View/Download this article in PDF format.

Preface

The abundant renewable energy resources of the public lands will play an important part in a transition to a more secure and sustainable energy future. The Wilderness Society (TWS) and Taxpayers for Common Sense (TCS) share a common interest in ensuring that a policy framework for wind and solar development is put in place now that strikes an optimal balance between needed development and sound stewardship of Americans’ natural and fiscal resources.

A critical component of this balance is clearly establishing a sound mechanism to determine the right price companies will pay for the commercial production of electricity from wind and solar resources on the public lands. This is especially important at a time when the commercial viability of many of these projects is tenuous. A policy that is too lenient could shortchange taxpayers and have the effect of inducing development on public lands rather than on comparable private lands, where landowners could directly benefit from a stable revenue source. A policy that is too stringent could have the effect of forestalling development at a time when a shift to renewable energy is vital.

Accordingly, TWS and TCS jointly commissioned a whitepaper to investigate what public land laws and regulations say about “fair market value” (FMV) and “fair return” in the context of other federal resource programs and current federal wind and solar programs on lands managed by the Bureau of Land Management (BLM), and how the revenues from wind and solar development might be used. The whitepaper addresses how revenues are collected and used in the federal programs for the development of onshore and offshore oil and gas, coal, offshore renewables, grazing, hydropower, geothermal, and onshore wind and solar. Other essential facets of a robust policy framework for wind and solar development are not addressed in this paper, such as siting criteria, best management practices, and mitigation requirements. The whitepaper is summarized herein and is available online via the sponsoring organizations’ websites.

The analysis is intended to shed light on how the Department of the Interior and the Congress should ensure that the public lands and resources are fairly and fully valued in pursuit of the needed new renewable energy that is the keystone of the clean energy priorities of the Administration and Congress.

Report Sections:

Executive Summary (jump to)

Introduction (jump to)

Do We Get a Fair Return for Our Public Lands (jump to)

Wind and Solar Development (jump to)

Wind Energy Development (jump to)

Solar Energy Development (jump to)

Fair Return for Taxpayers for Wind and Solar Development Must be Established (jump to)

Recommendations: Actions Needed to Establish Wind and Solar Programs (jump to)

Conclusions (jump to)

About the Sponsoring Organizations

The Wilderness Society (TWS) is committed to the preservation of our nation’s wild lands as thriving ecological communities. The organization’s mission is to protect wilderness and inspire Americans to care for wild places. TWS supports sustainable energy policies that protect and conserve the health and integrity of wild places from irresponsible energy development.

Taxpayers for Common Sense (TCS) is a nonpartisan budget watchdog serving as an independent voice for American taxpayers. Its mission is to achieve a government that spends taxpayer dollars responsibly and operates within its means. TCS works with individuals, policymakers, and the media to increase transparency, expose and eliminate wasteful and corrupt subsidies, earmarks, and corporate welfare, and hold decision makers accountable.

Executive Summary

Our public lands will play an important role in the transition to a clean energy future. However, the Department of the Interior currently does not have the tools it needs to properly administer programs for the development of wind and solar resources on public lands. This research shows that the existing programs for wind and solar energy development do not ensure taxpayers are receiving the fair market value for public lands. This brief compares the Bureau of Land Management’s current system for wind and solar development to the programs of other energy development and extraction on federal lands, including oil and gas, coal, hydropower, and geothermal energy.

It finds that all other commercial energy programs analyzed have more robust elements to ensure taxpayers are receiving a fair return than the programs for wind and solar projects. For example, other programs are: authorized in statute, permitted with a leasing rather than a right-of-way system (except hydropower), provide for competitive leasing, and include royalty authority (except hydropower). And most programs require that a portion of revenues be devoted to offsetting environmental impacts.

The administration of wind and solar energy projects on public lands as it stands today almost certainly fails to ensure taxpayers receive a fair market value for these public resources. In order to address the deficiencies in the current program so that the public is getting a fair return for its land and resources, Congress, working with the Administration, should create—in statute—a wind and solar development program that includes features of the development programs surveyed here, including:

- Offering wind and solar development rights in suitable areas as leases.

- Offering prime areas for competitive leasing.

- Charging royalties to collect a fair return from commercial generation.

- Encouraging prompt development and maximizing returns through specific leasing provisions.

- Establishing robust verification mechanisms.

- Reinvesting revenues in improved system design and conservation activities to ensure long-term project sustainability.

These recommendations will help guarantee that revenues from the development of the public’s energy and land resources can be collected accurately and diligently, and that fair market value is received.

