While agricultural special interest groups sew tales of doom and gloom, farming and ranching businesses are expected to experience near-record levels of income in 2021. Farm income in 2021 is expected to reach the highest level since 2013. Despite this good news, special interests continue to demand more federal subsidies for select farming and ranching businesses. Lawmakers should resist efforts to further increase subsidies to a sector of the economy that has weathered COVID-19 and supply chain issues better than most.

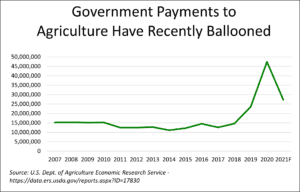

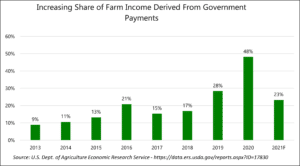

Official governmental estimates released by the U.S. Department of Agriculture’s Economic Research Service (USDA-ERS) today project government agriculture payments to reach $27.2 billion in 2021, fueled by continued COVID-19 payments, disaster subsidies, and more. While lower than the record level of subsidies in 2020 – $47 billion – farm subsidies are expected to still make up 23 percent of total farm income in 2021, 1.3 times the 15-year average. Near unprecedented levels of subsidies continue to flow despite most of the ag sector adjusting better than expected in the face of recent disasters, the COVID-19 pandemic, climate change, and more.

Entering this year, various sectors of agriculture predicted doom and gloom, with low commodity prices and a depressed ag economy due to the COVID-19 pandemic. However, because of producers’ resilience and a quick rebound in crop prices, the ag economy did much better than expected, with an expected $116.8 billion in net income. This would represent a nearly 20 percent increase ($18 billion) from 2020.

Experts predict the agriculture sector will continue to experience above-average income in 2022. Yet, instead of shutting off the subsidy spigot, Congress is directing more. The stopgap bill to keep the government running from October 1 to December 5, 2022, included another $10 billion in “emergency” cash for the agriculture disaster slush fund generally known as the Wildfire and Hurricane Indemnity Program (WHIP). USDA is also continuing to send out more COVID-19 subsidies. The administration has also proposed to begin subsidizing climate and carbon programs with Commodity Credit Corporation (CCC) funds without authorization from Congress or a full understanding of agriculture’s ability to store carbon in land and forests. And the Congressional Budget Office (CBO) estimates $26 billion in new farm income subsidies could occur under the current version of the Build Back Better Act, specifically new subsidies for cover crops and increased spending on existing ag conservation programs. Only $640 million, though, would be expected to actually land in producers’ pockets this Fiscal Year – for 2022.

Given Congress and USDA’s hesitance to ensure that recent high levels of subsidies are going to producers who truly need it, recent taxpayer dollars have gone to millionaires, people who don’t actually farm, and those who didn’t require taxpayer support to weather recent challenges. Some losses that weren’t covered by federal crop insurance or other farm bill disaster programs may have been warranted, but the recent level of intervention of the federal government into agriculture has been unprecedented.

Recent moves by Congress and USDA to increase agriculture’s reliance on government subsidies should be scaled back so the next ERS farm income update predicts a realistic level of federal support for agriculture that is based on real need, not billions of unnecessary subsidies. New spending on agriculture conservation within the budget reconciliation bill, if enacted, should also be prioritized toward proven, existing farm bill conservation programs. These should be reformed to provide taxpayers more bang for their buck – and deliver more climate, water, air, soil, and other public benefits. To achieve real climate and economic resilience, wasteful farm subsidies must also be scaled back or otherwise they will continue to work at cross purposes with other federal programs.

A more cost-effective, transparent, and accountable farm safety net can be achieved, but current high levels of farm subsidies – plus status quo policies – won’t help taxpayers achieve this goal.