The world’s four largest publicly traded oil and gas companies, ExxonMobil, Chevron, Shell, and Total SE reported their second quarter earnings this week. Thanks to soaring oil and gas prices, these companies are reporting some of the best quarterly results in the companies’ history. In total, these four companies reported $46.6 billion in profits this quarter, 200 percent more than what they brought in over the same period last year.

ExxonMobil reported $17.9 billion in profits, compared to $4.7 billion reported for the same period in 2021. With a strong free cash flow of $16.9 billion, the company distributed $7.6 billion to shareholders this quarter through dividends and share buybacks.

Chevron reported record profits of $11.6 billion, compared to $3.1 billion reported in Q2 2021. High oil and gas prices resulted in strong cash flow, $5.3 billion of which was distributed to investors through dividends and share repurchases just this quarter.

Shell (formerly Royal Dutch Shell, P.L.C.) brought in $11.5 billion in profits, more than doubling the $5.5 billion reported over the same period last year.

TotalEnergies SE reported quarterly earnings of $5.7 billion, compared to $2.2 billion in Q2 2021. The company recently increased its dividends by 5% year-over-year and authorized to continue share buybacks of up to $2 billion in the third quarter.

Net Income (Loss) Attributable to the Company ($, billions), Q2 2022 vs. Q1 2021

| $, Billions | Q2 2022 | Q2 2021 | Change (%) |

| ExxonMobil Corp. | 17.9 | 4.7 | 281% |

| Chevron Corp. | 11.6 | 3.1 | 277% |

| Shell p.l.c. | 11.5 | 5.5 | 107% |

| TotalEnergies SE | 5.7 | 2.2 | 159% |

| Total | 46.6 | 15.5 | 200% |

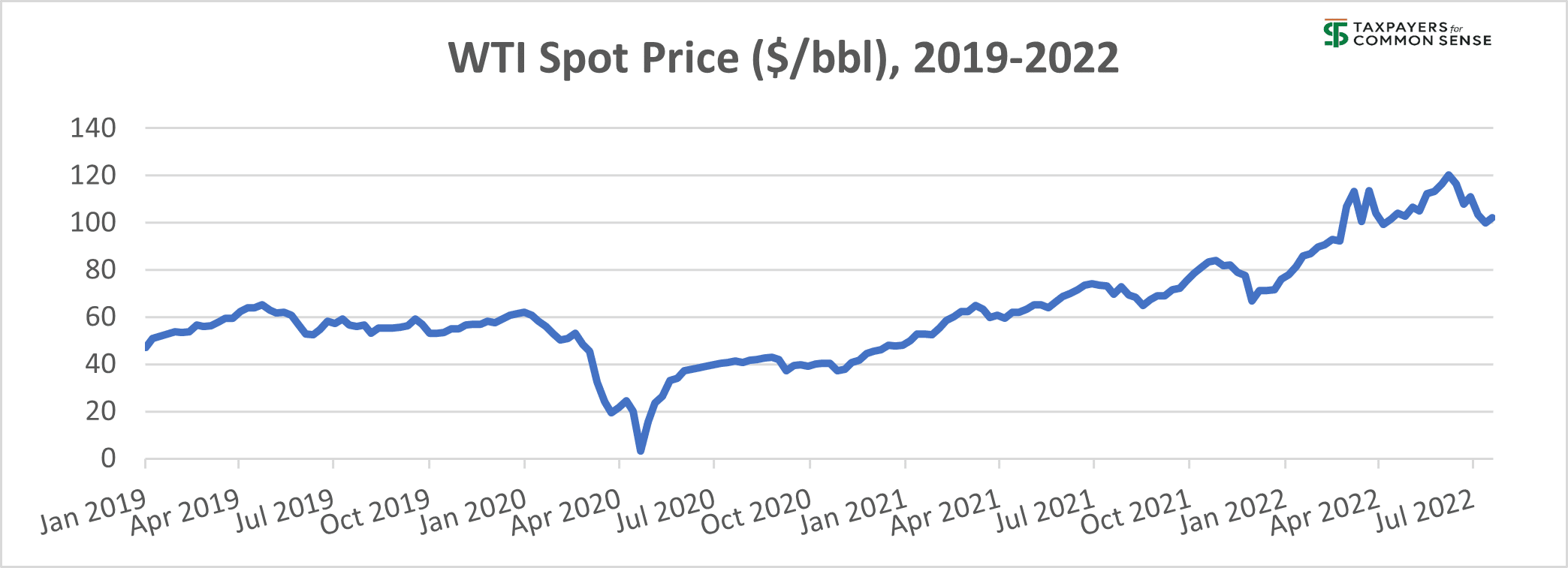

After a slight dip in Q4 2021, due to demand uncertainties caused by the Omicron variant, oil and gas prices continued to soar in 2022 due to heightened uncertainty from various factors, the biggest one being the war in Ukraine. The West Texas Intermediate (WTI) oil spot price did start to come back down in July and the Energy Information Administration (EIA) anticipates prices to average $104 per barrel (bbl) in 2022 and $95/barrel in 2023.

