The highly subsidized federal crop insurance program has quickly become the largest subsidy for agribusinesses. It is a shining example of a federal program filled with costly inefficiencies that detract from the program’s goals and produce unintended consequences. The program, which shifts costs of doing business from agribusinesses onto taxpayers, cost the government more than $14 billion in Fiscal Year 2012, and is expected to cost $9 billion annually throughout the next decade. Not only has crop insurance’s cost quadrupled and the number of crops covered more than doubled over the past ten years, but its footprint and potential for future taxpayer liabilities have grown as well. Much of this expansion has been influenced by a complicated web of outside special interests proposing new policy ideas, expansion of current policies to new areas, additional crops or new biotech technologies to be subsidized, among others. The 2014 farm bill continues this trend with special interests ramping up lobbying to secure new costly policies covering everything from catfish and cotton to peanuts and food poisonings.

**Data Download: Proposed and Approved Crop Insurance Policies 2001 to 2013**

Approval Process for New Taxpayer-Subsidized Crop Insurance Policies

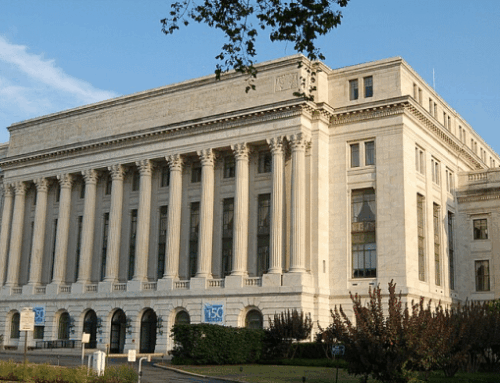

The crop insurance program is overseen by the U.S. Department of Agriculture’s Risk Management Agency (RMA) and a government-owned corporation known as the Federal Crop Insurance Corporation (FCIC). These entities administer program regulations, approve new policy applications, authorize changes to existing policies, establish premium rates, and are tasked with reducing moral hazard and waste, fraud, and abuse. The FCIC typically holds five to six meetings a year, where decisions are made about which policies graduate from the research stage and eventually to pilot or permanent programs (and thus become eligible for unlimited taxpayer subsidies).

To avoid government crowding out of existing private market insurance, Congress forbid approval of pilot programs that provide protection already “generally available from private companies.” Pilot programs can be put forward by colleges, universities, or cooperatives, but more often than not, they are offered by private insurance companies, commodity trade associations, or their consultants. The FCIC then determines whether these 3- to 4-year programs should be terminated, extended, or authorized as permanent policies, as long as a third party has been consulted. If approved, pilot program developers can also receive taxpayer subsidies to research, develop, and maintain crop insurance policies. If the submitter is a crop insurance company, it can also receive annual administrative and operating subsidies to sell and administer the new policy. If rejected due to infeasibility or excessive taxpayer risks, policy proposals are often resubmitted sometimes numerous times. In addition, Congress has a history of stepping in and requiring that a new policy is either researched or simply offered immediately; lobbying by crop-specific trade associations or individual companies influences these decisions.

Lobbying and Special Interest Influences on Crop Insurance

A growing number of agricultural lobbyists, commodity groups, and members of Congress are encouraging RMA and FCIC to expand crop insurance’s reach and ultimately, its cost to taxpayers. Much of this unfortunately takes place behind closed doors and is shielded from the public’s eye until a new policy is approved or existing policy is expanded. Crop insurance companies, agribusinesses, trade associations, and others cite “confidential business information” provisions to keep taxpayers in the dark about what new policies or program changes are being pursued. Until 2008, only a few organizations lobbied RMA/USDA and FCIC on crop insurance issues, but this number has grown to over 20 today. In the debate over the Agricultural Act of 2014, lobbying expenditures ramped up as commodity groups sought support from the House and Senate Agriculture Committees or individual Members of Congress to expand crop insurance. A few examples of these influences are listed below:

Congressional Influence

Several instances of Congress intervening into the FCIC’s new policy approval process have been documented, particularly during the most recent farm bill negotiations in 2012 and 2013. The FCIC Board of Directors has voted to reject several new policy requests since they were deemed too risky or infeasible, based on feedback from independent reviewers; examples include taxpayer subsidized insurance for cucumbers, raspberries, blackberries, squash, and premium discounts for “experienced” agricultural producers, among others.

However, there are instances where new policies have been approved years after they were rejected by the FCIC Board or where Congress, through the farm bill, dictates the research and development of new crop insurance policies for specific crops or practices. Examples include:

- Development of alfalfa crop insurance was declared “as one of the highest research and development priorities” in the 2014 farm bill through an amendment offered by Sen. Moran (R-KS). According to his press release, “The Risk Management Agency (RMA) is supportive of alfalfa insurance but is currently prohibited from working on research and development without this amendment.

