It’s time to put misguided federal handouts to agriculture out to pasture. As Congress and the President sit on the fence, billions in savings are being left to rot on the vine. Farm businesses are experiencing near record income – $98.1 billion in 2011 . Now it’s time for Congress to stop shoveling them taxpayer dollars. We need to harvest savings wherever they bloom, and it’s widely acknowledged that the federal handouts known as “direct payments” are ripe for the picking.

Direct payments are one of the most egregious entitlements around. Created in the ironically titled “Freedom to Farm” 1996 farm bill as a “temporary” measure, they’re cash given to owners of farmland that historically grew certain crops—corn, wheat, soybeans, cotton, and rice. The checks are cut regardless of current crop prices, and there’s not even a requirement these crops actually be grown on the land receiving payments. This has led to such “farmers” as Charles Schwab , subdivision homeowners in Texas , and even folks in DC —which, by the way, has no farmland — getting a share of the approximate $5 billion in federal dollars paid out each year.

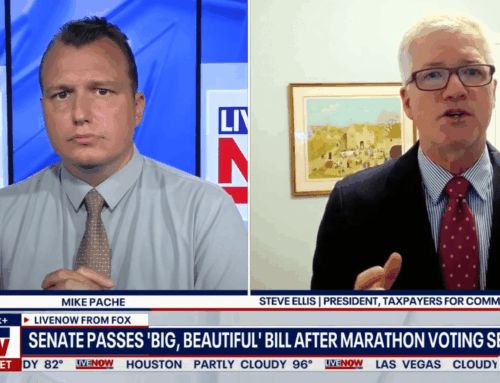

Direct payments are indefensible. Now Washington seems to be coming around to the notion that the era of direct payments is over. The President proposed their elimination last year, leaders of the Agriculture Committees have acknowledged a need to move on, and even the American Farm Bureau has called for their end.

But the agricultural entitlement roots run so deep, that if you lop off direct payments, another blatant giveaway just pops up in its place.

Instead of simply ending direct payments, many farm state lawmakers are proposing to plow those potential savings into new or expanded agricultural entitlements; namely, so-called “shallow loss” programs. Bills such as the ARRM Act , REFRESH Act , and proposals by groups like the American Soybean Association and the National Cotton Council would exchange direct payments for programs where taxpayers pay farmers when they suffer as little as a 5% loss. And it’s not just an actual loss of crops we’re talking about. Often it’s a shortfall in expected revenue from near record high prices.

The appetite for budget cutting in Washington has finally led politicians to the taxpayer handouts to agriculture. The President’s budget called for cutting agriculture subsidies by $33 billion . House Republicans agreed to a budget calling for $30 billion in cuts . And the Republican and Democratic leaders of both the House and Senate Agriculture Committees even agreed to $23 billion in cuts during the Super Committee debates.

Of course, that’s just the tip of the iceberg, and much larger cuts should be enacted. So let’s get cutting already! The Reducing the Deficit through Eliminating Agriculture Direct Payment Subsidies Act of 2011 (REAPS), introduced by Congressman Jeff Flake (R-AZ), is a good first step toward finding these savings. The REAPS Act would immediately and permanently end direct payments and apply all the savings to deficit reduction. The Congressional Budget Office (CBO) has scored the REAPS Act as saving $28.4 billion over 10 years. (Because many producers who lose direct payments will instead join another federal agriculture subsidy program, ACRE, taxpayers can’t count on saving the full $5 billion a year. Sigh.)

Since the Great Depression farm subsidies have been etched in the laws of the land. But agriculture today is not the same as it was 80 years ago or even 20 years ago. It’s a very technologically advanced sophisticated business and it doesn’t need to be on the corporate welfare dole. Considering that the country is staring down the barrel of trillion dollar deficits for the next decade, it’s time to start reforming federal agriculture policy. Eliminating an unjustifiable handout like direct payments and not replacing it with another entitlement sounds like a good place to start.

###

TCS Quote of the Week

“The highway bill is so popular that members on both sides of the aisle are willing to kick the can down the road… But passing a bill that spends money over 18 months and tries to recoup it over a 10 year period is a road to insolvency.” — Sen Bob Corker (R-TN) ( Infrastructure USA )