Introduction

The nation is on the verge of a clean energy revolution. The federal, state, and private sectors are working to increase the proportion of renewable energy in our national portfolio. The Department of Interior (DOI) has received hundreds of applications to construct wind and solar projects on federal land. In the Energy Policy Act of 2005, Congress set a goal of developing 10,000 megawatts (MW) of non-hydropower renewable energy on public lands by 2015. DOI has established a performance target of 9,000 MW of renewable energy to be under permit by the end of 2011.

But while the nation has much experience with development of traditional fossil fuels, renewable energy resources are a new opportunity—and challenge. Most of the federal policies that will govern how these public resources are developed are only now being written. Although commercial wind and solar development will not extract a resource from the federal lands in the same sense that removing a mineral does, it will use resources such as advantageous location, terrain, and prime wind and solar resources. Securing a fair return for the public from the commercial development of electricity from wind and solar resources is a vital concern, especially in these times of fiscal constraints. Development will impact other values of the federal lands at a time when the lands have been demonstrated to play an increasingly significant role in the economies of surrounding communities, and dedicating a fair portion of the revenues from development to the restoration and protection of the federal lands also is a legitimate concern.

.jpg)

Our energy policy is at a crossroads. There are new economic and environmental realities that must be incorporated as we chart our energy future. The whitepaper summarized herein reviews the current laws and regulations of several federal resource development programs—such as oil and gas development, hydropower, and grazing—and highlights the anachronistic nature of many of the laws on the books. It looks at the statutory language and implementing regulations governing these current federal programs that are germane to designing a fiscally sound system for developing wind and solar resources on public land. This analysis provides some important insights for such development, based on the success and failures of these existing programs at encouraging development in a manner that captures a fair return to taxpayers.

Fiscal concerns combined with the important roles the scenic, wildlife, and recreational attributes of the federal lands play in the economies of surrounding communities indicate both that revenues should be collected accurately and diligently from resource development on public lands—including renewable resources—and that a significant share of the revenues realized from wind and solar development programs should be dedicated to mitigating impacts of commercial development, and to restoring and maintaining the health and values of the remaining federal lands.

Do We Get a Fair Return for Our Public Lands?

The concept of establishing and receiving a fair return for private development of public lands is not new. Many of the existing statutes and regulations that govern the use of public lands expressly require that the government receive “fair market value” (FMV) or a “fair return” for the use or development. For example, the Federal Land Policy and Management Act (FLPMA), which governs the use of the extensive lands managed by the Bureau of Land Management (BLM), states that the United States is to receive FMV for the use of the public lands and resources unless otherwise provided by statute.

Fair market value is basically the amount for which a parcel of land would be sold by a willing and knowledgeable seller to a willing and knowledgeable buyer. On an open market, and for land to be used as input for a mature industry, the value of a parcel of land can be estimated by referring to comparable sales or prior transactions of the identical property. If a market or an industry is in its infancy, however, government auditors suggest estimating future income stream resulting from use of the land. The value of a property includes unique attributes of the land as inputs for commercial use. However, valuing the non-commercial values of lands presents difficulties.

Typically, the government collects payments from the individuals or corporations developing the land to cover administrative costs of leasing, to pay back taxpayers for loss of other uses of the land, and to share profits with taxpayers and with states in recognition of the tax-free status of the federal lands. In some cases, it may use the payments to fund other programs that benefit the federal lands, such as the Land and Water Conservation Fund. Payments to the government may take the form of application fees, processing or other service fees, or up-front cash bonus bids. In addition, the government has also traditionally imposed charges per unit of commodity produced, a royalty, to divide gross revenues between taxpayers and the person or corporation exploiting the lands or resources.

These charges vary depending on different factors, such as whether phase-in periods for payments are needed to allow private development to mature, or whether and how other “costs” are to be taken into account. And though Congress may have intended to capture a fair return to taxpayers in statute, many implementing regulations have failed to follow through on the original intent of the law. For example, royalties have usually been worded as a statutory minimum (“not less than X percent”) clearly intended to allow for upward adjustments. However, the implementing regulations and practices applicable to royalties in a number of energy sectors have rarely set higher amounts, and even have turned statutory minimums into maximums.

Express authorizations and vague statutory language have also provided agencies discretion to reduce or waive fees or royalties. General statutory language exhorting the implementing agency to “encourage production,” to “conserve the resource,” or “avoid waste,” is cited as providing the underlying authority to lower or waive returns. At times the delegation of authority was so broad and so vague as to allow anachronistic or lopsided approaches and regulations to be instituted and continued. These reductions and eliminations have often been investigated and debated, and the United States Government Accountability Office (GAO) has issued numerous reports describing how agency fee and royalty collections fall short of recouping fair market value.

