Today, the House Agriculture Committee held its third hearing in preparation for the 2023 farm bill. The title of the hearing was “A 2022 Review of the Farm Bill: Commodity Group Perspectives on Title 1.” Title 1 is the Commodities Title of the farm bill, which primarily includes price supports, shallow loss, marketing loan, and other agriculture income subsidies for a select group of “commodity” crops such as corn, soybeans, cotton, rice, peanuts, and wheat.

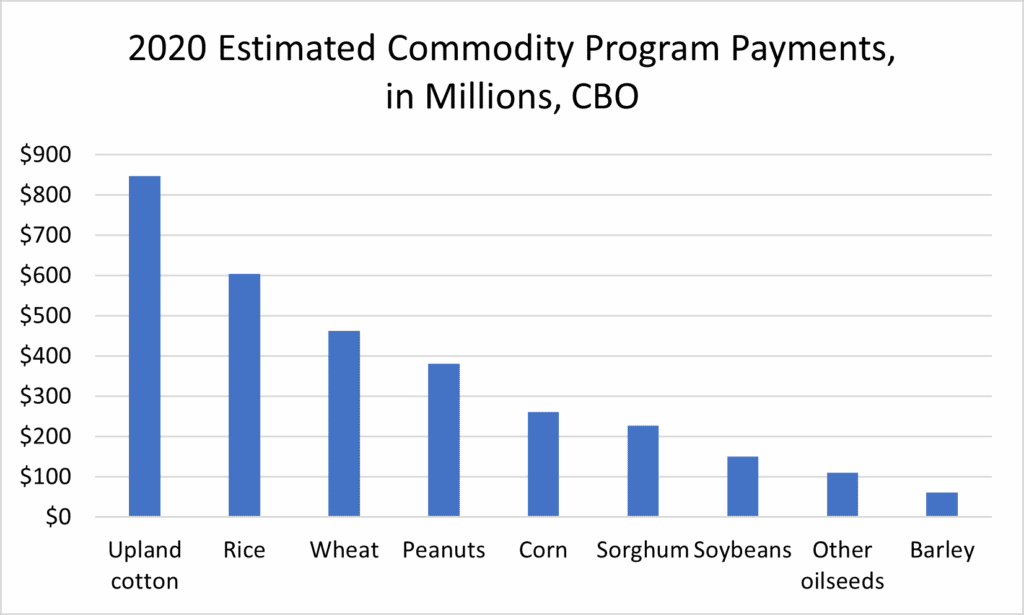

Yes, there are also special interest programs for sugar and dairy, plus government-set prices for other crops like oats and barley, but the majority of taxpayer spending goes to just a handful of crops. In 2020, the top three recipients of Price Loss Coverage (PLC) subsidies were crops grown primarily in the South – rice, peanuts, and cotton. Historically, beneficiaries of now-defunct direct payments plus the current shallow loss program (Agriculture Risk Coverage (ARC), which subsidizes small dips in annual income) were the “big five” – corn, wheat, soybeans, cotton, and rice. Compared to the billions in subsidies these crops typically cash in on every year, other crops like oats, sunflowers, canola, etc. receive crumbs. And given most subsidies are tied to historic acreage, the largest producers and landowners receive the most taxpayer subsidies.

Who’s left out of this equation? Small and beginning farmers. Livestock producers. Farmers selling local food and vegetables through Community Supported Agriculture (CSA) or at farmers markets. Farmers growing other crops not covered under Title 1. In other words, agricultural producers who use nonsubsidized risk management options to stay afloat, not to mention any other industry that fails to have two Committees named after them (manufacturing, tech, you get the idea). Yes, the federal crop insurance program covers a wider range of crop production than does Title 1, but most subsidies again benefit the same commodity crops year after year.

Today’s hearing reflected this reality. The committee invited testimony from eight representatives lobbying on behalf of specific crop growers. While farming and ranching businesses are forecast to experience $114 billion in net income in 2022 (income after expenses), the commodity group lobbyists marched in with talking points about higher input prices and weather challenges. Calls for more ad hoc disaster aid, higher government-set reference prices, more expensive shallow loss subsidies, and other asks ensued. When asked how the next farm bill should adjust the PLC and ARC programs, in which federal checks are sent when commodities fall short of a government set target price (PLC) or revenue target (ARC), the lobbyists repeatedly urged “focusing on margins.” Margins, the difference between the cost of inputs and final sales, is a polite way of saying the government should focus on guaranteeing profitability, regardless of economic conditions.

