Download and read this fact sheet as a PDF

Background

U.S. agriculture subsidies were created nearly a century ago to help farmers make ends meet during the Great Depression. Much has changed in U.S. agriculture since the 1930s, but one thing remains the same – the government is still subsidizing the incomes of agricultural businesses through government-set minimum prices, revenue guarantees, supply management, and a maze of other market interventions. Because agriculture subsidies are largely tied to planted acreage, they can influence farm management decisions and encourage farmers to plant for Washington instead of planting for the market. This often results in increased plantings of the most input-intensive crops, and subsequently, increased applications of nitrogen fertilizer which runs off into nearby waterways, polluted drinking water, conversion of native grasslands and wetlands to row crops, loss of wildlife habitat, and other unintended consequences. These environmental impacts increase costs for both consumers and taxpayers – including higher water treatment costs to remove nitrates and pesticides and higher costs for conservation programs to help mitigate environmental impacts. Instead of promoting agricultural policies that work at cross-purposes with other federal programs, the government should reform agricultural safety net programs to reduce market- and trade-distortions while reducing negative environmental impacts.

Current Agricultural Policies

The majority of price supports, crop insurance subsidies, income guarantee subsidies, and other disaster and marketing loan payments are handed out to producers of the “big five” crops – corn, soybeans, wheat, cotton, and rice.[1] Because federally subsidized crop insurance and marketing loan programs are tied to planted acreage, and Title 1 base acreage updates and program elections are calculated on recent plantings, agribusinesses can expand their eligibility for federal payments if they plant more acres to these farm program-favored crops.[2] In addition, these federal supports can push businesses to concentrate on short-term profitability at the expense of longer-term impacts or those occurring further downstream.

While agricultural income subsidy programs produce numerous unintended consequences, negative impacts on the environment, like lower soil quality and reduced water quality, are some of the most costly. They are costly for producers and communities immediately affected by the changes and federal taxpayers who annually spend nearly $5 billion on agricultural conservation programs to address these environmental concerns.

Several agricultural policies affecting water quality can be found below:

- Price supports (or counter-cyclical payments, currently known as Price Loss Coverage – PLC – payments) are government-set prices that have been on the books in various forms for decades.

- The highly subsidized crop insurance program operates as an income guarantee program for over 120 crops but the majority of subsidies go to the “big five” crops, ensuring that an expected level of income is received every year, regardless of whether producers even experience an actual loss of crops.

- New income guarantee/shallow loss subsidies, including Agriculture Risk Coverage (ARC), add another layer to the expanding subsidy sandwich, ensuring that producers receive a government check if crop revenue (prices times yield) dips below levels achieved in recent years, but not enough to trigger crop insurance payments.

- Other federal agriculture subsidies like disaster and market loan payments increase crop revenue and allow agribusinesses to expand farm acreage at taxpayer expense.[3]

- Federal mandates and historic subsidies for corn ethanol encourage production of corn-based biofuels regardless of market conditions, availability of supplies, commodity prices, environmental damage, etc.

Farm Subsidies Alter Agribusinesses’ Risk Management Decisions

According to researchers, federal agricultural policies alter agribusinesses’ risk management decisions in several ways:

- Farm payments and unlimited crop insurance subsidies reduce producers’ business risks, increase returns to scale, distribute resources ineffectively, increase agribusiness income, allow farm sizes to increase, and consolidate production in fewer hands.[4],[5]

- More specifically, counter-cyclical payments increase liquidity of credit-constrained farmers, influence farm labor decisions, alter land values, and reduce income variability.[6]

- Counter-cyclical payments (such as PLC) can also “encourage farmers to plant the program crop for which they have base acreage” (and subsidy eligibility) even if it is riskier to do so by reducing the risk of revenue loss if market prices fall.[7] The availability of government-set target prices induces agribusinesses to increase nitrogen use by up to 15 percent even if production does not jump by a commensurate amount.[8]

- Crop insurance and shallow loss programs allow agribusinesses to shift routine business risks onto taxpayers because the government picks up on average 62 cents for every 38 cents that producers pay for their own insurance coverage.[9] Crop insurance subsidies also guarantee revenue – not just yield losses due to natural disasters – reducing the economic risks of planting on less productive land or planting crops less likely to succeed, such as planting corn in dry areas of Kansas and Oklahoma.