- Taxpayer subsidized business disruption and catastrophic loss insurance policies for poultry were added to the farm bill despite a 2013 RMA report stating that insurance for poultry is infeasible. Backed by the National Chicken Council, National Turkey Federation, and North Carolina Poultry Federation, members such as Reps. McIntyre (D-NC) and Kissell (D-NC) and Sens. Coons (D-DE) and Chambliss (R-GA) offered successful farm bill amendments to secure research and development of these new policies.

- A new catfish profit margin insurance policy was inserted into the new farm bill despite a similar adverse ruling from the most recent RMA report on new crop insurance policies; this new policy is supported by Senate Agriculture Committee Ranking Member Cochran (R-MS) since Mississippi produces over half of the nation’s catfish.

- Livestock Risk Protection (LRP) policies for swine and lamb were rejected in 2003 and 2005, respectively, due to noncompliance only to be approved a few years later. One of the lamb policy developers, then-president of the American Sheep Industry Association Burdell Johnson, worked with then-Senate Agriculture Committee Chairman Harkin (D-IA) to get the new policy approved. After approval the American Sheep Industry Association created a fully-owned insurance agency subsidiary, ASI Food and Fiber Risk Managers LLC, that is getting paid taxpayer subsidies to sell the new policy. Requirement for a study on creation of a new taxpayer subsidized policy for catastrophic swine disease insurance was inserted into the 2014 farm bill with the backing of the National Pork Producers Council and Sens. Klobuchar (D-MN) and Grassley (R-IA).

- Crop insurance for pennycress, a weed being tested for use in biodiesel production, was added to the 2014 farm bill via an amendment to the House farm bill by Rep. Schock (R-IL). In 2009, Schock met with USDA officials to devise short- and long-term plans to obtain insurance coverage for pennycress. He also secured a $500,000 earmark in FY10 for a Peoria “Demonstration Plant for Biodiesel Fuels from Low-Impact Crops” which uses pennycress as a feedstock in its production process.

- Crop insurance for biomass and sweet sorghum for use in biofuels production was inserted into the 2014 farm bill by Sens. Donnelly (D-IN) and Roberts (R-KS), at the request of the Kansas Grain Sorghum Producers Association and the National Sorghum Producers. This is despite a recent RMA report that deemed insurance for certain biofuels feedstocks (for woody biomass and crop residues) infeasible.

Agribusiness and Crop Insurance Industry Influence

Several policies subsidizing the planting of biotech crops (already designed to reduce risks of crop losses due to weeds, insects, or other pests) have been offered by agribusinesses such as Monsanto, Pioneer Hi-Bred/DuPont, Dow AgroSciences, and Syngenta. Crop insurance companies working to get these policies approved (so they can benefit from increased administrative subsidies by selling the policies) include: Western Agricultural Insurance Company, XL Reinsurance America, Stonington Insurance Company, Agro National, and John Deere Risk Protection.

- In 2012, the FCIC Board approved a specialty corn insurance policy which “allows policyholders of high amylase and blue corn types to insure their corn at a contract price” in approved states like Kansas. High amylase corn, also known as Enogen corn, was developed by Syngenta for use in corn ethanol production.

- In May 2011, the FCIC approved a specialty trait soybean policy to allow producers to receive taxpayer subsidized payouts on new types of soybeans including “large seeded food grade, small seeded food grade, low linolenic acid, low saturated fat, high protein, and all other food grades;” Monsanto developed the low linolenic variety, while other agribusinesses developed the remaining varieties.

- The FCIC also approved premium rate reductions for certain technologies such as Pioneer Hi-Bred's rootworm seed technology called Optimum AcreMax; Syngenta’s Agrisure and Pioneer/Dow AgroSciences’ Herculex insect control seed; and Monsanto’s YieldGuard herbicide resistant corn and SmartStaxTM, a combination of insecticide and herbicide biotech seed.

Trade Association/Commodity Group Influences and Potential Conflicts of Interest

Some instances of commodity group influences in the development of new crop insurance policies or program regulations were noted above, but others include (see the Appendix for a list of 2012 lobbying expenditures and political contributions by these and other groups):

- Even though peanuts use alternative risk management strategies, a peanut revenue insurance policy was added to the 2014 farm bill at the request of the Western Peanut Growers Association (WPGA). Jimbo Grissom, president of WPGA and peanut grower from Texas, told the Senate Agriculture Committee in 2012: “A peanut revenue insurance program must be developed and made available to peanut growers… The price on which this program is based shall be the Rotterdam price index…” since another market pricing mechanism does not exist in the U.S.

