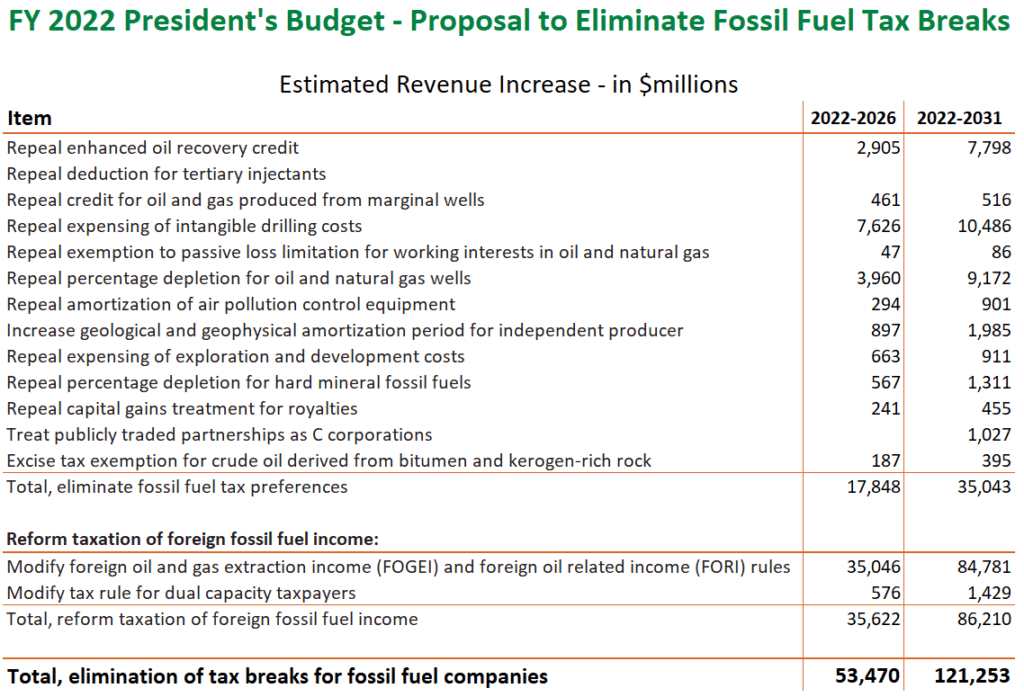

As expected, the President’s FY2022 budget includes proposals to eliminate tax breaks for fossil fuel companies, some of which have been on the books for a century. This matches similar efforts in budget requests during the Obama Administration. The U.S. Treasury projects that cutting the tax subsidies for domestic income would increase revenue for taxpayers by $35 billion over 10 years. Nearly a third of that savings ($10.5 billion) would come from cutting the intangible drilling costs deduction for oil and gas producers. The next biggest savings comes from the proposed repeal of the enhanced oil recovery credit, at $7.8 billion over 10 years. See all proposed cuts in the table below:

The budget goes further by also proposing to cut tax breaks that fossil fuel companies use to avoid taxes on their foreign income. By modifying rules for dual capacity taxpayers and other accounting rules, the cuts would save an additional $86.2 billion over 10 years. In total then, the proposal to eliminate all fossil fuel tax breaks would generate a whopping $121 billion by FY 2031.

That total is lower than it might have been, however. Conspicuously absent from the proposed fossil fuel tax break cuts is any change to the Last-In First-Out (LIFO) inventory accounting rules. Oil and gas companies use LIFO to increase their book costs and thus reduce the total amount of income that gets taxed. The JCT last estimated that LIFO costs taxpayers $4.8 billion over five years. When President Obama last proposed cutting LIFO in the FY2017 president’s budget, the Treasury Department estimated it would recoup $81 billion in revenue over 10 years, though at that time the corporate tax rate was higher, making the break more valuable.