- Inflexible federal biofuels mandates pick winners and losers, causing producers to expand production and plant certain crops like corn and soybeans over others such as forage crops or fruits and vegetables. Mandates and subsidies also increase demand for biofuel feedstocks, causing crop prices to increase and production to expand onto sensitive land like pasture, grasslands, and highly erodible acres since historic yields have not kept up with increased demand.[10]

Farm Subsidy Impacts on Water Quality

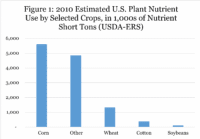

As agribusinesses shift routine business risks onto taxpayers, perverse incentives often encourage producers to maximize short-term profits at the expense of long-term productivity. One means of maximizing profits is to increase plantings of crops with the highest rate of subsidy while decreasing plantings of crops with fewer or no subsidies. Federal subsidies for crops and corn ethanol have incentivized producers to become less diversified and plant more acres of corn while plantings of oats, barley, alfalfa, and others have declined. In addition up to six percent more acres are in production because of government intervention in the marketplace.[11] It’s no surprise that the most heavily subsidized crops – corn, cotton, soybeans, and wheat – are the most widely produced crops.[12] But these crops also happen to be the most input-intensive (see Figure 1). USDA researchers found that “roughly two-thirds of all fertilizer nutrients are spread on [fields planted to these four crops].”[13] Together, these changes have had a direct impact on water quality and land conservation. Researchers note that our agricultural policies (primarily misguided subsidies) have led to more soil erosion, plowing up native grasslands and draining wetlands, water pollution, and unnecessary costs for downstream users like higher water treatment costs, less recreational opportunities, and lower fishing revenues. More specific effects of federal agricultural policies on water quality are explored below.

Crop Insurance Subsidies

Since agribusinesses are eligible for unlimited crop insurance subsidies and subsidies are based on current production, researchers have found that subsidies distort markets and planting decisions. The U.S. Department of Agriculture’s Economic Research Service (USDA-ERS) found that the combination of crop insurance, marketing loan, and disaster subsidies increased cropland acreage by about three percent between 1998 and 2007 (but note that these projections fail to account for significant changes in cropland use after the 2007 corn ethanol boom).[14] Other economists estimate that increases in crop insurance subsidies during the 1990s brought 15 million new cropland acres into production (or about five percent of cropland).[15]

Effects of greater income guarantee subsidies are more prevalent in certain areas than others. States like North Dakota and South Dakota accounted for more than half of all grassland conversions between 1998 and 2007.[16] Northern Plains agribusinesses also switched from wheat to corn and soybeans more quickly than any other part of the country due to various commodity and crop insurance subsidies. This is despite the fact that land in the Dakotas and other sensitive land is more likely to have lower soil productivity, higher vulnerability to erosion and nitrogen fertilizer runoff, to include wetlands and lie in the floodplain, and provide habitat for imperiled species (particularly in the Mississippi River Basin).[17] In fact, crop insurance subsidies increased the rate at which wetlands were drained and converted to crop production: from 1992 to 1997, income guarantee subsidies were responsible for a fifth of the net loss of non-Federal wetlands.[18] Finally, research has shown that by treating growing areas nearly all the same regardless of land quality, climate, availability of water, and other factors, subsidized crop insurance has altered producers’ financial risk calculations resulting in marginally productive land remaining in production and collecting crop insurance payouts.[19] More cropland acres instead of grasslands and wetlands results in more nitrogen fertilizer and pesticide runoff into waterways since crops such as corn require these inputs while they are rarely applied to marginal land (in pasture, wetlands, alfalfa, etc.).