Source: EIA Spot Prices, https://www.eia.gov/dnav/pet/pet_pri_spt_s1_w.htm

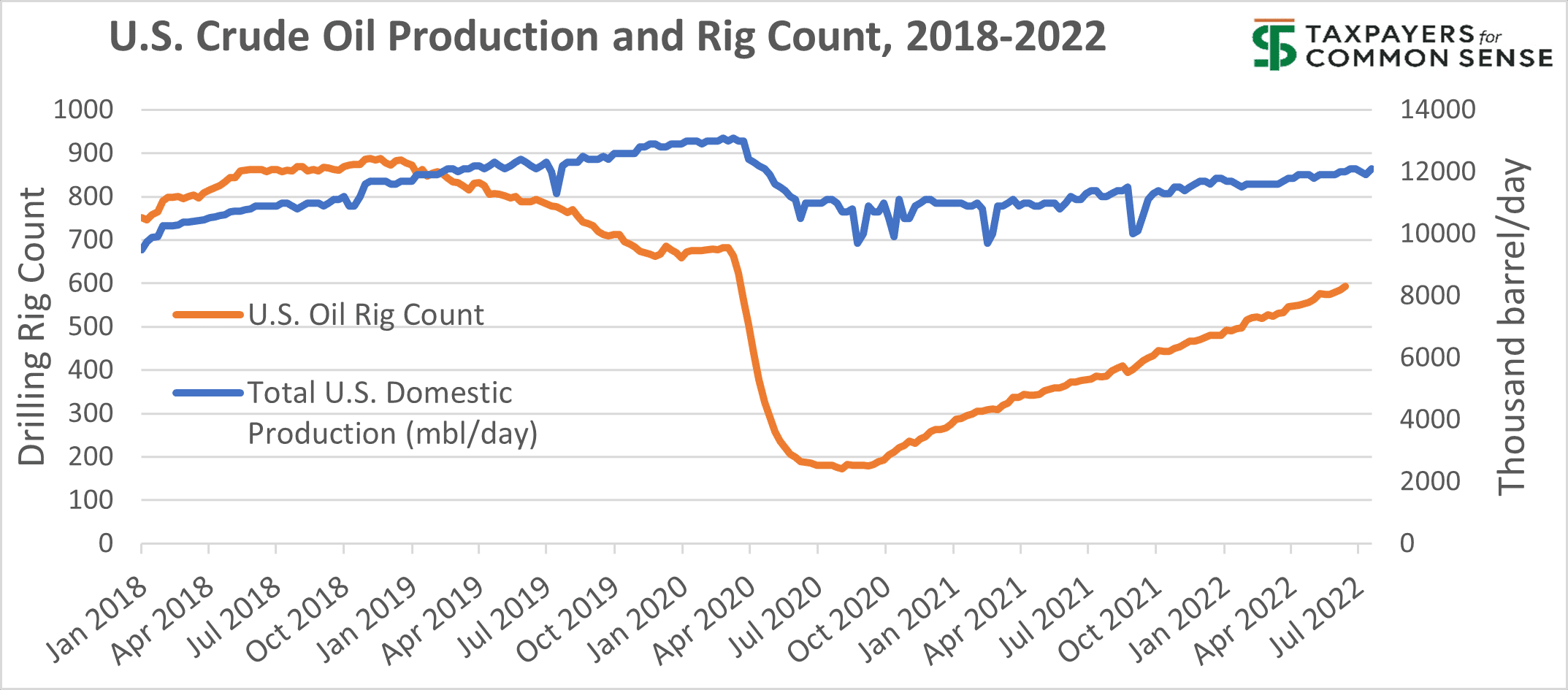

U.S. crude oil production and rig count has also been climbing consistently. The EIA forecasts that U.S. crude oil production will average around 11.9 million barrels per day (mb/d) in 2022 and 12.8 mb/d in 2023, which would set a record for most U.S. crude oil production in a year. In fact, from 2020 to 2021 oil production on federal land rose by 18% and reached its highest production level of all time. Gas production increased slightly by 0.66%. Oil and gas companies are exploiting concerns about gas prices and energy security and spreading false claims about gas prices and production. While the oil and gas industry is calling on the administration to “unleash” oil and gas development, production is already near record high and oil and gas execs have publicly pledged to restrain production growth and prioritize returns for investors. Meanwhile, oil and gas companies are spending millions of dollars on well-connected lobbyists so they can get more and easier access to federal lands with less oversight. According to lobby disclosure reports, many oil and gas companies have been taking advantage of the war in Ukraine and have lobbied Congress and the Administration specifically for “continued crude oil and LNG exports and U.S. global energy security in the wake of invasion on Ukraine” and against “potential restrictions on U.S. crude oil and/or LNG exports.”

Source: EIA Weekly Petroleum Status Report, https://www.eia.gov/petroleum/supply/weekly/

Baker Hughes – North America Rig Count, https://rigcount.bakerhughes.com/na-rig-count

Despite raking in billions of dollars and setting record profits each quarter, oil and gas companies pocket $3.2 billion in tax breaks and $3.6 billion in sweetheart leasing terms every year. There is no reason to continue subsidizing a highly mature and profitable industry. Companies are choosing to limit production and keep oil prices high so they can return more capital to their shareholders, all while seeking for more money from taxpayers. It’s time to reverse course and end unnecessary tax breaks, reform the federal leasing system, and hold the oil and gas industry accountable. Stay tuned while we roll out more analysis as more oil and gas companies release their earnings results in the next few weeks.