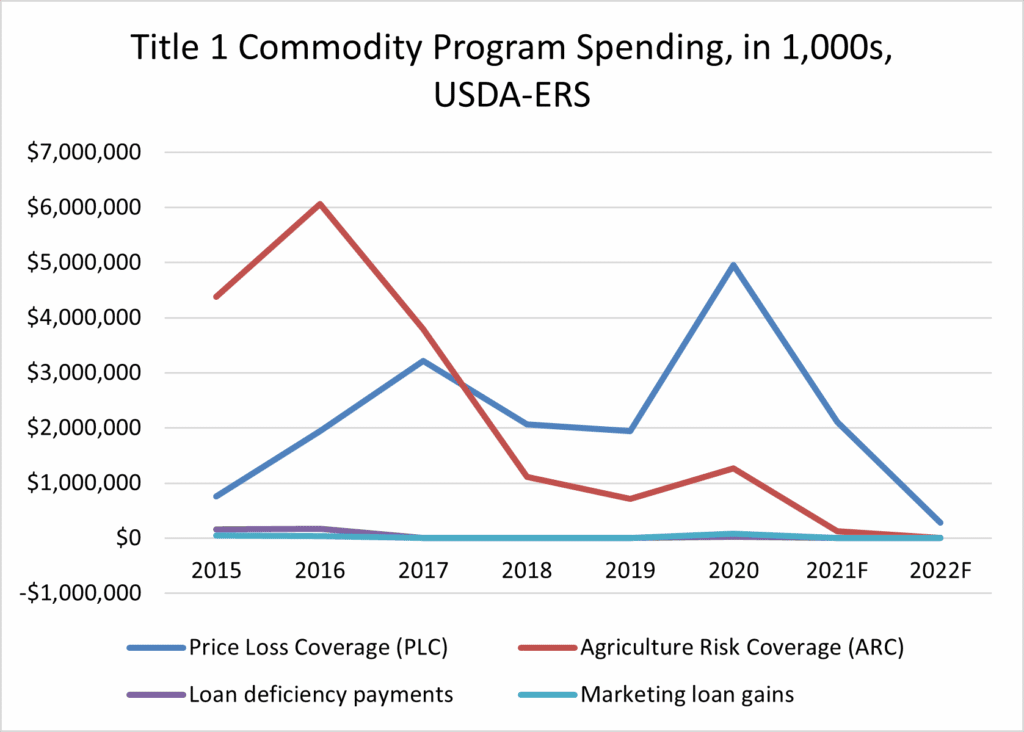

However, more status quo government subsidies will fail to promote the resilience that is desperately needed in the face of future economic and climate challenges. Government payments to agriculture reached a record in 2020 – $47 billion. While commodity supports made up a smaller share of this pie than in previous years, government subsidies have remained at high levels in recent years regardless of the state of the farm economy, crop prices, etc.

Moreover, historic subsidies for marketing loans, disaster payments, and other programs have contributed to loss of grasslands, wildlife habitat, and other sensitive land, with negative impacts on soil and water quality and efforts to reduce greenhouse gas (GHG) emissions. Other commodity supports distort markets, inflate land values, and benefit landowners who are not tied to day-to-day farming.

Taxpayers – and farmers alike – deserve a more cost-effective, equitable, accountable, and transparent farm safety net that promotes public goods instead of undermining them. A safety net should be one that only kicks in during true times of need, promoting resilience, instead of dependence on federal subsidies. Continuing special interest subsidies – or worse yet, expanding Title 1 and ad hoc disaster aid – will only increase commodity growers’ dependence on the federal government. The Agriculture Committees should eliminate wasteful subsidies that no longer serve a public purpose and instead invest in programs that promote opportunity and innovation for all of agriculture – not just select commodities.

Get Social