On the other hand, consideration of benefits to the public from disposals of federal lands typically results in reduced prices and hence returns to the government. Clearly there is a tension between the need to maximize economic returns for public lands and resources, and more qualitative considerations of the “public interest.” However, it is fair to question the nature, extent, and necessity of initiating and perpetuating reductions or waivers of fees or royalties, as some rationales may no longer be valid. For example, the reasons for the low fees and absence of royalties in the 1872 Mining Law—populating the West and developing a fledgling nation’s mineral resources—have obviously passed, such that the situation can now be characterized as sacrificing the resources of the public in favor of one private commercial sector.

Many earlier resource development laws included provisions suitable to a particular point in time, but lacked sunset provisions or links to outside factors that would shift the initial generous provisions appropriate to one point in time to others more suitable for longer-term development and fair returns. And once on the books, these laws have proven difficult to amend and modernize. Future policymakers and practitioners should consider these issues when faced with the task of designing new resource development programs that will ensure the public is fully compensated for the private development of public resources.

Wind and Solar Development

Congress and recent presidential administrations have recognized the potential for renewable energy production on public lands. The Energy Policy Act of 2005 encouraged the development of renewable energy sources and established a goal of 10,000 MW of new renewable energy projects on the public lands by 2015 from sources other than hydropower. In March 2009, less than two months after the Obama Administration took office, Interior Secretary Ken Salazar issued Secretarial Order 3285, which formally established renewable energy development as a priority for DOI. The American Recovery and Reinvestment Act of 2009 (stimulus bill) provided funds for the rapid deployment of renewable energy projects, and BLM is fast-tracking applications for wind and solar development on prime sites.

As mentioned above, FLPMA requires the government to receive fair market value for the use of federal lands and their resources unless otherwise provided by statute. This standard is also found in statutes governing some of the more traditional energy development programs. Many existing energy programs, including oil and gas development, rely on competitively-offered leases to determine FMV whenever a competitive interest in a parcel of land exists. However, in part because the BLM has implemented wind and solar programs based on ROWs that are not traditionally offered via competitive bidding, the agencies are processing applications on a “first come, first served” basis, raising questions about the ability of the agencies to ensure a fair return.

Additionally, express statutory authority does not exist for the agencies to charge a royalty as a means to ensure a fair return by sharing profits reaped from commercial development of wind and solar resources on public lands. Rather, the agencies have established rental rates for the use of public lands that attempt to take into account the project developer’s ability to produce power. The conceptual difficulty of relying on a system of land “rents” to encompass the development and marketing of a commodity is awkward at best, as a ROW relates to the use of lands rather than to the commercial development of a resource from the lands.

Wind Energy Development

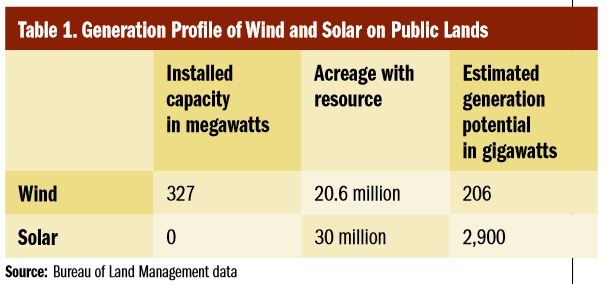

Federal lands show much promise for wind development. According to the Interior Department, “About 18 percent of Federal lands, principally in the West, have high potential for the development of wind. About 46 percent of the 261 million acres managed by the Bureau of Land Management have commercial wind energy development potential.” The development of new wind facilities has mushroomed in recent years, totaling nearly 35,000 MW in 2009. Growth surged in 2009, with more than 10,000 MW of wind capacity added, accounting for 40 percent of all new generating capacity in the U.S. Thirty-five states now have utility scale wind projects. The Department of Energy has stated that achieving 20 percent of our nation’s electricity from wind energy alone by 2030 is feasible with no new technological breakthroughs.

The BLM received $305 million from the American Recovery and Reinvestment Act to help stimulate the economy. Of this amount, a total of $41 million will be used for 65 projects to facilitate a rapid and responsible move to large-scale production of solar, wind, and geothermal energy, as well as the siting of transmission infrastructure to supplement renewable energy development. Numerous projects are being processed on a “fast track” under the agency guidance documents.