- Priority for development of rice profit margin coverage was added to the 2014 farm bill at the request of the USA Rice Federation even though rice is irrigated and faces little yield risks. According to USA Rice, it pursued two new possible crop insurance products for rice growers in 2010 with the help of a “crop insurance consulting and development firm,” which would “insure a certain level of margin against potential increases in key inputs (fuel and fertilizer), reductions in price or reductions in yield.”

- A new shallow loss program for cotton (STAX), which is 80 percent subsidized by taxpayers, was developed by the National Cotton Council (NCC) and inserted into the 2014 farm bill. NCC’s Chairman Chuck Coley, when testifying before the House Agriculture Committee in 2012, called STAX “the U.S. cotton industry’s proposal” and urged the Committee to include STAX in new farm law. NCC also noted that since 2005, it has “consulted with representatives of the crop insurance industry and USDA's Risk Management Agency in the development of the program.” This program will likely run counter to international trade laws and result in future payments from U.S. taxpayers to Brazilian cotton interests.

- New shallow loss income entitlement programs in the 2013 House and Senate farm bills were based on proposals by the National Corn Growers Association (NCGA) and American Soybean Association, with some dating back to before the 2008 farm bill. The corn growers' initial shallow loss proposal became the failed Average Crop Revenue Election (ACRE) program in the 2008 farm bill. After the farm lobby realized ACRE’s shortcomings and unpopularity with farmers, it began to develop altered versions of this agribusiness revenue guarantee program. NCGA introduced a new shallow loss proposal in 2012 called the Agriculture Disaster Assistance Program (ADAP) while the soybean growers' proposal was entitled Risk Management for America’s Farmers (RMAF). These were then transformed into stand-alone pieces of legislation prior to the 2012 farm bills (which never became law), called the Aggregate Risk and Revenue Management (ARRM) program, for instance, which was introduced by Sens. Brown (D-OH), Thune (R-SD), Lugar (R-IN), and Durbin (D-IL). Ohio NCGA member and corn grower Anthony Bush said NCGA worked closely with his home-state Senator Sherrod Brown, to get the proposal introduced in Congress; he told Brownfield Ag News, “We are thrilled that they have taken some of our ideas and incorporated them into a bill that’s going to be put in front of the Super Committee.” Sens. Conrad (D-ND), Hoeven (R-ND), and Baucus (D-MT) also introduced a similar shallow loss program called the Revenue Loss Assistance Program (RLAP). These stand-alone pieces of legislation were transformed by the Agriculture Committees first into a farm bill proposal for the 2011 Super Committee and then into new 100-percent-taxpayer-subsidized shallow loss programs that passed the House (Revenue Loss Coverage – RLC) and Senate (Agriculture Risk Coverage – ARC) in 2012 and 2013, and ultimately became ARC in the final 2014 farm bill.

- Finally, a similar but somewhat separate shallow loss program that would expand crop insurance to cover profit margin losses and lock-in record income was first proposed during the 2008 farm bill debate and then again in 2011 as a stand-alone bill by Rep. Neugebauer (R-TX) (originally called the Total Coverage Option). As early as March 2012, the American Farm Bureau and the Texas Wheat Producers Association supported this policy, which would subsidize agricultural producers at an even higher level than the current crop insurance program. Under the Supplemental Coverage Option (SCO) crop insurance companies would be able to receive subsidies to sell and service the new policies; crop insurance lobbying groups such as the Crop Insurance and Reinsurance Bureau lobbied on bills that included SCO. Rep. Neugebauer also received over $150,000 in agribusiness and crop insurance political contributions during the 2012 election. After passage of the 2014 farm bill with SCO included, Rep. Neugebauer boasted, “I’m also proud that my market-based… SCO was included in the final report.”

Potential Conflicts of Interest and Oversight of Program Operations

Since by law some members of the FCIC Board must be agricultural producers themselves, potential conflicts of interest arise when they also hold senior positions within commodity groups or trade associations or receive financial benefits from the crop insurance industry. Not only are lobbyists present at FCIC Board meetings, meaning they have some type of vested interest in the outcomes of the Board’s decisions, but some Board members recuse themselves from certain crop insurance policy decisions. This begs the question as to what type of financial interests they have in policy outcomes. Some examples include:

- Curt Sindergard, former member of the FCIC Board and director of the Iowa Soybean Association, recused himself from biotech and corn technologies decisions that involved Monsanto seed.

- James Nickel, a former FCIC Board member and a member of the California Citrus Mutual Board, recused himself from voting on a new olive crop insurance policy.

