It’s official! The 2023 farm bill debate has begun.

On February 2nd, Groundhog Day, the House Agriculture Committee held its first farm bill reauthorization hearing. Perhaps it was on purpose, as Ag Committee Ranking Member “GT” Thompson happens to represent Pennsylvania’s 15th Congressional District, the home of Punxsutawney Phil. (ICYMI, the famous groundhog saw his shadow on Wednesday – get ready for six more weeks of winter.)

It was definitely appropriate as federal farm policy is stuck in an endless loop of expensive bailouts and broken budgetary promises. The last thing taxpayers, and farmers, need is to repeat past policy mistakes. Congress needs to rethink the farm bill.

To achieve bold, bipartisan reforms, extensive debate, hearings, and full opportunity for amendments and votes will be necessary. Ranking Member Thompson (R-PA) said he’d like farmers’ voices to be brought to the 2023 farm bill process as well. We couldn’t agree more. In our recent conversations with Nebraska farmers, they’ve warned the status quo isn’t working, with subsidies spurring farm consolidation and environmental damage. Other farmers agree.

In 2020, government payments for agriculture reached a record high – $47 billion – partially due to the COVID-19 pandemic, but expensive farm bill subsidies and ad hoc disaster aid also played a hand. While the ag lobby told tales of doom and gloom during the pandemic, farm income and commodity prices have done just fine. However, subsidies are stuck at above-average highs.

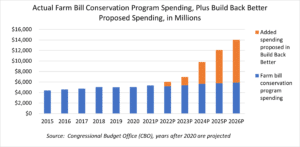

Creating a more cost-effective, transparent, and accountable farm safety net that is responsive to real need instead of political power takes more than dollars, it requires change. During last fall’s debate on the Build Back Better (BBB) Act, the House Ag Committee adopted its $80 billion portion of the reconciliation package with the $27 billion Conservation title, sight unseen. While increasing conservation investments – and directing funding toward climate and water goals – can deliver public benefits, it was concerning that the Committee passed a bill at the time without any conservation text.

With BBB stalled, there’s talk of added conservation spending resurfacing in the farm bill. Some members are worried the conservation title could become the climate title. However, it already is. Existing conservation programs funding cover crops, grassed buffers, and wetlands restoration also benefit the climate.

Yes, we agree federal programs shouldn’t be one-size-fits-all and taxpayer dollars shouldn’t be wasted, but it’s not as black and white as winter or no winter. Changing tillage practices can reduce greenhouse gas emissions while lowering farmers’ costs, a win-win. In fact, the whole farm bill is a “climate bill.” Increasingly “dynamic weather,” such as a drier Texas and wetter North Dakota, are driving up the costs of the $9 billion federal crop insurance program. And hurricanes, bomb cyclones, and historic heat domes led lawmakers to appropriate $16 billion in “emergency” subsidies on top of farm bill programs.

Increasing resilience to future climate and economic challenges can be achieved by investing in existing, tried and true conservation programs, as the House Ag Committee has proposed. This is a better bet for taxpayers than shoveling billions into “climate-smart” commodity subsidies. The U.S. Department of Agriculture (USDA) is cooking up new subsidies as we speak. However, not only is the Administration proposing new programs without Congress’s input, but taxpayer and producer benefits are questionable. Plus, layering more status quo subsidies on top of an already broken farm safety net – which distorts markets and promotes risk taking at taxpayer expense – is a recipe for waste. Former USDA Chief Economist Dr. Joe Glauber warns new climate subsidies may also fly in the face of international trade agreements. (Hint: we’ve already been there and done that with cotton, trade war, and other subsidies.)

Now is a pivotal Groundhog Day-like moment for Congress to get their hands dirty, meet with farmers, determine which programs work, and rethink what a true safety net is. It should be one that you hope you never lean on but is there in case of unforeseen events that aren’t already covered by federal programs or private insurance. Reformed agriculture conservation practices can help build resilience to eliminate the need for disaster aid, an overly costly federal crop insurance program, and other subsidies. Future climate risks should also be incorporated into federal programs, as the Government Accountability Office (GAO) recommended, instead of treating crop insurance and climate mitigation like apples and oranges, for instance.

If Punxsutawney Phil can teach us anything, it’s start anew. Taxpayers don’t need another trillion-dollar farm bill that fails to promote resilience. Taxpayers shouldn’t be on the hook for guaranteeing nearly 100 percent of certain farmers’ income or similar asks from the farm lobby. Taxpayers and farmers deserve better – a less costly farm bill that promotes innovation, equity, and opportunity for all of agriculture, not just the politically favored.

Congress, we’re here to help. Let’s think bigger and bolder.

Get Social