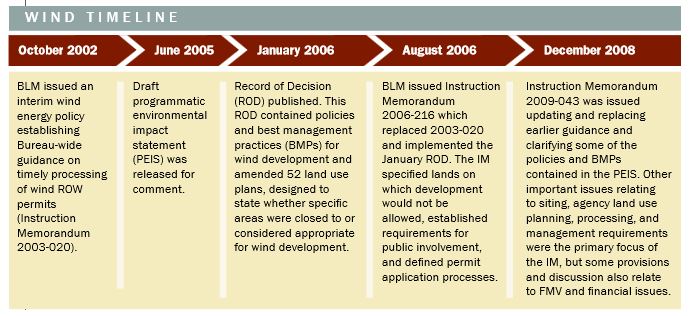

Wind development has been subject to a flurry of policies over the last five years (see inset box). The prevailing Instructional Memorandum (IM) from BLM Director Bob Abbey issued in late 2008 lays out the agency’s policy for ROW grants for wind energy projects, covering the three basic project types: 1) site-specific grants for individual meteorological towers and instrumentation facilities, with a term that is limited to three years; 2) project area grants for a larger site testing and monitoring area also with a term of three years, renewable; and 3) commercial development grants that will generally be for a term of 30 years. Analysis here will focus primarily on commercial development grants.

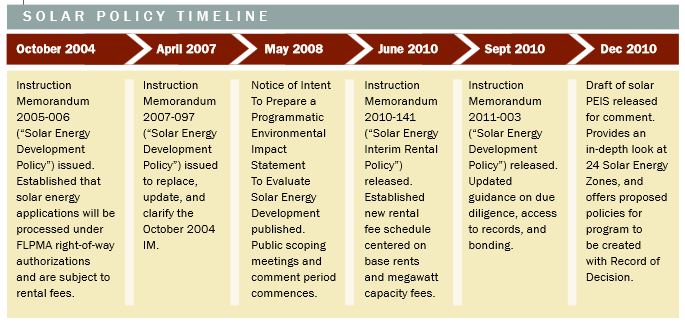

Solar energy development on the public lands is also receiving more and more attention, in both the Energy Policy Act of 2005 and Secretarial Order 3285 as mentioned in the wind section above. The stimulus bill also provided funds for the rapid processing of solar energy projects. The solar industry has grown remarkably with the annual rate of photovoltaic (PV) installations alone increasing by more than 80 percent in 2008. While no utility-scale solar facilities have been built on public lands, the first were recently permitted and projects on private lands have been proposed and built in many states, including California, Texas, Florida, Pennsylvania, and New York, totaling more than 10,000 MW currently proposed or under development.38 In recent guidance issued June 10, 2010, the Director of BLM stated that there is “significant potential for the development of solar energy on the public lands in the southwestern states. BLM is processing solar applications as it has identified some 23 million acres of public lands with utility-scale energy potential, and over 200 right of way applications have been submitted.” Nine such projects were recently approved for construction on public lands in California and Nevada.

Similar to wind energy, Congress has not established a framework for the development of solar energy on the federal lands. However, unlike wind, a solar PEIS has not been completed—a draft was released in December 2010 that evaluates solar energy development zones and proposed policies. Nonetheless, like wind energy development, BLM is processing solar projects under the ROW provisions of Title V of FLPMA and the implementing regulations. These regulations relate to linear rights of way such as transmission lines and “areal” (non-linear) rights of way for other uses of lands. ROW decisions are “full force and effect” decisions that are effective during any appeals.

Fair Return to Taxpayers from Wind and Solar Development Must be Established

The current ROW-based systems used by BLM for development of wind and solar energy projects on public land almost certainly will fail to ensure the government is receiving FMV for the development of these public resources. This concern is based on the following:

- FMV not expressly required: Despite the repeated references in FLPMA to obtaining FMV, neither the policies set out in the wind development PEIS, nor the policy guidance in IMs for both wind and solar contain goals or requirements for FMV or other financial returns. Many authorizations have already been processed.

- Competitive leasing not required: IM 2009-043 and IM 2007-097 for wind and solar, respectively, provide that areas specifically identified for “competitive leasing” in land use plans will be offered competitively, but it is unknown how many wind or solar sites will be so developed. The wind PEIS set out information on the location of high potential lands, and the ROD that followed the PEIS amended many land use plans to declare certain areas appropriate for wind development. But neither document specified under what procedures development would occur nor declared any suitable for further study for possible competitive bidding procedures. None of the subsequent BLM guidance materials mention using wind class ratings of the federal lands as the basis for a determination to preliminarily open specific areas to competitive bidding (depending on subsequent environmental studies). Similarly, although prime solar sites have been identified, the solar development guidance to date establishes that competitive bidding will only be utilized if the relevant land use plan has specifically identified an area for competitive leasing, and that the BLM may also consider other public interest and technical factors in determining whether to offer lands for competitive leasing. The agency guidance that authorized noncompetitive development could just as well have authorized competitive bidding for prime sites that are found to meet all screening criteria. And BLM’s statement that competitors will be encouraged to share sites seems unrealistic. Based on publicly-available information, “first come-first served” is likely to be the rule even where a competitive interest exists.