Federal Biofuels Policies

Federal biofuels mandates and historic subsidies for corn ethanol have also spurred changes in the agricultural landscape and resulted in negative effects on water quality. Despite promises from biofuels proponents, corn yields have not kept pace with increased corn ethanol production. While corn ethanol production increased nearly eight-fold over the past decade, corn production only increased by 25 percent, mainly due to an increase in corn acreage.[20] States with huge increases in corn acreage (and lower reliance on diversified crop rotations) primarily include those in the lower Mississippi River Basin and dry areas of the Dakotas, Nebraska, Oklahoma, Texas, and Montana.[21] Because corn is the largest user of nitrogen fertilizer and pesticides, nearly half of U.S. inputs are applied to corn (46 and 43 percent, respectively).[22] South Dakota State University researchers found that biofuels mandates and subsidies from 2006 to 2011 contributed to a loss of 1.3 million acres of grasslands in the Dakotas, Nebraska, Iowa, and Minnesota as more corn and soybeans were planted on acres that had never been cropped before.[23] Many of these acres were near wetlands, signaling that worsening water quality conditions are at least partially due to land conversion. Other recent studies have found even larger land conversions tied to ethanol subsidies[24], with some showing land conversions are centered around ethanol facilities.[25]

Nitrogen Runoff Leads to Impaired Water Quality

Nitrogen runoff from farmland has increased over time as more fields were planted to corn, annual rotations were forgone, and more herbicides and fertilizer were used to squeeze the highest yield out of each acre. Excess nitrogen has impaired water quality, particularly in the Mississippi River Basin, and increased costs for taxpayers and communities and industries relying on clean water. Agribusinesses often over apply nitrogen fertilizer when planning for ideal growing conditions even though perfect conditions rarely continue throughout the entire growing year. Farmers also install drainage tile beneath fields to accelerate the rate at which water migrates from wetlands or low-lying parts of fields to nearby water bodies. More acres then become suitable for cropland production even though there is a greater likelihood of water pollution due to unfiltered, nitrogen-laden water reaching nearby rivers and streams more rapidly. USDA’s Natural Resources Conservation Service (NRCS) warns that “tile [drains] are being installed faster than conservation practices are being adopted to address the modified flow of water and nutrients.”[26] Pollution from tile drains is also largely unregulated.

Drinking water pollution is so bad in Iowa that the Des Moines Water Works filed a lawsuit against three counties for failing to adequately manage nitrogen run-off from farms. In 2015, the water utility reportedly spent an additional $1.2 million to operate a special system to remove nitrates from residents’ water supplies.

Government data also shows that agribusinesses are “failing to apply best management practices [which] increases the risk that excess nitrogen can move from the field to water resources or the atmosphere.”[27] NRCS found that of all U.S. cropland, two-thirds was failing to meet USDA’s criteria for good nitrogen management.[28] Better timing and application rates are needed on a high portion of cropland acres in the following watersheds: 86 percent of cropland in the Upper Mississippi Basin, 87 percent in the Chesapeake Bay watershed, 82 percent in the Great Lakes watershed, and 93 percent in the Ohio-Tennessee Basin.[29] Since the greatest portion of drainage tile has been installed on corn acres in the MS River Basin, concerns are growing about effects on the Gulf of Mexico’s hypoxic zone and downstream costs for water treatment facilities, industries, and recreational users.”[30] The greatest concern lies with increased corn plantings since the number of corn acres failing to meet best management criteria increased by 18 percent from 2001 to 2010; in addition, nearly 90 percent of manure-treated corn acres fail to meet minimum nitrogen application standards.[31] If corn ethanol mandates and federal subsidies that bias production for corn continue or are expanded, the situation will only worsen with taxpayers and consumers bearing the brunt of the downstream costs.

Recommendations

For nearly a century, U.S. agriculture subsidies have distorted markets, promoted risky planting decisions, and supported corporate welfare at the expense of taxpayers, consumers, and the environment. Subsidies promoting fencerow-to-fencerow crop production have resulted in millions of acres of wetlands, native grasslands, and other sensitive acres being converted into crops that require large amounts of fertilizer and pesticides. Water quality has suffered as a result of soil erosion and runoff of these contaminants into local drinking water supplies. Taxpayers cannot afford to shoulder the responsibility for managing normal business risks or guaranteeing high government-set crop prices that encourage farmers to plant for Washington instead of the market where individual farm businesses can navigate markets based on their own perception of market needs and individual ability. Reforming economically wasteful and environmentally harmful subsidies would be a major step in the right direction toward freeing farmers to plant for the market while creating a more cost-effective, accountable, transparent, and responsive agricultural safety net.

