Introduced as part of the Tax Cuts and Jobs Act of 2017 (TCJA), Section 199A offers a 20% deduction on qualified business income for pass-through entities, such as sole proprietorships, partnerships, and S-corporations. A pass-through business is an entity where profits or losses are “passed through” directly to the owners, who report them on their personal tax returns, bypassing taxation at the business level.

The expiration of TCJA provisions in 2025 presents a good opportunity to evaluate their impact and consider whether they should continue as part of U.S. tax policy. Section 199A was meant to create a level playing field between pass-through businesses and corporations. The TCJA also significantly reduced the corporate tax rate from a graduated structure with a top rate of 35% to a flat rate of 21%.

Proponents of Section 199A argue that it has been a boon for small businesses, allowing them to reinvest in their operations, hire more workers, and purchase more capital assets. The National Association of Manufacturers reports that 93% of pass-through manufacturers say “losing the pass-through deduction will cost jobs, growth and investment.”

Mixed Results

Even so, a National Bureau of Economic Research paper titled, “How Do Business Owners Respond to a Tax Cut? Examining the 199A Deduction for Pass-Through Firms,” finds the 199A deduction has had minimal impact. The research shows little change in real economic activities such as investment, wages, or employment. In short, the deduction did not lead to substantial behavioral changes or significant increases in business activity.

Internal Revenue Service data on the Section 199A deduction show that while it does provide significant tax relief to pass-through business owners, the benefits have disproportionately favored higher-income taxpayers, with 39% of the deduction in 2020 going to taxpayers with incomes of more than $1 million.

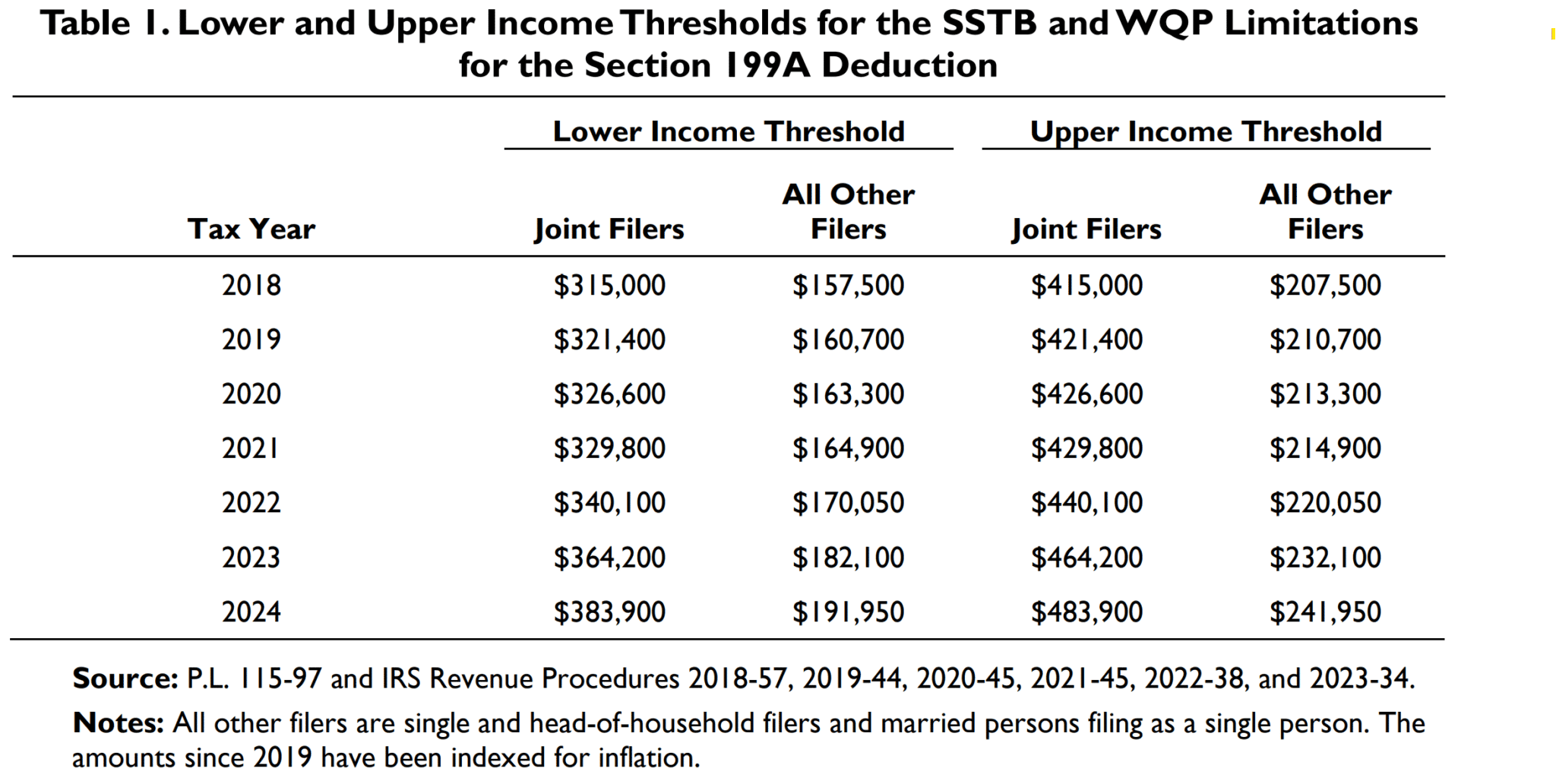

One of the weaknesses of 199A is its complexity, which has made it costly and burdensome for small business owners, who need professional assistance to utilize the deduction. 199A has intricate eligibility requirements and limitations, such as the Specified Service Trade or Business (SSTB) limit, which disqualifies certain service-based businesses from the deduction if their income exceeds specified thresholds, and the Wage and Capital Asset (WCA) limit, which restricts the deduction based on the wages paid and the basis of qualified property. Its complexity creates opportunities for tax avoidance, where similar businesses face different tax liabilities based entirely on their ability to navigate the rules.

Meanwhile, the financial implications of extending Section 199A are significant. The Joint Committee on Taxation estimates Section 199A deduction will cost $415 billion from FY2018 to FY2027. If extended permanently, the cost is projected to be $684 billion from FY2025 to FY2034. The Congressional Budget Office (CBO) estimates that extending all the expiring provisions in TCJA, including individual tax cuts, would add approximately $4.6 trillion to the federal debt over the next decade.

Some suggested reforms of 199A include tying it more directly to job creation by designing tax incentives that are contingent on measurable economic outcomes. Another alternative is to implement a more uniform tax rate for all pass-through businesses and privately held corporations to treat all business income more consistently, regardless of the entity’s structure.

Get Social