- Rate of return too low: The rent formula used for wind and solar energy uses a “federal rate of return” that is keyed to the 10-year average of 30-year and 20-year Treasury bond interest rates respectively. This appears to be an attempt to charge a fee analogous to a royalty, but it is low compared to royalty rates paid by other industries. The justification for the rate of return is that the Treasury bond rate is an example of a rate of return for a long-term investment. However, the federal bond rate is a rate paid by the federal government to borrow money, rather than a rate received by the federal government for the development of a public resource. More analogous rates would be royalty rates received by the government for the commercial development of other resources on the federal lands to ensure appropriate profit sharing for taxpayers.

Recommendations:

Actions Needed to Establish Sound Wind and Solar Programs

Securing a fair return for the public from the commercial development of federal wind and solar resources is a legitimate and vital concern, especially in these times of fiscal constraints. Analysis of the government’s efforts to collect a fair return for the use of public lands for development of other energy resources leads to some general conclusions about how to improve those programs and highlights some important features critical to developing sound federal wind and solar development programs.

Statutorily establish wind and solar development programs: Development of wind and solar energy programs is proceeding on a “fast track” without a clear framework. Prime sites are being processed without statutory requirements for commercial leasing, production royalties, competitive bidding, siting standards, or dedication of receipts to the protection of surrounding lands. Some of these elements can be achieved by administrative action alone, but a statutory basis is essential to ensure a robust program. Enacting legislation would allow elected officials to establish these important programs, would provide clear program requirements and the consistency and stability that investors need to go forward, and would also likely reduce litigation.

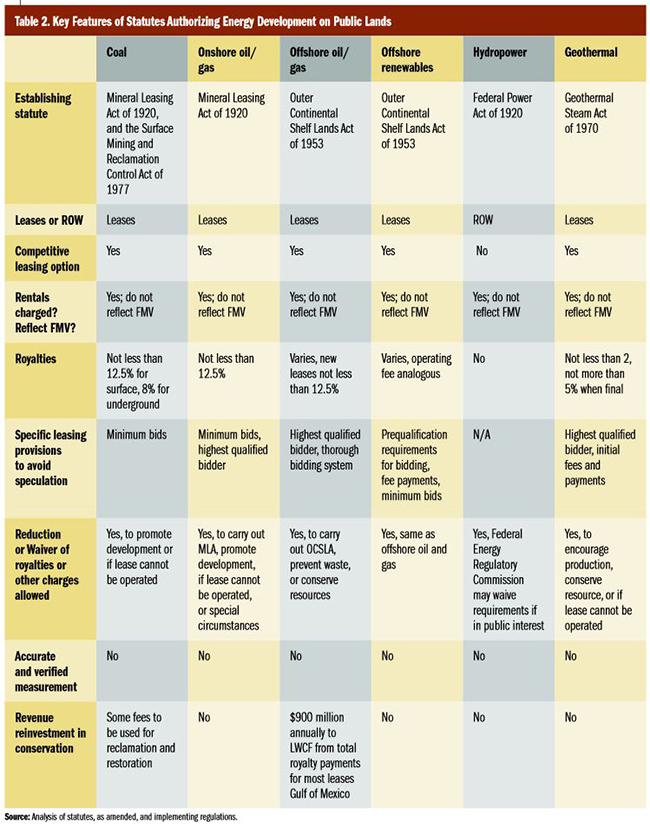

A review of current laws and regulations for several federal resource development programs such as oil and gas, hydropower, and offshore renewables reveals many precedents important to sound onshore wind and solar programs. Certain statutory provisions could impede desirable and effective wind and solar programs; others could be conducive to them. Several features of current programs are set out in Table 2.

Many of these statutes have had mixed results in returning FMV for the resources and also demonstrate that it is simpler to establish robust programs from the outset than to modify them at a later date.

Offer wind and solar development rights in suitable areas as leases: Wind and solar development is currently proceeding through issuance of ROW authorizations. Because a ROW relates to the use of lands rather than to the development of a resource on or emanating from lands, the legal instrument is a bad fit for the development of resources. The placement of facilities on, or other physical use of, federal lands is very different from the commercial development of a resource. For other energy resources, leases have proven more appropriate than ROW authorizations in collecting a fair return to taxpayers and ensuring the long-term certainty required by developers and the public alike. Moreover, ROW authorizations under FLPMA are intended for and better suited to limited uses of lands under a multiple-use framework, than to long-term, exclusive commercial resource development operations. Many of the ROW regulations are worded permissively, whereas clear requirements are preferable for development programs. In addition, using existing ROW regulations supplemented by unilateral agency IMs precludes public input on issues, including FMV.

