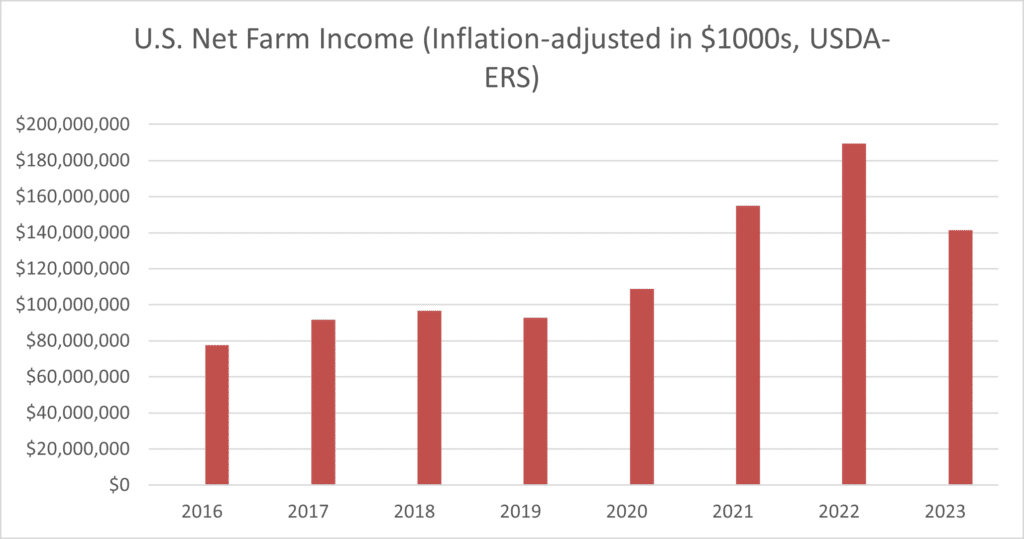

Today, the U.S. Department of Agriculture’s (USDA) Economic Research Service (ERS) released new farm income and farm subsidy projections for 2023. The numbers are staggering: $12.6 billion in government payments are expected to go out Uncle Sam’s door this year, despite agriculture coming off a year of record farm income last year.

USDA-ERS reports that 2022 set a new record for the highest level of net farm income in agriculture (in inflation-adjusted dollars, since USDA recordkeeping began in 1910). While farm subsidy levels will likely decrease from a record level of $46 billion (set during the 2020 COVID-19 pandemic), federal subsidies are still expected to remain at excessively high levels. Certain federal farm subsidies flow to individuals who do not need such high levels of U.S. taxpayer support.

Despite farm lobbyist talking points – including high input costs and low profitability in U.S. agriculture – new USDA-ERS data paints a much different picture:

- 2023 net farm income: USDA-ERS projects net farm income, for the U.S. agriculture sector as a whole, to reach $141.3 billion this year. If realized, it would be the 5th highest level of income U.S. agriculture has experienced in the past half century (in real, inflation-adjusted dollars).

- 2022 net farm income: USDA-ERS reports that net farm income reached a record level of $183 billion last year, shattering previous records.

- Crop revenues made up for increased input costs: From 2021 to 2022, the cost of fertilizer and other crop inputs indeed increased the same time period. While higher input costs presented challenges for many farmers, crop cash receipts increased by $21.4 billion from 2021 to 2022, meaning most farmers still remained profitable in 2022.

- 2023 government payments: USDA-ERS projects the $12.6 billion in government payments to agriculture will be comprised of the following in 2023…

- Conservation: $3.9 billion in conservation payments for producers to implement various soil and water conservation practices, among others.

- Other supplemental and ad hoc disaster assistance: $7.4 billion in ad hoc disaster aid and other payments, coming off last year’s level of $11.3 billion. Some of these disaster payments are in addition to other farm safety net program payments, and at times are duplicative, wasting taxpayer dollars.

- Farm commodity payments: Notably, subsidies in the farm bill commodity title – such as Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC) – are only expected to cost taxpayers $42.6 million in 2023. The Congressional Budget Office (CBO) expects these payments to cost taxpayers an average of $5 billion annually over the next ten years (FY24-33), even without Congress increasing subsidy levels in the next farm bill.

- Crop insurance subsidies: Please note that USDA-ERS government payment data does not include an additional $11.5 billion in crop insurance premium subsidies that benefited producers in 2023, according to USDA’s Risk Management Agency (RMA). CBO estimated that the federal crop insurance program overall would cost taxpayers a record $16.3 billion in FY23 due to drought, other disaster-related losses, and more.

Farm lobbyists have recently called for higher levels of farm subsidies to be provided to certain crop producers in the next farm bill. Proposals to increase government-set reference prices, ad hoc disaster aid, and taxpayer subsidies within the already highly subsidized federal crop insurance program are just a few of the ideas being presented to U.S. House and Senate Agriculture Committees. Instead of increasing farm subsidy handouts and government intervention into an already highly profitable sector, independent analysts have suggested ways to scale subsidies back, save taxpayer dollars, and minimize market distortions.

Such common sense reforms, including those from the Government Accountability Office (GAO), would ensure federal programs are working as intended and not spurring unintended consequences, such as farm consolidation and increased barriers for beginning farmers. Common sense reforms to cap currently unlimited federal crop insurance premium subsidies, for instance, or rein in subsidies to millionaires and billionaires, would only affect a small percentage of program participants and would not impact the program’s actuarial soundness. In fact, certain reforms could actually improve program integrity while promoting fiscal responsibility and better resilience for producers.