A 2005 USDA Office of Inspector General (OIG) “audit [also] disclosed several weaknesses in the review of pilot programs.” The review found that “RMA has not established written procedures to monitor and review the implementation and performance of [new crop insurance policies]… For the three programs reviewed, RMA experienced mounting losses through consecutive years but either made no adjustments to program provisions or made adjustments that had no perceptible effect on the losses themselves.” Hence, OIG found that the “monitoring process was ineffective,” and “vulnerabilities in privately developed products may go undetected and result in losses.” It recommended that RMA implement better monitoring and oversight procedures in the future to ensure that taxpayer dollars were not being wasted.

Risks Disproportionately Shifted onto Taxpayers

As you can see, changes to the federal crop insurance program are approved on a piecemeal basis without any comprehensive analysis to determine whether or not taxpayer support is even needed, whether other risk management options exist, if coverage is actuarially sound, or what level of support taxpayers can afford. In 2013, RMA stated that the Agency is considering developing new policies for crops such as hay simply because very few hay acres are insured under existing policies; however, not every crop should have access to unlimited crop insurance subsidies since some producers have access to other unsubsidized risk management options like irrigation, diversification, hedging, and more. Because premium subsidies and payouts from crop insurance have no payment limits, as more crops and areas are approved for insurance sales, taxpayer costs skyrocket.

Examples of policy changes that unnecessarily shift risks onto taxpayers include:

- Sesame crop insurance, approved in 2012: Steven Chapman, president of the American Sesame Growers Association, testified before the House Subcommittee on General Farm Commodities and Risk Management in 2007 stating, “We respectfully request a pilot program for… crop insurance for sesame. Mr. Chairman, the irony is sesame is a very low risk crop. Let me be clear, we don’t need crop insurance because of sesame’s inherent production risks, [but rather]… because of the commercial practicalities of securing acres and financing.”

- Allowing high risk and low risk fields to be insured separately: Starting in 2013, the FCIC Board allowed policies that exclude high risk land from typical crop insurance policies and also allow higher levels of coverage on high risk land, effectively increasing taxpayer costs and the likelihood that large payouts will occur on poor, marginal land. Similarly, FCIC approved optional units, meaning producers can separate fields for insurance purposes, resulting in more taxpayer subsidized payouts since higher production on some fields fails to cancel out low production on others.

- Expanded corn dryland coverage in North Dakota: RMA recommended in 2006 that with corn ethanol production ramping up, more corn is needed from dryland acres in North Dakota; hence, the North Dakota Corn Growers Association pushed for expanded taxpayer-subsidized corn insurance policies even though there are high risks of flooding and drought in North Dakota.

- North Dakota Personal Transition Yield Pilot: this new policy was approved to allow producers to use historic transitional yields if their production records were insufficient, a circumstance that can arise after successive years of crop losses. In 2012, FCIC approved insuring “without a written agreement, new breaking acreage of 320 acres or less (on a whole field basis) per county” as long as certain minimum conditions were met whereas previously producers “would have needed a written agreement in order to be insurable.” Planting on newly broken ground that was previously native grassland or wetlands carries a huge financial risk for taxpayers because the probability of crop losses increases. As one of RMA’s own commissioned studies found in 1998, “premium subsid[ies] can significantly influence [planting] behavior,” meaning federal subsidies actually contribute to land breakings.

- Limited irrigation coverage: RMA “announced that it is offering [this policy] for corn and soybeans… in Kansas starting the 2013 crop year… in response to declining water yields in groundwater wells in that area. Prior to this program, RMA offered only an irrigated and a non-irrigated practice.” As the drought persists in many Western states and results in crop losses, taxpayer subsidized payouts will only increase.

- Prevented planting abuse: Currently, producers can receive taxpayer subsidized insurance payouts when cold or wet conditions prevent them from planting before a predetermined spring date. In 2011, RMA noted that “farmers [in ND] are frustrated when neighbors rent wet acreage with the intent of collecting a prevented planting indemnity and make no effort to plant.” While RMA’s response to these complaints is unknown, this provides further evidence that taxpayers are subsidizing land that shouldn't be planted because it carries undue risks.

Conclusion/Recommendations

In the future, we need to step back and ask what level of support for agriculture is currently necessary, and then develop a more cost-effective, accountable, transparent, and responsive farm safety net. In the near-term, risky policies should undergo more scrutiny, and more transparency is needed to understand which crops are being considered for new or expanded crop insurance coverage (and taxpayer subsidies) since most information is currently shielded from the public eye. At a minimum, taxpayers deserve to know what they’re being asked to pay for and at what levels.

For more information contact Joshua Sewell, josh at taxpayer.net.

Just the Facts about Corporate Subsidies in the Farm Bill

Just the Facts about Corporate Subsidies in the Farm Bill

Just the Facts about the Farm Bill and Spending on Crop Insurance and Disaster Aid