Under the Mineral Leasing Act, coal and onshore oil and gas companies are authorized to operate on and extract resources from public lands under a leasing structure. The Outer Continental Shelf Lands Act sets up a leasing program to develop OCS resources expeditiously and in an orderly fashion, subject to environmental safeguards, and “in a manner consistent with the maintenance of competition and other national needs.” This statute, as amended by Section 388 of the Energy Policy Act of 2005, also allows leasing for offshore renewable energy resources. Finally, the Geothermal Steam Act allows for leasing of geothermal resources.

The only energy resource managed with the ROW system (besides solar and wind) is hydropower. Unfortunately, the ROW approach has caused many issues with confusing permit terms and an inadequate return to the public. The GAO found that the ROW framework used by the Federal Energy Regulatory Commission for hydropower development resulted in a return of less than two percent of the market value of the federal lands.

It is important to note that leasing programs for all of these fuel sources are complicated, and sometimes include areas off limits to leasing, the distinguishing between commercial, limited, and noncompetitive leases, and other terms that are specific to the resource. Nevertheless, it is clear that the management of these fuel sources benefits from leasing systems designed to deal with long-term, commercial operations.

Offer prime areas competitively: Offering leases competitively is a straightforward way to determine the value of federal lands and resources for commercial electricity generation. Competitive offering appropriately shifts the risk burden from taxpayers onto the economic interests who stand to profit from access to the resource in question.

All leased energy resources are offered competitively, at least in some instances. Coal leases are offered on a competitive or noncompetitive basis depending on whether an area is designated a “coal producing region,” emergency circumstances exist, or in other circumstances. Onshore oil and gas parcels are offered initially (and most frequently) on a competitive basis, and secondarily on a noncompetitive basis. Offshore oil and gas leases are offered competitively, although with complex bidding systems that can be changed at the Secretary of the Interior’s discretion. Offshore renewable leases for commercial development are also authorized to be competitively offered when competitive interest exists, although this has not yet occurred. Limited leases—those for site assessment and technology testing, for up to five years—may be issued on a competitive or noncompetitive basis. Geothermal leases are offered competitively unless no bids are received, in which case an area may be leased noncompetitively during a two-year period following the lease sale.

While competitive offering is the norm, it is important to note that many questions remain unanswered with regard to how a competitive system should function for wind and solar resources. Policymakers should carefully evaluate the impact of different auction systems on the industries before implementing a policy.

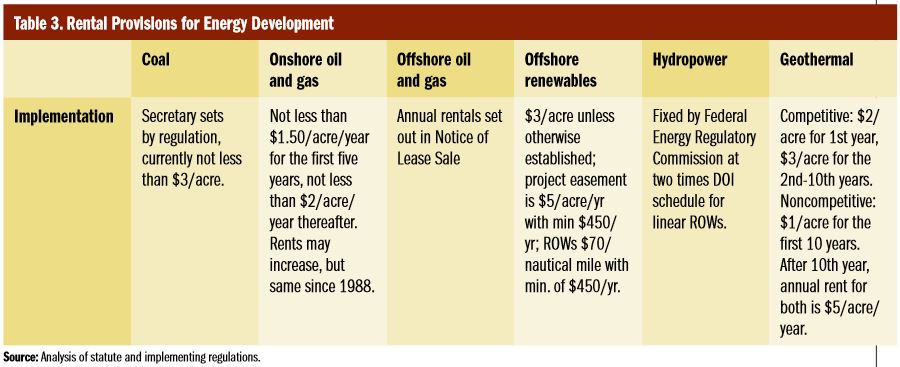

Charge rental rates comparable to those on nearby private and state lands: Because wind and solar facilities will use public lands, rents for this use should be charged. Charging rental rates that are comparable to adjacent state and private lands is integral to ensuring fair market value is returned to taxpayers for the duration of the project. Phasing in rents is appropriate, both to allow time for construction and final permitting, and because rental fees are an important component of diligence requirements to ensure development rights are acted upon in a timely manner.

Development of all energy resources on federal lands is subject to annual rents (see Table 3), but not all rental rates accurately reflect fair market value. For example, coal leases are subject to rents of not less than $3 per acre. This amount may be reduced or waived to promote development or if the Secretary of the Interior determines the lease cannot be successfully operated. Onshore oil and gas lessees are required to pay rents of not less than $1.50 per acre for the first five years of a lease and not less than $2 per acre per year for each year thereafter; a minimum royalty in lieu of rental may be applied if the royalty is not less than the rental that would otherwise apply. Because of the lessons learned from other fuel sources about the difficulties of assessing fair market value for rental rates, it is important that guidelines to ensure that rental rates are comparable to nearby nonfederal lands are established for wind and solar resource programs.