For more information, visit www.taxpayer.net, or contact Joshua Sewell at josh@taxpayer.net.

[1] http://farm.ewg.org/cropinsurance.php?fips=00000&summpage=FP_BY_YEAR&statename=theUnitedStates

[2] https://www.ers.usda.gov/webdocs/publications/44564/6905_eib79.pdf?v=41055

[3] https://www.ers.usda.gov/webdocs/publications/44876/7477_err120.pdf?v=41056

[4] https://www.ers.usda.gov/webdocs/publications/44619/10629_eib88_1_.pdf?v=41055

[5] http://naldc.nal.usda.gov/download/18868/PDF

[6], https://lib.dr.iastate.edu/econ_las_workingpapers/225/

[7] http://www.choicesmagazine.org/2005-3/grabbag/2005-3-05.htm

[8] http://ageconsearch.umn.edu/bitstream/7347/2/wp070021.pdf

[9] https://www.ers.usda.gov/webdocs/publications/44619/10629_eib88_1_.pdf?v=41055

[10], https://www.ers.usda.gov/webdocs/publications/44656/16748_eib92_2_.pdf?v=41055

https://www.ers.usda.gov/webdocs/publications/44564/6905_eib79.pdf?v=41055

[11] https://www.ers.usda.gov/webdocs/publications/44564/6905_eib79.pdf?v=41055

[12] https://www.ers.usda.gov/webdocs/publications/44619/10629_eib88_1_.pdf?v=41055

[13] https://www.ers.usda.gov/webdocs/publications/44619/10629_eib88_1_.pdf?v=41055

[14] https://www.ers.usda.gov/webdocs/publications/44876/7477_err120.pdf?v=41056

[15] https://www.ers.usda.gov/webdocs/publications/45609/17593_err25_1_.pdf?v=41056

[16] https://www.ers.usda.gov/webdocs/publications/44564/6905_eib79.pdf?v=41055

[17] https://www.ers.usda.gov/webdocs/publications/45609/17593_err25_1_.pdf?v=41056

[18] https://www.ers.usda.gov/webdocs/publications/45609/17593_err25_1_.pdf?v=41056

[19] https://www.ers.usda.gov/webdocs/publications/45609/17593_err25_1_.pdf?v=41056

[20] http://usda.mannlib.cornell.edu/MannUsda/viewDocumentInfo.do?documentID=1194

[21] https://www.ers.usda.gov/webdocs/publications/44564/6905_eib79.pdf?v=41055

[22] https://www.ers.usda.gov/webdocs/publications/42865/33561_eb20.pdf?v=41228

[23] http://www.pnas.org/content/early/2013/02/13/1215404110.full.pdf+html?sid=11181637-caa2-4b09-ad2b-964b57fc7bd1

[24] http://news.wisc.edu/plowing-prairies-for-grains-biofuel-crops-replace-grasslands-nationwide/

[25] http://iopscience.iop.org/article/10.1088/1748-9326/aa6446

[26] http://www.nrcs.usda.gov/Internet/FSE_DOCUMENTS/stelprdb1047813.pdf

[27] https://www.ers.usda.gov/webdocs/publications/42865/33561_eb20.pdf?v=41228

[28] https://www.ers.usda.gov/webdocs/publications/42865/33561_eb20.pdf?v=41228

[29] https://www.ers.usda.gov/webdocs/publications/42865/33561_eb20.pdf?v=41228

[30] https://www.ers.usda.gov/webdocs/publications/44918/6767_err127.pdf?v=41056

[31] https://www.ers.usda.gov/webdocs/publications/42865/33561_eb20.pdf?v=41228

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]