry producers. All while creating new “shallow loss” entitlements that pay farmers who experience just a five or ten percent drop in expected revenue.

Washington should untangle the complex web of agricultural subsidies, not pile on new treats for the favored. They should finally slay “temporary” programs, like direct payments, that keep rising from the dead. The poltergeist of government mandated crop prices, taking the latest form of Price Loss Coverage in the House bill, should be eliminated. And they should exorcise the demons of old farm bills by repealing the outdated 1939 and 1947 legislation that is still on the books and often used as scare tactics to jam through new farm bills.

Taxpayers deserve policies that say no to ghosts of farm bills past and provide producers with a limited, effective, and efficient farm safety net. The days of ghoulish legislation wasting taxpayer dollars on profitable agribusinesses must be laid to rest.

TCS Quote of the Week:

“I don't think we're going off that cliff. … When it's 48 hours from going home for Christmas we can do about anything.”

– Senator Johnny Isakson (R-GA), commenting on a potential last minute deal by Congress to avoid the upcoming automatic budget cuts. (Bloomberg)