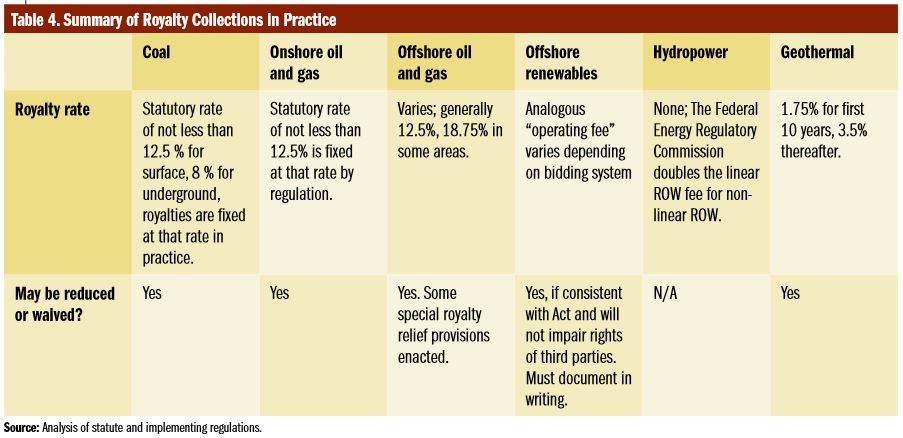

Charge royalties to collect a fair return from commercial generation: Leases should include royalties at a rate that provides a fair return to the public and encourages responsible development. In addition to a rent for the use of the land, commercial energy developers on public lands have been required to pay taxpayers a fraction of each unit of commodity produced, in cash or in kind, effectively as a profit sharing arrangement (see Table 4). This is also typically the case for energy development on private lands.

However, the current rental-based system established for wind and solar energy imprecisely attempts to charge a royalty with a rental rate that includes a “capacity factor charge.” This approach does not necessarily ensure a fair return because it is not directly linked to actual commodity production.

Although royalties are commonly used with other fuel sources, implementation has often resulted in less than a fair return. For example, statute calls for royalties on coal development of not less than 12.5 percent of the value of coal removed from a surface mine, and no less than 8 percent of the value of the coal removed from an underground mine. These rates have become fixed rates at the statutory minimum in practice. For onshore oil and gas, even though before 1988 royalties were charged on a sliding scale of up to 25 percent (depending on quantity of production), since 1988 the BLM regulations have locked in the 12.5 percent as the fixed rate, thereby again turning the statutory minimum into a regulatory maximum.

Royalties should be linked to market prices in order to: avoid the necessity for either Congress or the administering agencies to step in with corrections (that may be difficult to put in place); ensure a fair share of high profits are captured for the public; provide lessees with relief during down years, thereby avoiding most “hardship” royalty waivers that then may be difficult to undo; and assure more consistent revenues. If royalties are not linked to market prices, the government risks losing large amounts of money-in fact, the GAO found that the revenues lost during a period of royalty relief between 1996 and 2000 was between $21 and $53 billion.

Importantly, most energy sectors enjoy “ramping up” periods during which royalties are phased in. For example, in the case of geothermal power, a royalty on electricity produced is charged at 1.75 percent of gross proceeds for the first 10 years of production and 3.5 percent for subsequent years of production. The Secretary of the Interior may waive, suspend, or reduce the rental or royalty for any lease or portion of a lease. Given the national policy priority placed on clean energy deployment, a phase in period appears desirable in the case of wind and solar.

Encourage prompt development and maximize returns through specific leasing provisions: Avoiding speculation and encouraging development should be a priority for wind and solar development programs. Other fuel sources incorporate various provisions to encourage development, discourage speculation, and ensure a fair return to the public. Measures that encourage prompt development of leases include short lease terms, royalty rates linked to prompt development, and higher royalty rates in areas believed to have good resource potential. Discouraging specious or speculative market behavior has sometimes been accomplished by setting applicant qualifications, establishing minimum bids, or by the use of “reservation bids” equal to the amount the agency has concluded from agency or independent analysis is the market value of a particular tract for certain offshore drilling leases. Coal leases have minimum bids set on a regional basis that may be expressed in either dollars per acre or cents per ton, to be not less than $100 per acre. For onshore oil and gas leases a national minimum bid of $2 per acre has been established, and for both on and offshore leases the Secretary is to accept the highest bid from a “responsible qualified bidder.” And when selecting a bidding system for offshore oil and gas leases, the decision should be based on providing a fair return, increasing competition, avoiding speculation, avoiding delays, developing resources in a timely manner, and other factors. To dampen speculation for offshore renewables, prequalification requirements for bidding are required, fee payments encourage participation by serious project proponents, and the sites offered for lease will have high enough resource potential to set a high minimum bid. The agency will also assess the adequacy of high bids for a specific area in comparison to calculated reservation prices for the rights.

