This week, the House Agriculture Committee plans to hold its second hearing on farm bill conservation programs. These programs, which include both working lands and set-asides to idle production, are the primary means by which taxpayers compensate farmers and farm landowners that implement practices to improve water quality, increase wildlife habitat, or provide other public benefits. Whether paying farmers to conserve wetlands and grasslands, plant cover crops, transition to no-till, or other conservation measures, farm bill conservation programs have the potential to increase public goods while helping to reduce economic risk and improve long-term farm profitability.

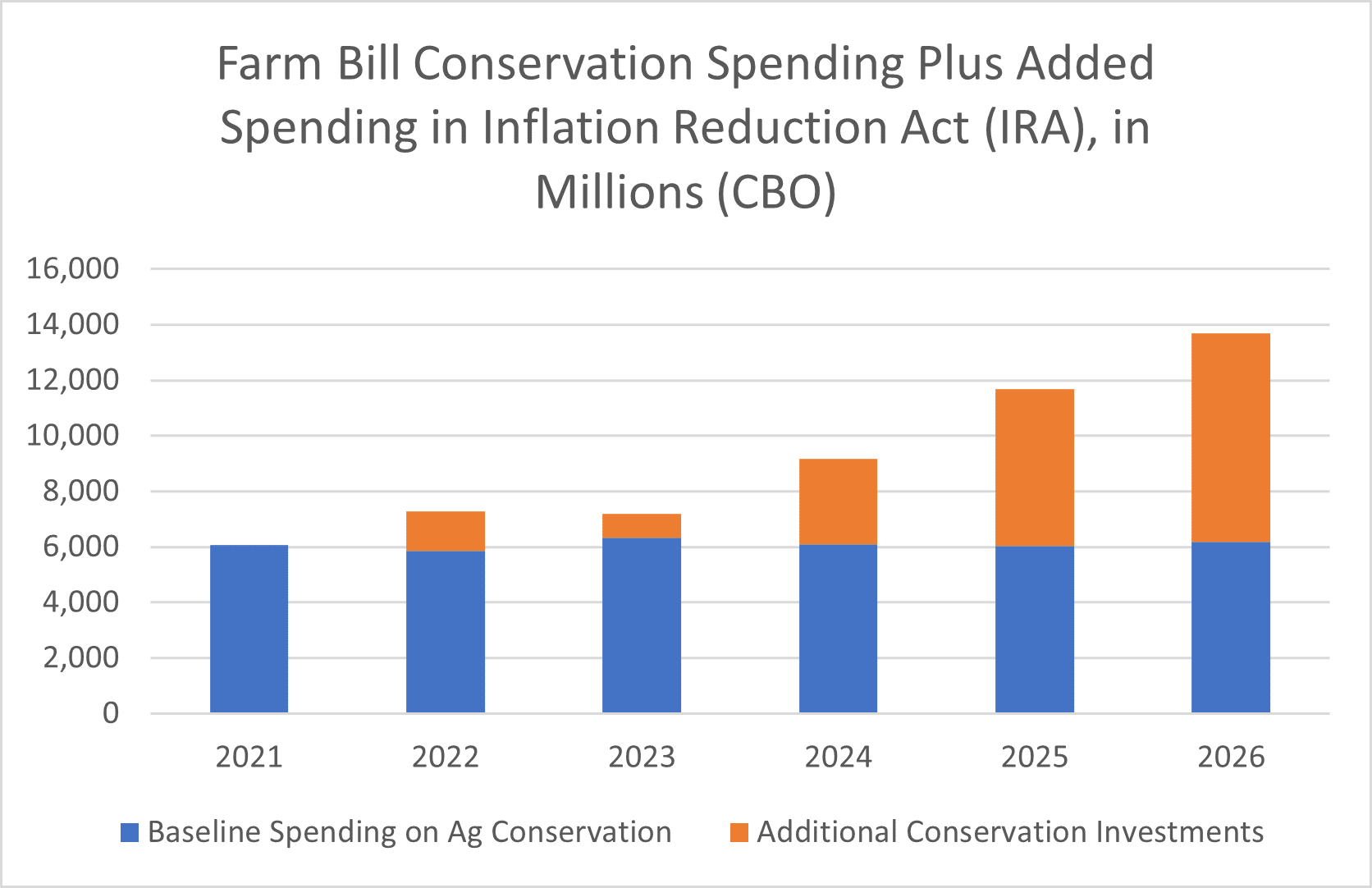

Conservation programs in Title II of the farm bill cost taxpayers an average of $5-6 billion annually. The primary conservation programs in the farm bill include the Environmental Quality Incentives Program (EQIP), Conservation Stewardship Program (CSP), Regional Conservation Partnership Program (RCPP), Agricultural Conservation Easement Program (ACEP), and the Conservation Reserve Program (CRP).

The recently-enacted Inflation Reduction Act (IRA) added nearly $20 billion in FY22-26 spending authority on the aforementioned agriculture conservation programs, with the exception of CRP which is a land set-aside program. The Congressional Budget Office (CBO) estimates that new conservation spending in IRA, targeted toward practices that are intended to deliver climate and water quality benefits, will increase spending by more than $18 billion. For more on the conservation spending bump in IRA, please see this post.

The figure below shows baseline (status quo) farm bill conservation spending authority in blue, with IRA spending additions in orange. The FY22 spending increase of $1.4 billion includes conservation technical assistance, funding for outreach and education to producers to increase conservation adoption, that is intended to be utilized in years to come.

Conservation spending has the potential to deliver significant benefits for taxpayers, farmers, the climate, and environment. Additional public benefits can be realized when federal dollars are prioritized toward projects with the best bang for taxpayer’s buck, in addition to other recommendations about how to ensure taxpayer dollars are spent wisely.

In this week’s hearing, Agriculture Committee members must also not forget about farm commodity, disaster, and crop insurance subsidies that, often times, work at cross purposes with conservation goals such as conserving soil, sequestering carbon, and improving water quality. Reforming these subsidy programs should go hand in hand with added conservation investments to ensure farm safety net programs promote resilience, instead of dependence on federal subsidies.

Get Social