The 2023 farm bill cometh. Preparing the legislative landscape for a trillion-dollar farm bill rewrite, this Wednesday, the House Agriculture’s Subcommittee on Conservation and Forestry will hold a hearing entitled “A 2022 Review of Farm Bill Conservation Programs.” Both taxpayers and businesses involved in farming and ranching need the committee to turn a critical eye in assessing the effectiveness of farm bill conservation programs. Because efforts to promote resilience, instead of dependence on federal subsidies, require effective conservation to be a cornerstone of agricultural operations, not an afterthought.

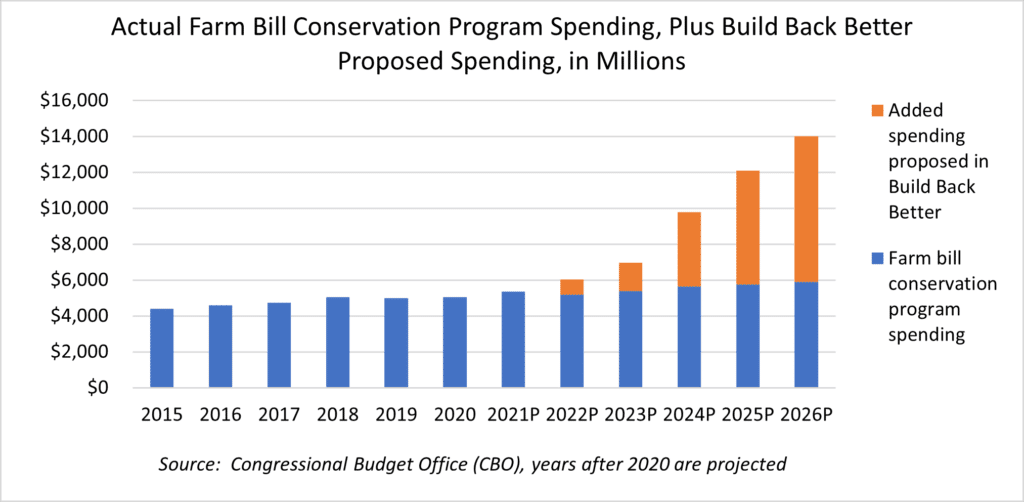

Federal taxpayers are on track to spend more than $5 billion a year on federal farm conservation programs. Generally, these programs have successfully assisted producers in conserving wetlands, grasslands, installing grassed buffers and filter strips, planting cover crops, etc. which improve producers’ bottom lines while achieving public benefits, such as cleaner water. However, no federal program is perfect. Congress should thus seize the opportunity presented by the 2023 farm bill to create a more accountable, cost-effective, and transparent farm safety net responsive to actual need as opposed to political power. This goes for conservation programs too.

Recent farm bills took some small steps forward toward better integrating conservation goals with agricultural production, but the U.S. has a long way to go toward achieving an agricultural sector that promotes resilience. As a whole, the underlying farm safety net – including commodity and crop insurance subsidies – often works at cross purposes with other federal programs aimed at conservation, climate mitigation, and improved water quality.

Government payments have recently risen to record levels – $47 billion in 2020 alone – and are ripe for reform. An agriculture sector that is resilient to future economic challenges and climate change will require rethinking the current farm safety net, including the role of farm bill conservation programs.

The budget reconciliation package (Build Back Better Act) proposed increased spending on conservation programs. If enacted, proposals could send conservation program spending to $14 billion by Fiscal Year 2026, without even considering proposals for cover crop subsidies.

While added investments – especially those targeted toward water quality and climate outcomes – can achieve additional public benefits, the Agriculture Committees must think bigger. Simply spending more money won’t cut it. Producers, taxpayers, and consumers alike deserve real, lasting change.

The Problem

Before we jump in to see what a true safety net looks like in the year 2023, let’s see what status quo commodity and crop insurance subsidies have delivered for taxpayers historically:

- Increased greenhouse gas (GHG) emissions, loss of soil carbon and more erosion, groundwater pollution, and the loss of biodiversity (don’t take our word for it, but rather the U.S. Department of Agriculture (USDA) itself)

- Farm consolidation and larger farms (which limits opportunities for small, new, and socially disadvantaged farmers)

- Limited use of cover crops and other risk-reducing conservation measures, plus increased moral hazard

- Market distortions, less crop diversification, and cropland expansion at the expense of carbon-rich grasslands and wetlands

Our Solution

Lawmakers should use the farm bill reauthorization and climate change mitigation debates to ensure farm bill programs promote economic resilience, instead of dependence on federal subsidies. This applies across the board to conservation programs as well, not just commodity and crop insurance subsidies. Promoting resilience and saving taxpayer dollars can go hand in hand. Toward this end, some ideas for the Agriculture Committees to consider include:

(1) Increase the cost-effectiveness of conservation programs by prioritizing taxpayer dollars toward areas with the greatest resource concerns, programs/practices with best return on investment, and projects with additional, measurable, verifiable, and lasting public benefits. Public auctions and better processes to optimize public benefits in the Conservation Reserve Program (CRP) and the Environmental Quality Incentives Program (EQIP), respectively, are innovative ways to stretch taxpayer dollars further.

(2) Promote climate resilience and water quality improvements within existing conservation programs, making these practices a priority for funding opportunities.

(3) Increase data collection, agricultural extension, and technical assistance opportunities to reach more producers at lower cost to taxpayers. These investments can help speed the flow of information from researchers to farmers and improve farmers’ bottom lines while yielding public benefits. They can also benefit a wide range of producers, including young, beginning, and/or socially disadvantaged farmers and ranchers.

(4) Improve equity in conservation programs by eliminating spending set-asides for large livestock producers who should shoulder the cost of manure management with their own dollars instead of taxpayers’. Reduce payment limits so more producers can benefit from federal programs’ limited budgets. Spread the love, if you will!

(5) Increase accountability by strengthening conservation accountability standards and their implementation to ensure producers adopt a basic level of conservation on land receiving generous taxpayer subsidies.

(6) Enhance transparency by publicly releasing conservation program outcomes and data about program funding, including which practices work best in certain areas so producers and researchers don’t have to reinvent the wheel.

(7) Invest in what works by prioritizing spending toward proven, old-school conservation programs instead of new alphabet soup initiatives that may or may not yield public benefits, such as USDA’s proposed “climate smart” commodity subsidies.

(8) Eliminate subsidies that work at cross purposes with conservation outcomes, including certain commodity and crop insurance subsidies that promote risk taking – instead of risk reduction – at taxpayer expense. A holistic review of farm bill programs should identify places where conservation and production can be win-wins instead of at odds with one another.

So, there you have it. Our first of many 2023 farm bill recommendations! Let’s just hope Congress listens this time around.

Get Social