Geothermal leases are awarded to the highest qualified bidder, who must initially pay 20 percent of the amount bid, a processing fee, and the first year’s rental. However, there are no requirements for minimum or reservation bids. Current agency instructions for wind and solar rely on applicant qualifications and on diligent developments requirements. However, the current ROW regulations will apply, and these provide only discretionary consequences for failure to comply with the timely development requirements.

Establish robust verification mechanisms: Inspections, audits, or independent testing should be required by the managing agency to verify information crucial to the determination of appropriate charges or royalties. Many of the current regulatory programs that allow “self-reporting,” by which lessees, whether by sworn statements or not, submit this data have experienced significant underreporting. For example, GAO found that 40 percent of the geothermal royalty figures were missing for the projects it reviewed. Agencies should require the use of up-to-date measuring devices that are calibrated regularly, and maintain internal data-processing systems adequate to the task of communication and storage of production figures. The recent solar IM requires agency access to company records, but does not require that the agency request information that could verify the elements of the fee formula.

Determination of FMV for most energy resources derived from federal lands is not subject to robust measurement and verification mechanisms. Rather, it is often subject to the Secretary’s discretion and authority, sometimes supplemented by measures such as public comment on coal appraisals. Many agencies have been criticized for their lax oversight, which may have resulted in the loss of large returns to the federal government.

Reinvest revenues in improved system design and conservation activities to ensure long-term project sustainability: Because wind and solar development are novel activities for DOI, dedicating a portion of receipts to improving the permitting system is likely to improve the overall outcome with regard to both fiscal and natural resources. Funds should also be made available for transfer to state agencies involved in permitting projects on public lands to ensure a federal commitment of resources can be met with an equal commitment by state partners and avoid stranded federal investments. Additionally, in light of the reasonably foreseeable adverse impacts of development on the demonstrated economic value of the goods and services provided by public lands to the surrounding communities and the nation, a significant share of the federal revenues generated by commercial wind and solar development should be dedicated to offsetting development impacts across the landscape through restoration, and management of affected lands and resources for wildlife, ecosystem health, and recreational values.

Under many current statutes, federal receipts from resource development programs are dedicated in whole or in part to processing more development permits, or are returned to the Treasury as miscellaneous receipts. Rental revenues from onshore oil and gas are divided 50 percent to the states and 50 percent into the BLM Permit Processing Improvement Fund. Generally, onshore oil and gas revenues are divided 50 percent to states, 40 percent into the Reclamation Fund under the 1902 Act, and 10 percent to the U.S. Treasury. Offshore oil and gas and renewables revenues within three miles of shore are subject to revenue sharing, and usually 27 percent of revenues are paid to coastal states. Revenues from leases more than three miles offshore are to be deposited in the Treasury, although special regulations exist for the Gulf of Mexico. Of hydropower license revenues, 12.5 percent are paid to the Treasury, 50 percent are paid into the 1902 Reclamation Fund and 37.5 percent are paid to the state. And for geothermal energy, except in Alaska, 50 percent are paid to the state, 25 percent to the county, and 25 percent to the Treasury.

Some federal receipts are also directed to conservation to offset development impacts and for reclamation. For example, the Surface Mining Control and Reclamation Act imposes additional fees on coal mining that go to states and tribes to be used for reclamation and restoration of land and water resources adversely affected by past coal mining. Additionally, $900 million annually of offshore drilling revenues are set aside for the Land and Water Conservation Fund, subject to annual appropriation, to be spent on land acquisition programs.

Conclusions

A review of current laws and regulations for several federal resource development programs reveals many issues relevant to the development of sound wind and solar programs. The use of some provisions could impede desirable and effective programs; the use of others could be conducive to sound programs. Although commercial wind and solar development will not extract a resource from the federal lands in the same sense that removing a mineral does, the commercial development will use resources – such as advantageous terrain and prime wind and solar sources. Development will impact the values of the federal lands that have been demonstrated to play an increasingly significant role in the economies of the surrounding communities. Securing a fair return for the public from the commercial development of wind and solar resources is a legitimate concern, and, in these times of fiscal constraints, a vital one. Fiscal concerns combined with the important roles the scenic, wildlife, and recreational attributes of the federal lands play in the modern economies of surrounding communities indicate both that revenues should be collected accurately and diligently, and that a significant share of the revenues realized from wind and solar development programs should be dedicated to mitigating impacts of commercial development, and to restoring and maintaining the health of the remaining federal lands.

For more information, please contact Autumn Hanna at 202-546-8500 x112 or autumn taxpayer.net.

Get Social