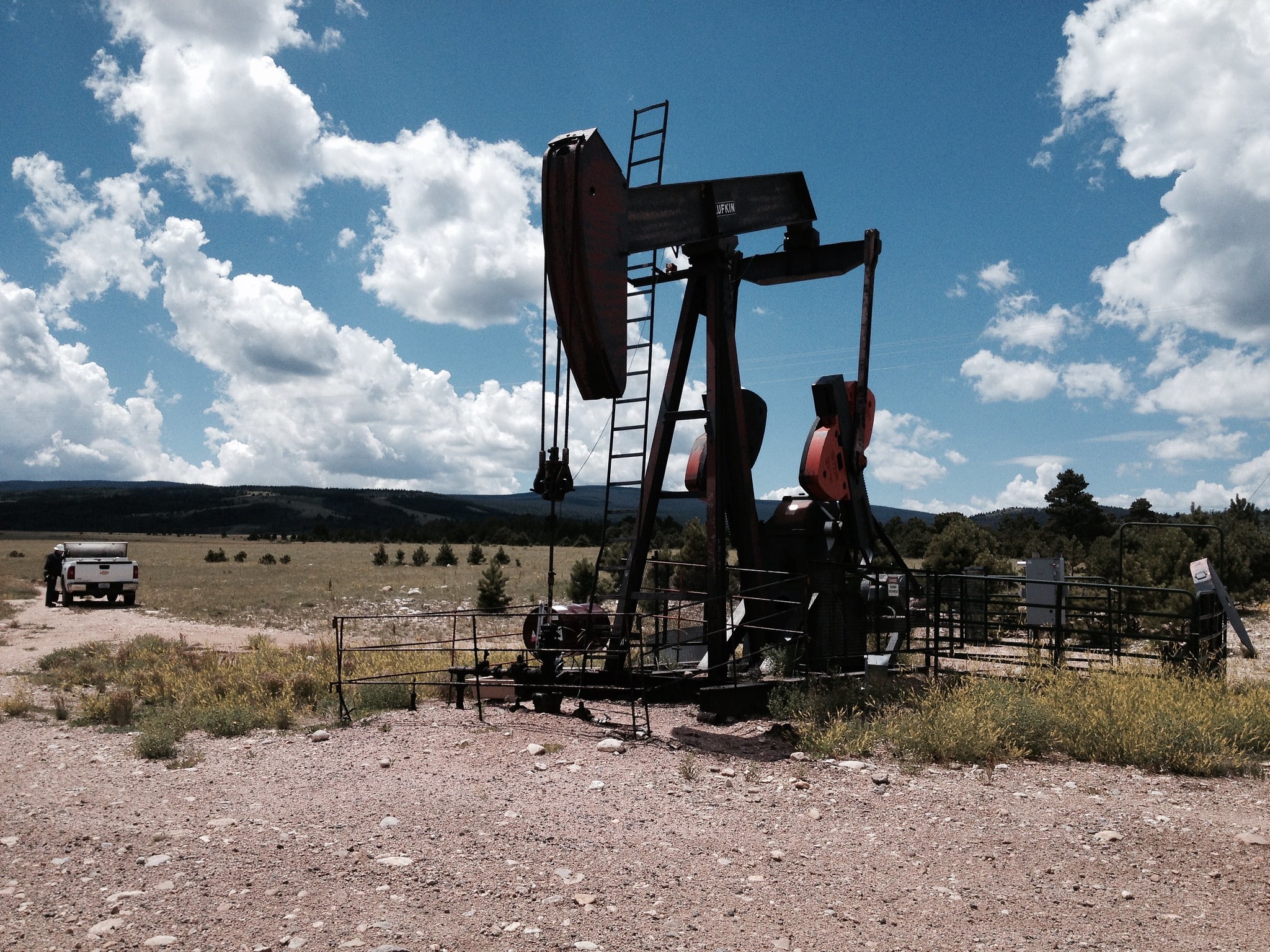

The federal Farm Bill is a $1.3 trillion piece of legislation that impacts all taxpayers. The bill is the primary vehicle providing the farm financial safety net, shapes the nation’s largest nutrition assistance program, and covers a wide array of areas including energy investments in rural America, trade promotion programs, agricultural research, and farm conservation. It also a bill with a history of wasteful special interest spending, abuse, and fiscal malpractice.

Taxpayers for Common Sense is releasing a comprehensive report identifying opportunities for improving program integrity across all parts of the Farm Bill. Reforming Farm Bill authorized programs to encourage fiscal responsibility while better achieving their intended outcomes can reap taxpayer savings and provide greater public good. With the national debt at a record $36 trillion, annual interest payments on that debt now exceed $900 billion, making debt service the costliest annually appropriated federal program. Even larger than the entire national defense portfolio.

Taxpayers cannot afford to continue business-as-usual. Lawmakers must look for credible, durable, effective reforms that ensure federal farm bill programs more effectively deliver for the public good. The reforms identified in this report are a starting point for making the farm bill work for taxpayers.